Q2 2022 SHAREHOLDER LETTER INVESTORS.SHIFT4.COM Exhibit 99.1

Non-GAAP Financial Measures and Key Performance Indicators Safe Harbor Statement and Forward-Looking Information We use supplemental measures of our performance which are derived from our consolidated financial information but which are not presented in our consolidated financial statements prepared in accordance with generally accepted accounting principles ("GAAP"). These non-GAAP financial measures include: gross revenue less network fees, which includes interchange and assessment fees; adjusted net income; adjusted net income per share; free cash flow; adjusted free cash flow; earnings before interest, income taxes, depreciation, and amortization (“EBITDA”); and Adjusted EBITDA. Gross revenue less network fees represents a key performance metric that management uses to measure changes in the mix and value derived from our customer base as we continue to execute our strategy to expand our reach to serve larger, complex merchants. For the three months ended September 30, 2021 and December 31, 2021, gross revenue less network fees excludes the impact of the payments to merchants, included in "Gross revenue," and payments to partners and associated expenses due to the TSYS outage, included in "Network fees" and "Other costs of sales" in our Consolidated Statements of Operations for the same periods. These are nonrecurring payments that occurred outside of our day-to-day operations, and we have excluded them in order to provide more useful information to investors in the evaluation of our performance period- over period. Adjusted net income represents net income (loss) adjusted for certain non-cash and other nonrecurring items that management believes are not indicative of ongoing operations, such as the TSYS outage payments and associated costs, acquisition, restructuring and integration costs, equity-based compensation expense, and other nonrecurring items. Adjusted EBITDA is the primary financial performance measure used by management to evaluate its business and monitor results of operations. Adjusted EBITDA represents EBITDA further adjusted for certain non- cash and other nonrecurring items that management believes are not indicative of ongoing operations. These adjustments include TSYS outage payments and associated costs, acquisition, restructuring and This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding Shift4 Payments, Inc.’s (“our”, the “Company” or "Shift4”) expectations regarding new customers; acquisitions and other transactions, including Finaro and The Giving Block and our ability to consummate the Finaro acquisition on the timeline we expect or at all; our plans and agreements regarding future payment processing commitments; our expectations with respect to economic recovery; our stock price; and anticipated financial performance, including our financial outlook for fiscal year 2022 and future periods. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the effect of the COVID-19 global pandemic and any variants of the virus on our business and results of operations; our ability to differentiate ourselves from our competitors and compete effectively; our ability to anticipate and respond to changing industry trends and merchant and consumer needs; our ability to integration costs, equity-based compensation expense and other nonrecurring items. Free cash flow represents net cash provided by operating activities adjusted for non-discretionary capital expenditures. Adjusted free cash flow represents free cash flow further adjusted for certain transactions that are not indicative of future operating cash flows, including changes in working capital exclusively related to the calendar effect on settlement funding balances, supply chain purchases accelerated to avoid procurement issues, payments and costs associated with the TSYS outage, acquisition, restructuring and integration costs, the impact of timing of annual performance bonuses, and payroll taxes on IPO-related equity- based compensation that are not indicative of ongoing activities. We believe adjusted free cash flow is useful to measure the funds generated in a given period that are available to invest in the business, to repurchase stock and to make strategic decisions. We believe this supplemental information enhances shareholders’ ability to evaluate the Company’s performance. The Adjusted EBITDA conversion rate is calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA. We use non-GAAP financial measures to supplement financial information presented on a GAAP basis. We believe that excluding certain items from our GAAP results allows management to better understand our consolidated financial performance from period to period and better project our future consolidated financial performance as forecasts are developed at a level of detail different from that used to prepare GAAP-based financial measures. Moreover, we believe these non-GAAP financial measures provide our stakeholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and enabling them to make more meaningful period to period comparisons. There are limitations to the use of the non-GAAP financial measures presented in this presentation. Our non- GAAP financial measures may not be comparable to similarly titled measures of other companies. continue making acquisitions of businesses or assets; our ability to continue to expand our market share or expand into new markets; our reliance on third-party vendors to provide products and services; our ability to integrate our services and products with operating systems, devices, software and web browsers; our ability to maintain merchant and software partner relationships and strategic partnerships; the effects of global economic, political and other conditions, including inflationary pressure and rising interest rates, on consumer, business and government spending; our compliance with governmental regulation and other legal obligations, particularly related to privacy, data protection and information security, and consumer protection laws; our ability to establish, maintain and enforce effective risk management policies and procedures; our ability to protect our systems and data from continually evolving cybersecurity risks, security breaches and other technological risks; potential harm caused by software defects, computer viruses and development delays; the effect of degradation of the quality of the products and services we offer; potential harm caused by increased customer attrition; potential harm caused by fraud by merchants or others; potential harm caused by damage to our reputation or brands; our ability to recruit, retain and develop qualified personnel; our reliance on a single or limited number of suppliers; the effects of seasonality and volatility on our operating results; the effect of various Other companies, including companies in our industry, may calculate non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes. The non-GAAP financial measures are not meant to be considered as indicators of performance in isolation from or as a substitute for net income (loss) prepared in accordance with GAAP, and should be read only in conjunction with financial information presented on a GAAP basis. Reconciliations each of EBITDA and Adjusted EBITDA, gross revenue less network fees, adjusted net income, adjusted net income per share, free cash flow and adjusted free cash flow to its most directly comparable GAAP financial measure are presented at the end of this presentation. We are unable to provide a reconciliation of Adjusted EBITDA for 2023 to net income (loss), the nearest comparable GAAP measure, and projected Adjusted Free Cash Flow to net cash provided by operating activities, the nearest comparable GAAP measure, without unreasonable efforts. We encourage you to review the reconciliations in conjunction with the presentation of the non-GAAP financial measures for each of the periods presented. In future fiscal periods, we may exclude such items and may incur income and expenses similar to these excluded items. In addition, key performance indicators include end-to-end payment volume, spread and margin. End-to-end payment volume is defined as the total dollar amount of card payments that we authorize and settle on behalf of our merchants plus total cryptocurrency amounts transacted, translated at the spot price to U.S. dollars. This volume does not include volume processed through our gateway-only merchants. Spread represents the average yield Shift4 earns on the average end-to-end payment volume processed for a given period after network fees. Spread is calculated as payments-based revenue less gateway revenue and network fees for a given period divided by the end-to- end payment volume processed for the similar period. Adjusted EBITDA Margin represents Adjusted EBITDA divided by gross revenue less network fees. legal proceedings; our ability to raise additional capital to fund our operations; our ability to protect, enforce and defend our intellectual property rights; our ability to establish and maintain effective internal control over financial reporting and disclosure controls and procedures; our compliance with laws, regulations and enforcement activities that affect our industry; our dependence on distributions from Shift4 Payments, LLC to pay our taxes and expenses, including payments under the Tax Receivable Agreement; and the significant influence Rook has over us, including control over decisions that require the approval of stockholders. These and other important factors are described in “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Part I, Item 1A. in our Annual Report on Form 10-K for the year ended December 31, 2021, and in Part II, Item 1A in our Quarterly Report on Form 10-Q for the three months ended June 30, 2022 and could cause actual results to differ materially from those indicated by the forward- looking statements made in this presentation. Any such forward-looking statements represent management’s estimates as of the date of this presentation. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. 2

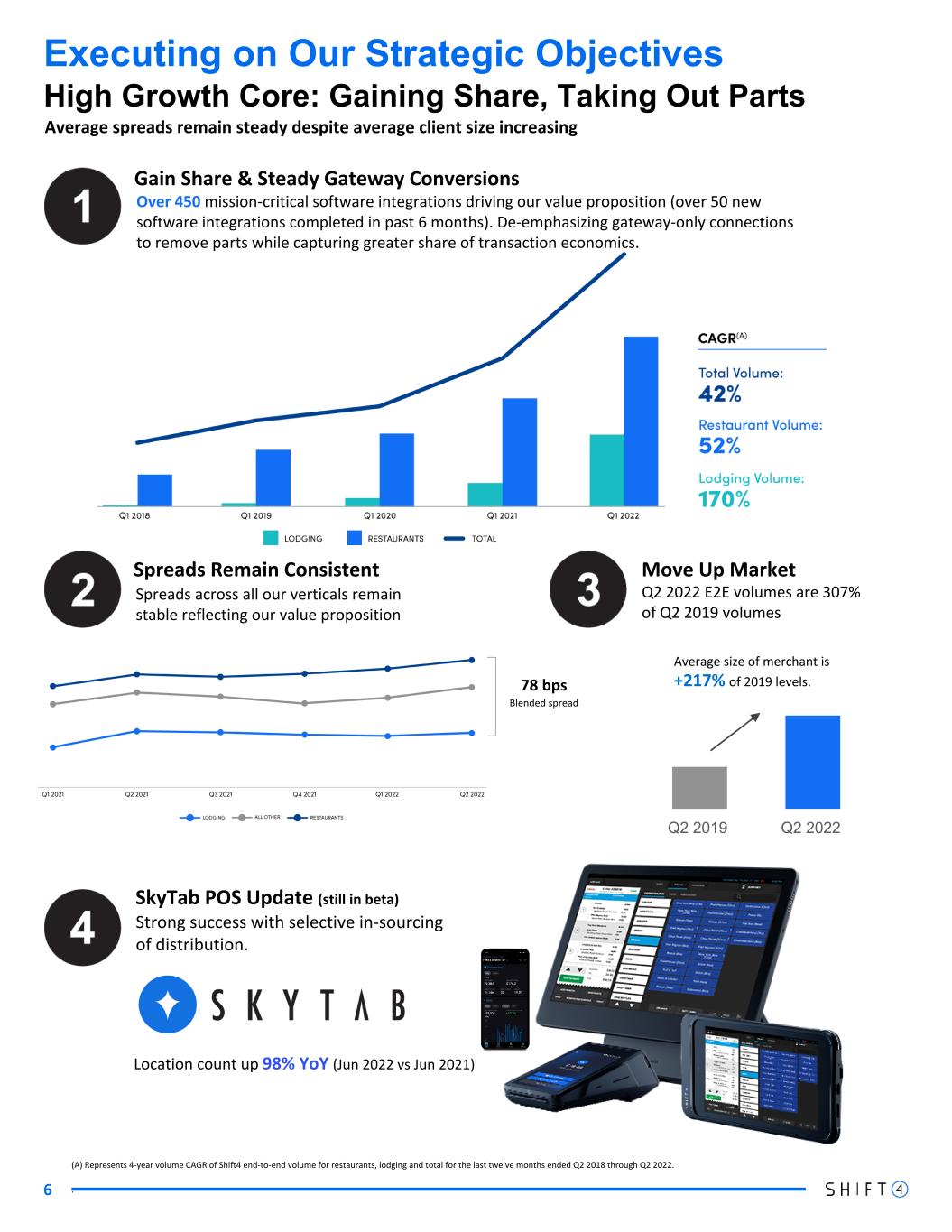

Dear Shareholders, 3 We completed a reasonably strong quarter, growing our end-to-end volume, gross profit, and gross revenue less network fees 43%, 35%, and 34%, respectively. This strong growth continued through July despite a macro-economic picture that is becoming increasingly less clear. While we have not seen any data to suggest softening in consumer spending, it seems logical that inflation will put downward pressure on consumer demand. Despite these uncertainties, I am incredibly excited about the opportunities they present. Since founding the company in 1999, we have encountered numerous shocks to the economy. Whether it be the dot-com bubble, the tragedies of September 11, the housing crisis, or most recently, the COVID-19 pandemic, we have endured the challenges presented and grown revenue every year of our operations. More important than growth in the face of uncertainty are the lessons we’ve learned along the way. These lessons have instilled a culture of financial discipline, diversification and a vigilant eye for strategic needle movers. During the second quarter, our end-to-end volume was $16.9 billion, up 43% year over year, and is 307% of 2019 levels. I consider this volume growth especially impressive given what are, in retrospect, tough comps from 2021. The ongoing resumption of travel was quite welcomed, but it is tough to gauge consumer sentiment as we cycle over a year of stimulus and pent-up demand. Additionally, the second quarter had very little volume contribution from our new verticals. That stated, we completed several key integrations and have already begun growing volume from these new verticals including beginning processing for Starlink in the last week of the second quarter. As you can see from the chart on page 8, new vertical volume is growing quickly in the third quarter. We expect the pace to only accelerate as previously announced wins, such as Allegiant airlines, and several sports stadiums, begin to come online in the months ahead. Throughout the quarter we have been quite busy: • High growth core: We continue to win share in the restaurant and hospitality verticals, with volumes up 52% and 170%, respectively, on a 4-yr CAGR. Brand new properties, like Nobu Atlanta among others have selected Shift4 given the value our unique End-to-End offering provides. Additionally, SkyTab POS growth has been impressive, especially given it's still in beta, but given the cloud architecture and how we have engineered the product, we have already begun selectively insourcing distribution as an enhancement to our go-to-market strategy. Additionally, one of the world's largest restaurant groups has selected Shift4 with a significant SaaS commitment to power their tablet and mobile strategy across all of their restaurant brands. • Gateway conversions: As discussed previously, our gateway strategy aims to properly monetize the value of our technology and accelerate conversion of volume to our End-to- End platform, in addition to unlocking operational efficiencies. We are only a few months in to this program and have already contracted an estimated $700 million in annualized volume directly attributed to this initiative.

4 Jared Isaacman CEO jared@shift4.com • New verticals: We continue to be the category leader in software and payments serving the Sports & Entertainment and Theme Park vertical, posting signature wins routinely. We are proud to welcome Notre Dame, Wisconsin and Alabama Universities as customers, among others. We have found similar success in non-profits, gaming, and in exciting technologies companies, or what we refer to as "sexy tech," all of which are ramping volumes. • New signature wins: We signed Fanatics and TIME, both benefiting from investments we made in our payment platform including recurring billing, business intelligence and fraud management capabilities. • M&A: Lots of progress throughout the technical and operational integrations, commercial collaboration and regulatory approvals with respect to our previously announced Finaro acquisition. We anticipate closing in the 4th quarter this year. Additionally, the current economic climate has resulted in the development of an extensive pipeline of targets that are very compatible with our strategic objectives. Based on the performance of the business and the momentum in our new verticals and initiatives, we are sufficiently confident to raise Gross Revenue Less Network Fees and Adjusted EBITDA guidance as well provide a new guide to Adjusted Free Cash Flow. This business momentum is a stark contrast to our share price, which we believe has suffered disproportionately as public equity markets seek to assign value to an uncertain economy, particularly as a profitable company, with expanding adjusted free cash flow and an enviable balance sheet in the middle of our 23rd consecutive year of revenue growth. I have been Shift4’s largest shareholder since going public and have continued to grow my position in the face of this dislocation because, as I said previously, the opportunities presented by uncertainty are significant. I would like to end by expressing my immense appreciation for the Shift4 team. I am really proud of the performance as we deliver on so many initiatives, manage complexity, execute on the game plan and embrace the Shift4 way. Our corporate and social responsibility programs have made an impact across our workforce, our customers and in the local communities. This includes millions in funds raised to support charitable causes and significant commitment of time through volunteering. As always, I welcome any and all feedback from our investors. Please don’t hesitate to contact me directly.

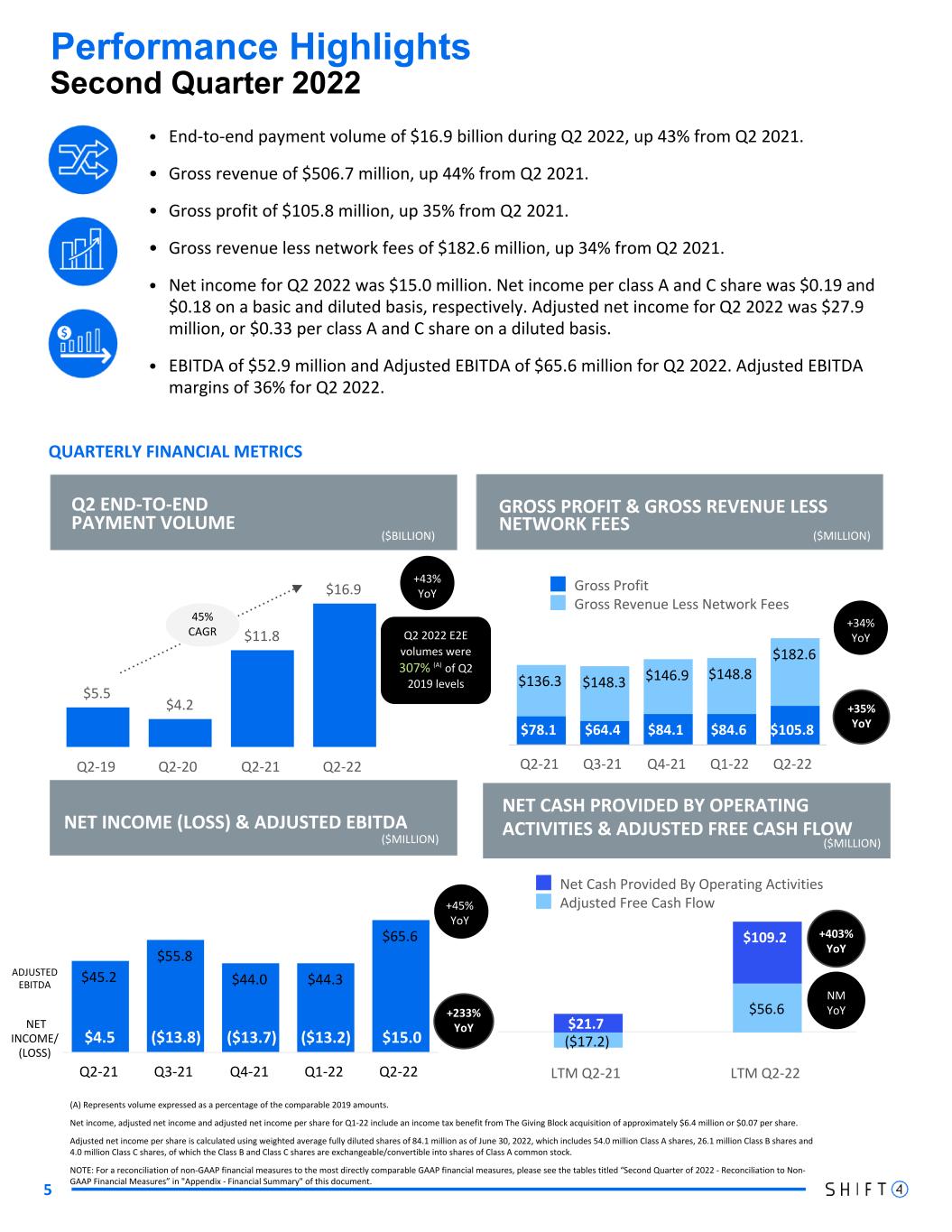

(A) Represents volume expressed as a percentage of the comparable 2019 amounts. Net income, adjusted net income and adjusted net income per share for Q1-22 include an income tax benefit from The Giving Block acquisition of approximately $6.4 million or $0.07 per share. Adjusted net income per share is calculated using weighted average fully diluted shares of 84.1 million as of June 30, 2022, which includes 54.0 million Class A shares, 26.1 million Class B shares and 4.0 million Class C shares, of which the Class B and Class C shares are exchangeable/convertible into shares of Class A common stock. NOTE: For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, please see the tables titled “Second Quarter of 2022 - Reconciliation to Non- GAAP Financial Measures” in "Appendix - Financial Summary" of this document. 5 Q2 END-TO-END PAYMENT VOLUME GROSS PROFIT & GROSS REVENUE LESS NETWORK FEES ($BILLION) ($MILLION) Second Quarter 2022 $(1.9) QUARTERLY FINANCIAL METRICS • End-to-end payment volume of $16.9 billion during Q2 2022, up 43% from Q2 2021. • Gross revenue of $506.7 million, up 44% from Q2 2021. • Gross profit of $105.8 million, up 35% from Q2 2021. • Gross revenue less network fees of $182.6 million, up 34% from Q2 2021. • Net income for Q2 2022 was $15.0 million. Net income per class A and C share was $0.19 and $0.18 on a basic and diluted basis, respectively. Adjusted net income for Q2 2022 was $27.9 million, or $0.33 per class A and C share on a diluted basis. • EBITDA of $52.9 million and Adjusted EBITDA of $65.6 million for Q2 2022. Adjusted EBITDA margins of 36% for Q2 2022. Performance Highlights $5.5 $4.2 $11.8 $16.9 Q2-19 Q2-20 Q2-21 Q2-22 $45.2 $55.8 $44.0 $44.3 $65.6 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22 ($MILLION) $78.1 $64.4 $84.1 $84.6 $105.8 $136.3 $148.3 $146.9 $148.8 $182.6 Gross Profit Gross Revenue Less Network Fees Q2-21 Q3-21 Q4-21 Q1-22 Q2-22 +34% YoY +45% YoY 45% CAGR +43% YoY Q2 2022 E2E volumes were 307% (A) of Q2 2019 levels NET INCOME/ (LOSS) $4.5 ($13.8) ($13.7) ($13.2) $15.0 ($MILLION) NET CASH PROVIDED BY OPERATING ACTIVITIES & ADJUSTED FREE CASH FLOW ADJUSTED EBITDA ($17.2) $56.6 $21.7 $109.2 Net Cash Provided By Operating Activities Adjusted Free Cash Flow LTM Q2-21 LTM Q2-22 NET INCOME (LOSS) & ADJUSTED EBITDA +403% YoY +35% YoY +233% YoY NM YoY

6 Executing on Our Strategic Objectives High Growth Core: Gaining Share, Taking Out Parts (A) Represents 4-year volume CAGR of Shift4 end-to-end volume for restaurants, lodging and total for the last twelve months ended Q2 2018 through Q2 2022. . Over 450 mission-critical software integrations driving our value proposition (over 50 new software integrations completed in past 6 months). De-emphasizing gateway-only connections to remove parts while capturing greater share of transaction economics. Gain Share & Steady Gateway Conversions Spreads across all our verticals remain stable reflecting our value proposition Spreads Remain Consistent Q2 2022 E2E volumes are 307% of Q2 2019 volumes Move Up Market SkyTab POS Update (still in beta) 78 bps Blended spread Strong success with selective in-sourcing of distribution. Location count up 98% YoY (Jun 2022 vs Jun 2021) Average spreads remain steady despite average client size increasing Q2 2019 Q2 2022 Average size of merchant is +217% of 2019 levels.

7 Executing on Our Strategic Objectives Gateway Sunset Strategy Underway PRIORITIES • May: Reduce operational inefficiencies associated with Gateway Only merchants • June: Provide notice to discontinue oldest connections • July: Adjust pricing for lowest margin merchants EARLY RESULTS • Eliminated several hundred operational tasks per month • Targeted $4B of volume on oldest connections for sunsetting • $700 million of annualized end-to-end volume contribution as of July 31 • Increased Gateway Only revenue and inbound merchant conversions

Will process online digital subscriptions for TIME magazine. 8 Executing on Our Strategic Objectives New Markets and Verticals: Beginning to Ramp Domestic processing began the last week of June with material ramp-up in July. Anticipate continued increase in Starlink volume throughout end of 2022 with international volumes following close of Finaro. Momentum continues adding new college football, NFL, MLB and other professional sporting arenas, including ticketing for a number of sports and entertainment venues. Volume continues to ramp up throughout the year across both traditional card-based and crypto donation volumes with the 4th quarter expected to contribute the majority. Gaming volumes in 2Q were over 9x 1Q's gaming volumes, as we continue to add additional states. Strategy underway with Finaro for mutual gaming partners through partnership agreement and beta- testing crypto acceptance with partners. Sexy Tech Sports & Entertainment Gaming Non-Profits Allegiant scheduled to complete integration by September 1st. Kiwi.com signed & expected to begin processing by September 1st. Travel Digital Media Q1 Exit Rate Q2 Exit Rate July Less than 10% of 2022 anticipated new vertical volume was processed in the first half of the year. July marked a notable inflection in volume contribution. • Starlink: adding subscribers • Stadiums: Fall Football Season • Gaming: more states added to BetMGM • Non-Profits: year-end donation season • Allegiant: coming online in September NEW WIN NEW WIN July Volumes 3x Q1's Exit Rate NEW VERTICALS E2E VOLUME RAMP

Strong Momentum Continues in Sports & Entertainment NFL, NBA, College Football, MLS, and more. 9 Shift4 will process in-venue payments at more than 50 Fanatics-operated locations and events, including professional and college partner venues, PGA golf events and more. Shift4 will power payments for retail merchandise sales and food and beverage concessions at the Crimson Tide’s Bryant- Denny Stadium. University of Alabama Shift4 will process payments at BYU’s LaVell Edwards Stadium using VenueNext POS, mobile ordering and mobile wallet solutions, as well as at retail locations across campus. Brigham Young University Shift4 will power payments for all of the university’s sports facilities through a combination of VenueNext POS and SkyTab POS as well as mobile ordering and mobile wallet. University of Wisconsin Shift4 will provide its VenueNext POS, mobile ordering, and payment processing solutions for all of the university's sports facilities. University of Notre Dame Shift4 will process payments for all Saints and Pelicans ticketing transactions at the Caesars Superdome in New Orleans. New Orleans Saints & Pelicans Shift4 will power the entire commerce experience for the team, including ticketing, food and beverage concessions, retail sales and parking. St Louis City SC (MLS) SIGNATURE WIN

10 Shift4 will process payments for Feld’s productions across the US, including Disney on Ice, Monster Jam, Ringling Bros., Supercross, Marvel Universe Live, Sesame Street Live and Jurassic World Live. Feld Entertainment Shift4 will provide its end-to-end payment solution for this leading furniture retailer with over 300 stores across the country. Mattress Warehouse This luxury New Orleans hotel boasts 522 guestrooms, 26 meeting and reception rooms, an award-winning restaurant, the famous Carousel Bar & Lounge, a full-service day spa, and much more. Hotel Monteleone ★ The Langham Chicago features 316 luxurious guestrooms and suites, renowned dining options, 15,000 sq. ft. of event space, and a full service spa in a 52-story landmark tower in downtown Chicago. Langham Chicago ★ This iconic 186-room NYC hotel features a full service ground-floor restaurant, year-round rooftop bar and restaurant, and breathtaking 360-degree views of the Manhattan skyline. Gansevoort Hotel ★ Shift4 will power payments both in-store and online for this 50 year old brand with over 150 locations across the country. Rosati’s Pizza High Growth Core - Hospitality Momentum Combination of gateway conversions and net new wins Nobu Hotels blend modern luxury and minimal Japanese tradition into the concept of a lifestyle hotel, and Shift4 will power payments at their newest property when it opens in Atlanta later this year. ★ Denotes Gateway Conversion

Added credit card widget for TGB non-profits to accept card payments 5.2x growth in new non-profit clients and 5.6x growth in SaaS fees (June 2022 vs June 2021) Continue to execute on E2E cross-sell Added 400+ net new non-profits to platform since closing 11 Regulatory approvals on-track for Q4 close Substantial progress already underway connecting the payment platforms via arms-length partnership during regulatory review period • Transactions successfully flowing back and forth between U.S. and Europe • Both companies referring merchant leads to each other; these cross-sell merchants are in respective underwriting/onboarding processes with some U.S. volume beginning by end of summer • First international merchants signed and in testing ACQUISITION UPDATE ACQUISITION UPDATE

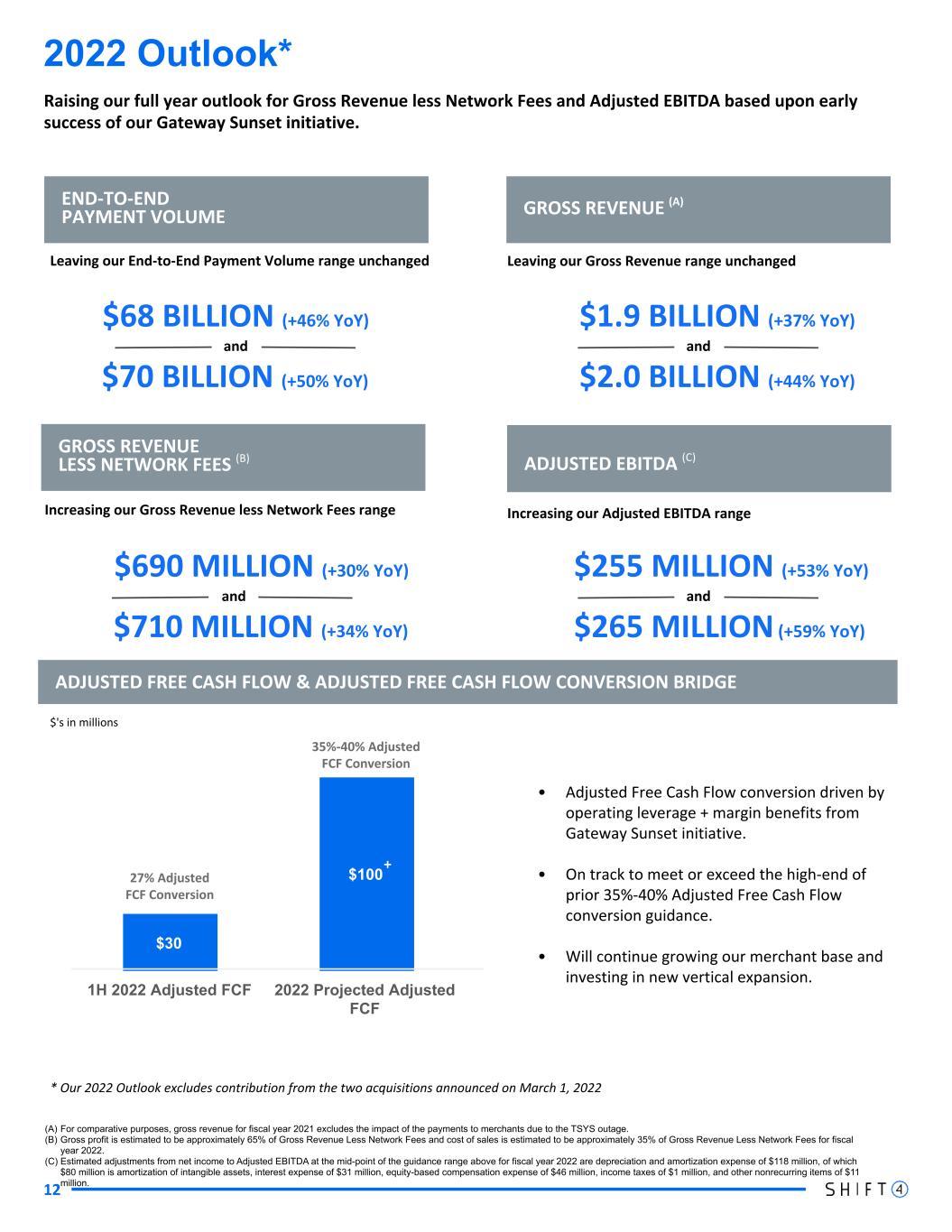

12 END-TO-END PAYMENT VOLUME ADJUSTED EBITDA (C) GROSS REVENUE LESS NETWORK FEES (B) GROSS REVENUE (A) Increasing our Adjusted EBITDA range Increasing our Gross Revenue less Network Fees range $68 BILLION (+46% YoY) $70 BILLION (+50% YoY) $255 MILLION (+53% YoY) $265 MILLION (+59% YoY) $690 MILLION (+30% YoY) $710 MILLION (+34% YoY) $1.9 BILLION (+37% YoY) $2.0 BILLION (+44% YoY) and andand and 2022 Outlook* (A) For comparative purposes, gross revenue for fiscal year 2021 excludes the impact of the payments to merchants due to the TSYS outage. (B) Gross profit is estimated to be approximately 65% of Gross Revenue Less Network Fees and cost of sales is estimated to be approximately 35% of Gross Revenue Less Network Fees for fiscal year 2022. (C) Estimated adjustments from net income to Adjusted EBITDA at the mid-point of the guidance range above for fiscal year 2022 are depreciation and amortization expense of $118 million, of which $80 million is amortization of intangible assets, interest expense of $31 million, equity-based compensation expense of $46 million, income taxes of $1 million, and other nonrecurring items of $11 million. * Our 2022 Outlook excludes contribution from the two acquisitions announced on March 1, 2022 Raising our full year outlook for Gross Revenue less Network Fees and Adjusted EBITDA based upon early success of our Gateway Sunset initiative. Leaving our End-to-End Payment Volume range unchanged Leaving our Gross Revenue range unchanged • Adjusted Free Cash Flow conversion driven by operating leverage + margin benefits from Gateway Sunset initiative. • On track to meet or exceed the high-end of prior 35%-40% Adjusted Free Cash Flow conversion guidance. • Will continue growing our merchant base and investing in new vertical expansion. ADJUSTED FREE CASH FLOW & ADJUSTED FREE CASH FLOW CONVERSION BRIDGE $30 $100 1H 2022 Adjusted FCF 2022 Projected Adjusted FCF 27% Adjusted FCF Conversion 35%-40% Adjusted FCF Conversion $'s in millions +

Appendix - Financial Information 13

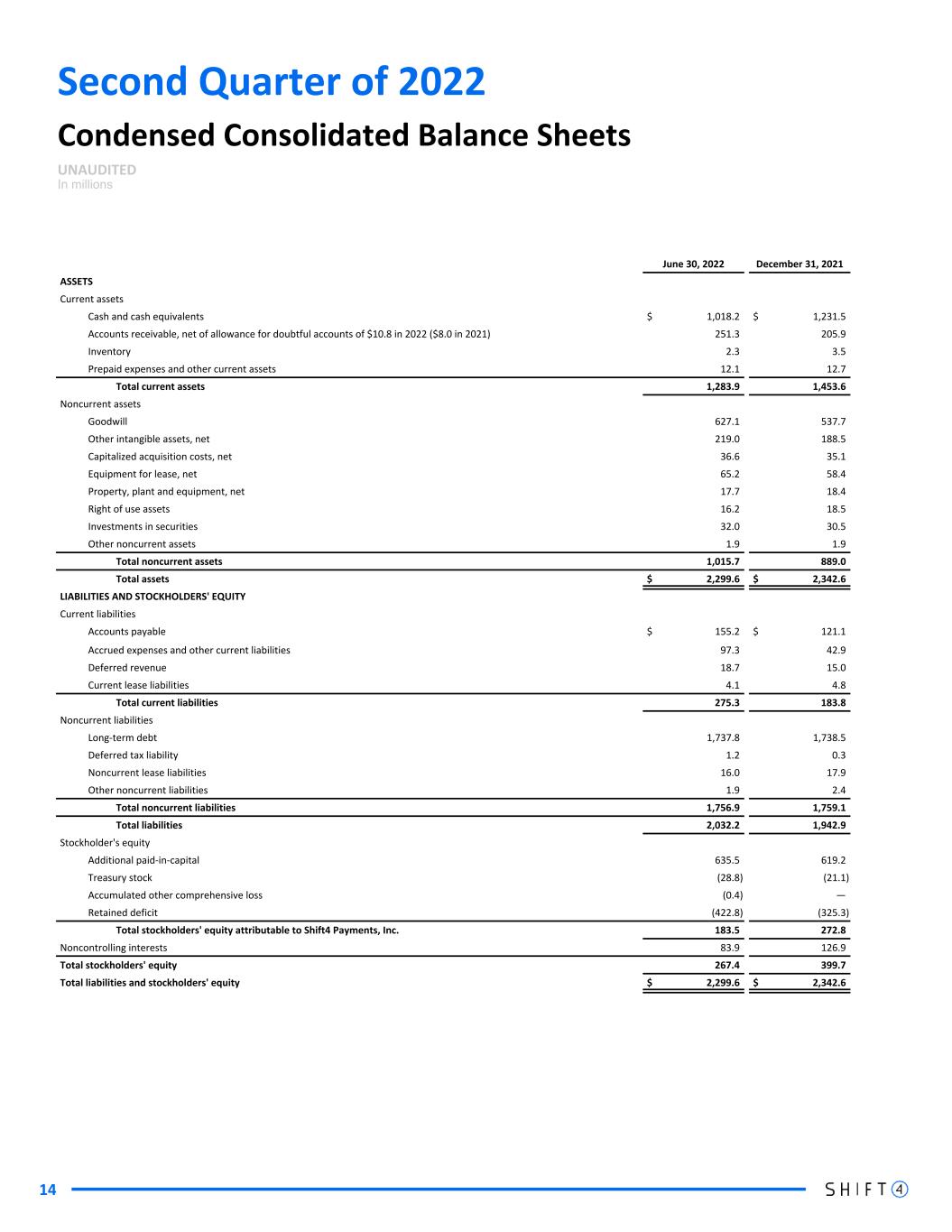

14 Second Quarter of 2022 Condensed Consolidated Balance Sheets UNAUDITED In millions June 30, 2022 December 31, 2021 ASSETS Current assets Cash and cash equivalents $ 1,018.2 $ 1,231.5 Accounts receivable, net of allowance for doubtful accounts of $10.8 in 2022 ($8.0 in 2021) 251.3 205.9 Inventory 2.3 3.5 Prepaid expenses and other current assets 12.1 12.7 Total current assets 1,283.9 1,453.6 Noncurrent assets Goodwill 627.1 537.7 Other intangible assets, net 219.0 188.5 Capitalized acquisition costs, net 36.6 35.1 Equipment for lease, net 65.2 58.4 Property, plant and equipment, net 17.7 18.4 Right of use assets 16.2 18.5 Investments in securities 32.0 30.5 Other noncurrent assets 1.9 1.9 Total noncurrent assets 1,015.7 889.0 Total assets $ 2,299.6 $ 2,342.6 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable $ 155.2 $ 121.1 Accrued expenses and other current liabilities 97.3 42.9 Deferred revenue 18.7 15.0 Current lease liabilities 4.1 4.8 Total current liabilities 275.3 183.8 Noncurrent liabilities Long-term debt 1,737.8 1,738.5 Deferred tax liability 1.2 0.3 Noncurrent lease liabilities 16.0 17.9 Other noncurrent liabilities 1.9 2.4 Total noncurrent liabilities 1,756.9 1,759.1 Total liabilities 2,032.2 1,942.9 Stockholder's equity Additional paid-in-capital 635.5 619.2 Treasury stock (28.8) (21.1) Accumulated other comprehensive loss (0.4) — Retained deficit (422.8) (325.3) Total stockholders' equity attributable to Shift4 Payments, Inc. 183.5 272.8 Noncontrolling interests 83.9 126.9 Total stockholders' equity 267.4 399.7 Total liabilities and stockholders' equity $ 2,299.6 $ 2,342.6

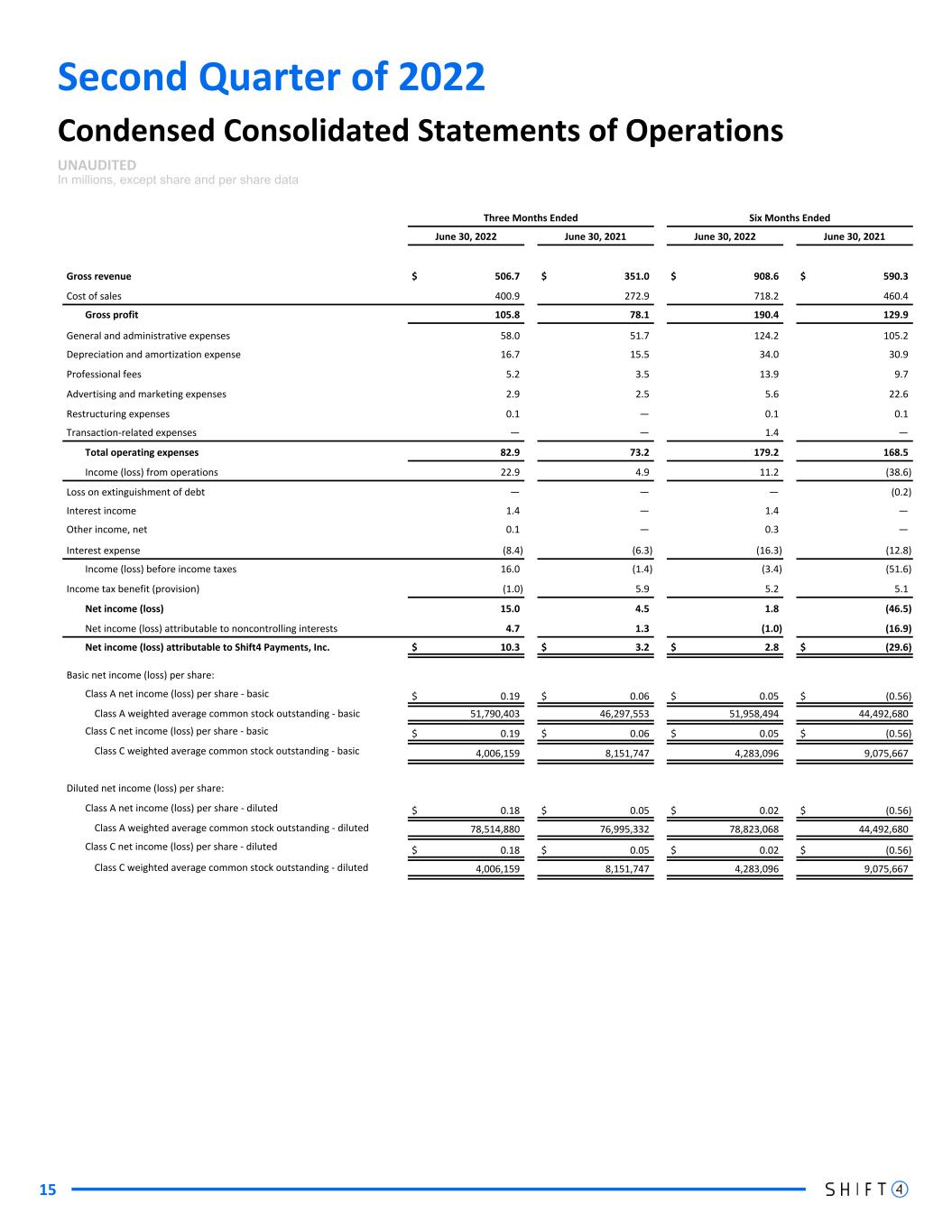

15 Second Quarter of 2022 Condensed Consolidated Statements of Operations UNAUDITED In millions, except share and per share data Three Months Ended Six Months Ended June 30, 2022 June 30, 2021 June 30, 2022 June 30, 2021 Gross revenue $ 506.7 $ 351.0 $ 908.6 $ 590.3 Cost of sales 400.9 272.9 718.2 460.4 Gross profit 105.8 78.1 190.4 129.9 General and administrative expenses 58.0 51.7 124.2 105.2 Depreciation and amortization expense 16.7 15.5 34.0 30.9 Professional fees 5.2 3.5 13.9 9.7 Advertising and marketing expenses 2.9 2.5 5.6 22.6 Restructuring expenses 0.1 — 0.1 0.1 Transaction-related expenses — — 1.4 — Total operating expenses 82.9 73.2 179.2 168.5 Income (loss) from operations 22.9 4.9 11.2 (38.6) Loss on extinguishment of debt — — — (0.2) Interest income 1.4 — 1.4 — Other income, net 0.1 — 0.3 — Interest expense (8.4) (6.3) (16.3) (12.8) Income (loss) before income taxes 16.0 (1.4) (3.4) (51.6) Income tax benefit (provision) (1.0) 5.9 5.2 5.1 Net income (loss) 15.0 4.5 1.8 (46.5) Net income (loss) attributable to noncontrolling interests 4.7 1.3 (1.0) (16.9) Net income (loss) attributable to Shift4 Payments, Inc. $ 10.3 $ 3.2 $ 2.8 $ (29.6) Basic net income (loss) per share: Class A net income (loss) per share - basic $ 0.19 $ 0.06 $ 0.05 $ (0.56) Class A weighted average common stock outstanding - basic 51,790,403 46,297,553 51,958,494 44,492,680 Class C net income (loss) per share - basic $ 0.19 $ 0.06 $ 0.05 $ (0.56) Class C weighted average common stock outstanding - basic 4,006,159 8,151,747 4,283,096 9,075,667 Diluted net income (loss) per share: Class A net income (loss) per share - diluted $ 0.18 $ 0.05 $ 0.02 $ (0.56) Class A weighted average common stock outstanding - diluted 78,514,880 76,995,332 78,823,068 44,492,680 Class C net income (loss) per share - diluted $ 0.18 $ 0.05 $ 0.02 $ (0.56) Class C weighted average common stock outstanding - diluted 4,006,159 8,151,747 4,283,096 9,075,667

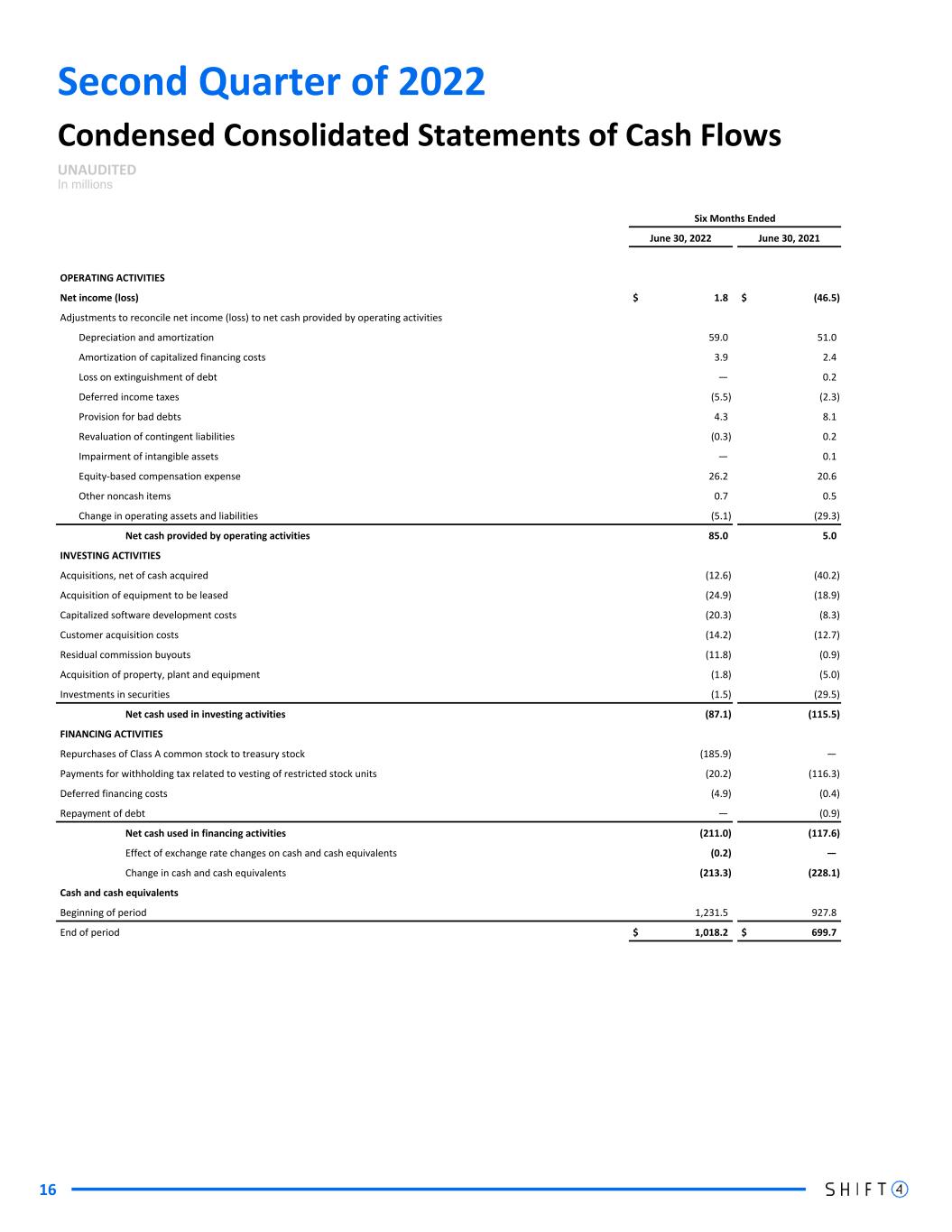

Second Quarter of 2022 16 Condensed Consolidated Statements of Cash Flows UNAUDITED In millions Six Months Ended June 30, 2022 June 30, 2021 OPERATING ACTIVITIES Net income (loss) $ 1.8 $ (46.5) Adjustments to reconcile net income (loss) to net cash provided by operating activities Depreciation and amortization 59.0 51.0 Amortization of capitalized financing costs 3.9 2.4 Loss on extinguishment of debt — 0.2 Deferred income taxes (5.5) (2.3) Provision for bad debts 4.3 8.1 Revaluation of contingent liabilities (0.3) 0.2 Impairment of intangible assets — 0.1 Equity-based compensation expense 26.2 20.6 Other noncash items 0.7 0.5 Change in operating assets and liabilities (5.1) (29.3) Net cash provided by operating activities 85.0 5.0 INVESTING ACTIVITIES Acquisitions, net of cash acquired (12.6) (40.2) Acquisition of equipment to be leased (24.9) (18.9) Capitalized software development costs (20.3) (8.3) Customer acquisition costs (14.2) (12.7) Residual commission buyouts (11.8) (0.9) Acquisition of property, plant and equipment (1.8) (5.0) Investments in securities (1.5) (29.5) Net cash used in investing activities (87.1) (115.5) FINANCING ACTIVITIES Repurchases of Class A common stock to treasury stock (185.9) — Payments for withholding tax related to vesting of restricted stock units (20.2) (116.3) Deferred financing costs (4.9) (0.4) Repayment of debt — (0.9) Net cash used in financing activities (211.0) (117.6) Effect of exchange rate changes on cash and cash equivalents (0.2) — Change in cash and cash equivalents (213.3) (228.1) Cash and cash equivalents Beginning of period 1,231.5 927.8 End of period $ 1,018.2 $ 699.7

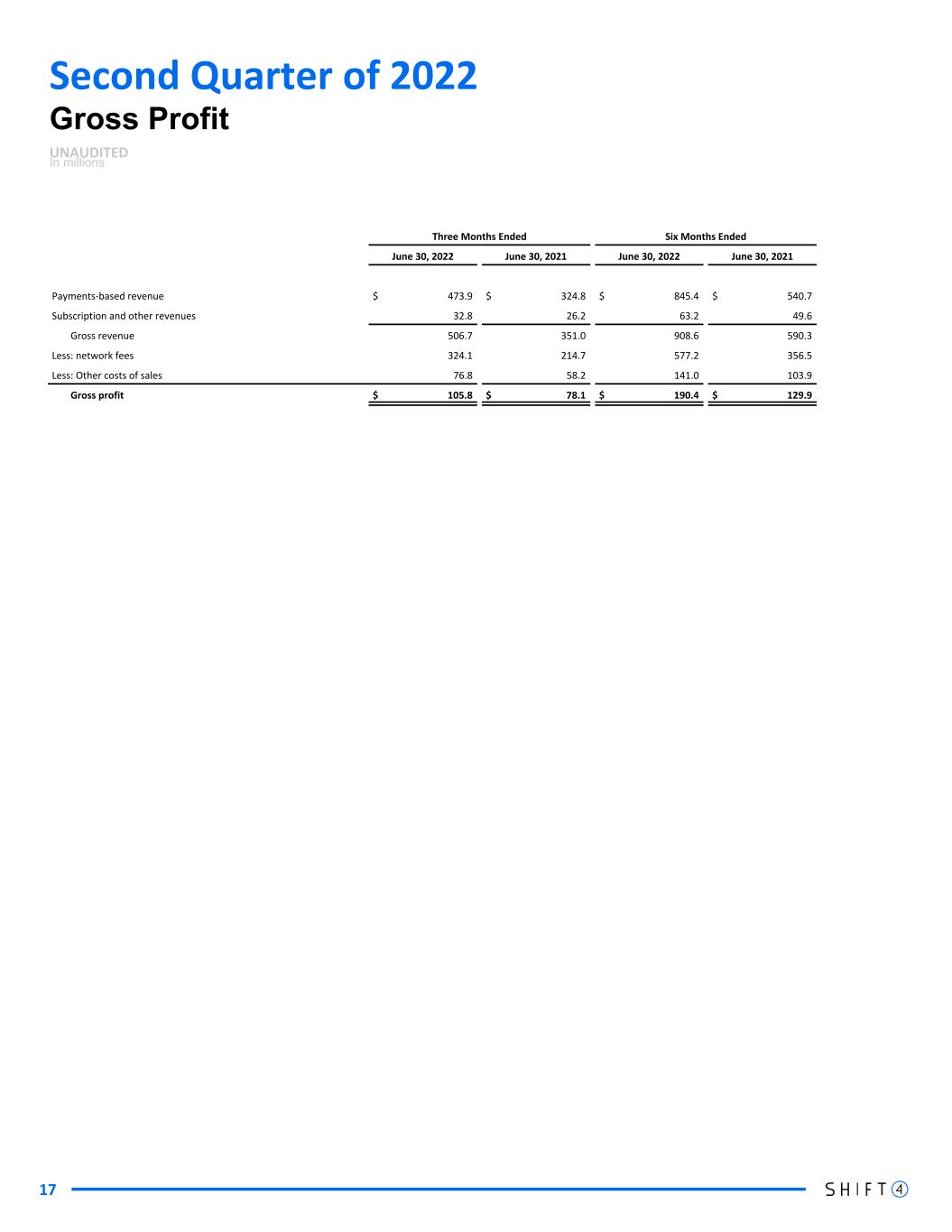

Second Quarter of 2022 Gross Profit UNAUDITED In millions Three Months Ended Six Months Ended June 30, 2022 June 30, 2021 June 30, 2022 June 30, 2021 Payments-based revenue $ 473.9 $ 324.8 $ 845.4 $ 540.7 Subscription and other revenues 32.8 26.2 63.2 49.6 Gross revenue 506.7 351.0 908.6 590.3 Less: network fees 324.1 214.7 577.2 356.5 Less: Other costs of sales 76.8 58.2 141.0 103.9 Gross profit $ 105.8 $ 78.1 $ 190.4 $ 129.9 17

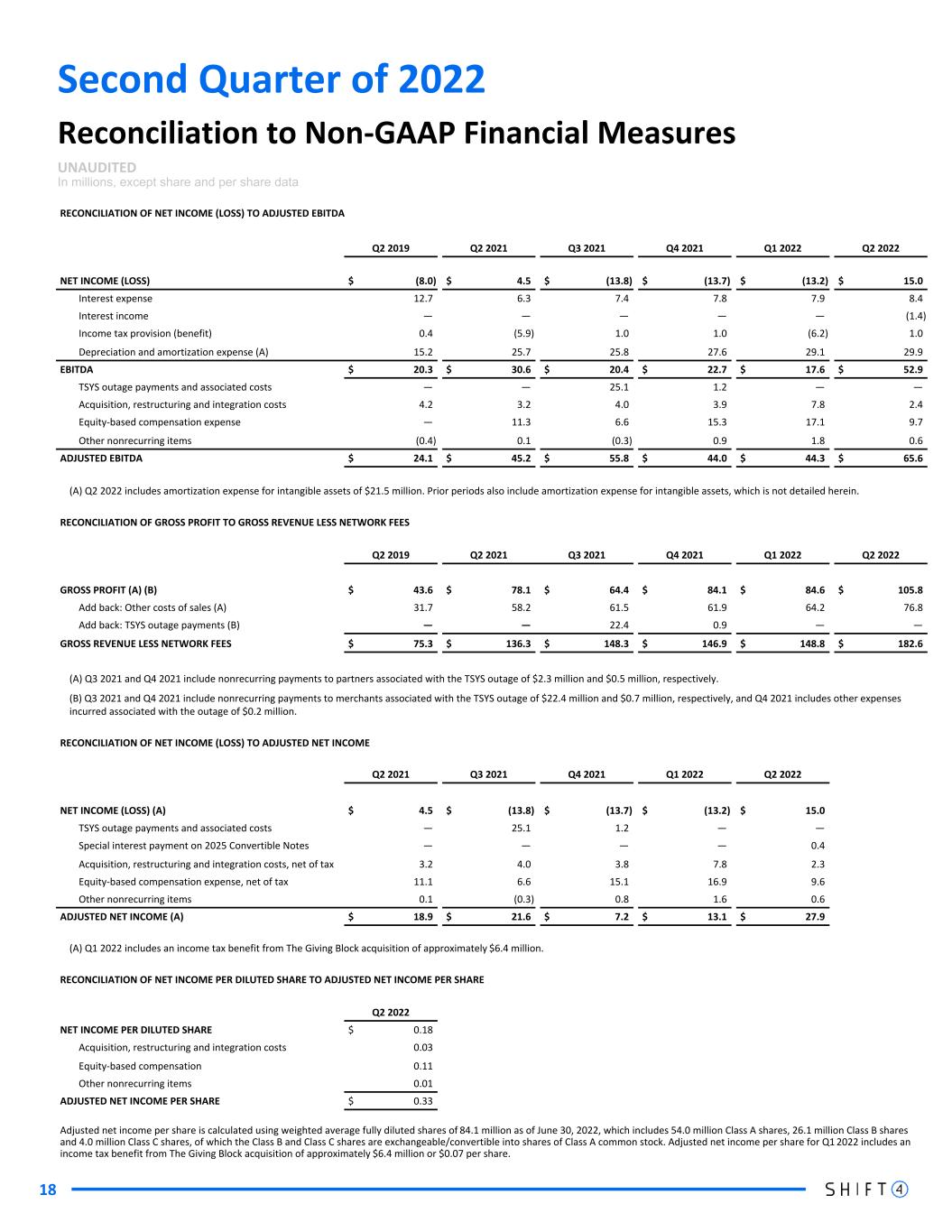

Second Quarter of 2022 18 Reconciliation to Non-GAAP Financial Measures UNAUDITED In millions, except share and per share data RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA Q2 2019 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 NET INCOME (LOSS) $ (8.0) $ 4.5 $ (13.8) $ (13.7) $ (13.2) $ 15.0 Interest expense 12.7 6.3 7.4 7.8 7.9 8.4 Interest income — — — — — (1.4) Income tax provision (benefit) 0.4 (5.9) 1.0 1.0 (6.2) 1.0 Depreciation and amortization expense (A) 15.2 25.7 25.8 27.6 29.1 29.9 EBITDA $ 20.3 $ 30.6 $ 20.4 $ 22.7 $ 17.6 $ 52.9 TSYS outage payments and associated costs — — 25.1 1.2 — — Acquisition, restructuring and integration costs 4.2 3.2 4.0 3.9 7.8 2.4 Equity-based compensation expense — 11.3 6.6 15.3 17.1 9.7 Other nonrecurring items (0.4) 0.1 (0.3) 0.9 1.8 0.6 ADJUSTED EBITDA $ 24.1 $ 45.2 $ 55.8 $ 44.0 $ 44.3 $ 65.6 (A) Q2 2022 includes amortization expense for intangible assets of $21.5 million. Prior periods also include amortization expense for intangible assets, which is not detailed herein. RECONCILIATION OF GROSS PROFIT TO GROSS REVENUE LESS NETWORK FEES Q2 2019 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 GROSS PROFIT (A) (B) $ 43.6 $ 78.1 $ 64.4 $ 84.1 $ 84.6 $ 105.8 Add back: Other costs of sales (A) 31.7 58.2 61.5 61.9 64.2 76.8 Add back: TSYS outage payments (B) — — 22.4 0.9 — — GROSS REVENUE LESS NETWORK FEES $ 75.3 $ 136.3 $ 148.3 $ 146.9 $ 148.8 $ 182.6 (A) Q3 2021 and Q4 2021 include nonrecurring payments to partners associated with the TSYS outage of $2.3 million and $0.5 million, respectively. (B) Q3 2021 and Q4 2021 include nonrecurring payments to merchants associated with the TSYS outage of $22.4 million and $0.7 million, respectively, and Q4 2021 includes other expenses incurred associated with the outage of $0.2 million. RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED NET INCOME Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 NET INCOME (LOSS) (A) $ 4.5 $ (13.8) $ (13.7) $ (13.2) $ 15.0 TSYS outage payments and associated costs — 25.1 1.2 — — Special interest payment on 2025 Convertible Notes — — — — 0.4 Acquisition, restructuring and integration costs, net of tax 3.2 4.0 3.8 7.8 2.3 Equity-based compensation expense, net of tax 11.1 6.6 15.1 16.9 9.6 Other nonrecurring items 0.1 (0.3) 0.8 1.6 0.6 ADJUSTED NET INCOME (A) $ 18.9 $ 21.6 $ 7.2 $ 13.1 $ 27.9 (A) Q1 2022 includes an income tax benefit from The Giving Block acquisition of approximately $6.4 million. RECONCILIATION OF NET INCOME PER DILUTED SHARE TO ADJUSTED NET INCOME PER SHARE Q2 2022 NET INCOME PER DILUTED SHARE $ 0.18 Acquisition, restructuring and integration costs 0.03 Equity-based compensation 0.11 Other nonrecurring items 0.01 ADJUSTED NET INCOME PER SHARE $ 0.33 Adjusted net income per share is calculated using weighted average fully diluted shares of 84.1 million as of June 30, 2022, which includes 54.0 million Class A shares, 26.1 million Class B shares and 4.0 million Class C shares, of which the Class B and Class C shares are exchangeable/convertible into shares of Class A common stock. Adjusted net income per share for Q1 2022 includes an income tax benefit from The Giving Block acquisition of approximately $6.4 million or $0.07 per share.

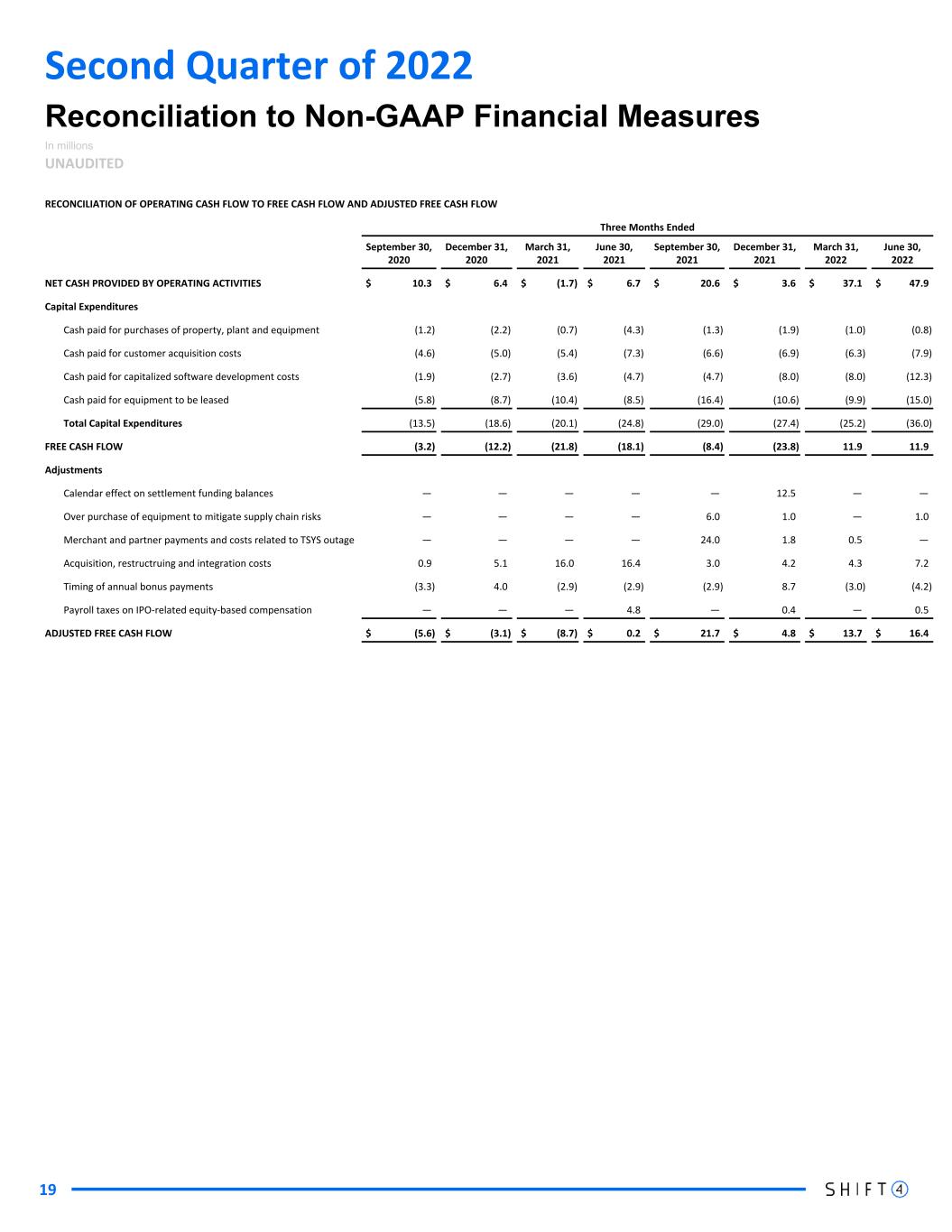

RECONCILIATION OF OPERATING CASH FLOW TO FREE CASH FLOW AND ADJUSTED FREE CASH FLOW Three Months Ended September 30, 2020 December 31, 2020 March 31, 2021 June 30, 2021 September 30, 2021 December 31, 2021 March 31, 2022 June 30, 2022 NET CASH PROVIDED BY OPERATING ACTIVITIES $ 10.3 $ 6.4 $ (1.7) $ 6.7 $ 20.6 $ 3.6 $ 37.1 $ 47.9 Capital Expenditures Cash paid for purchases of property, plant and equipment (1.2) (2.2) (0.7) (4.3) (1.3) (1.9) (1.0) (0.8) Cash paid for customer acquisition costs (4.6) (5.0) (5.4) (7.3) (6.6) (6.9) (6.3) (7.9) Cash paid for capitalized software development costs (1.9) (2.7) (3.6) (4.7) (4.7) (8.0) (8.0) (12.3) Cash paid for equipment to be leased (5.8) (8.7) (10.4) (8.5) (16.4) (10.6) (9.9) (15.0) Total Capital Expenditures (13.5) (18.6) (20.1) (24.8) (29.0) (27.4) (25.2) (36.0) FREE CASH FLOW (3.2) (12.2) (21.8) (18.1) (8.4) (23.8) 11.9 11.9 Adjustments Calendar effect on settlement funding balances — — — — — 12.5 — — Over purchase of equipment to mitigate supply chain risks — — — — 6.0 1.0 — 1.0 Merchant and partner payments and costs related to TSYS outage — — — — 24.0 1.8 0.5 — Acquisition, restructruing and integration costs 0.9 5.1 16.0 16.4 3.0 4.2 4.3 7.2 Timing of annual bonus payments (3.3) 4.0 (2.9) (2.9) (2.9) 8.7 (3.0) (4.2) Payroll taxes on IPO-related equity-based compensation — — — 4.8 — 0.4 — 0.5 ADJUSTED FREE CASH FLOW $ (5.6) $ (3.1) $ (8.7) $ 0.2 $ 21.7 $ 4.8 $ 13.7 $ 16.4 Reconciliation to Non-GAAP Financial Measures In millions UNAUDITED 19 Second Quarter of 2022

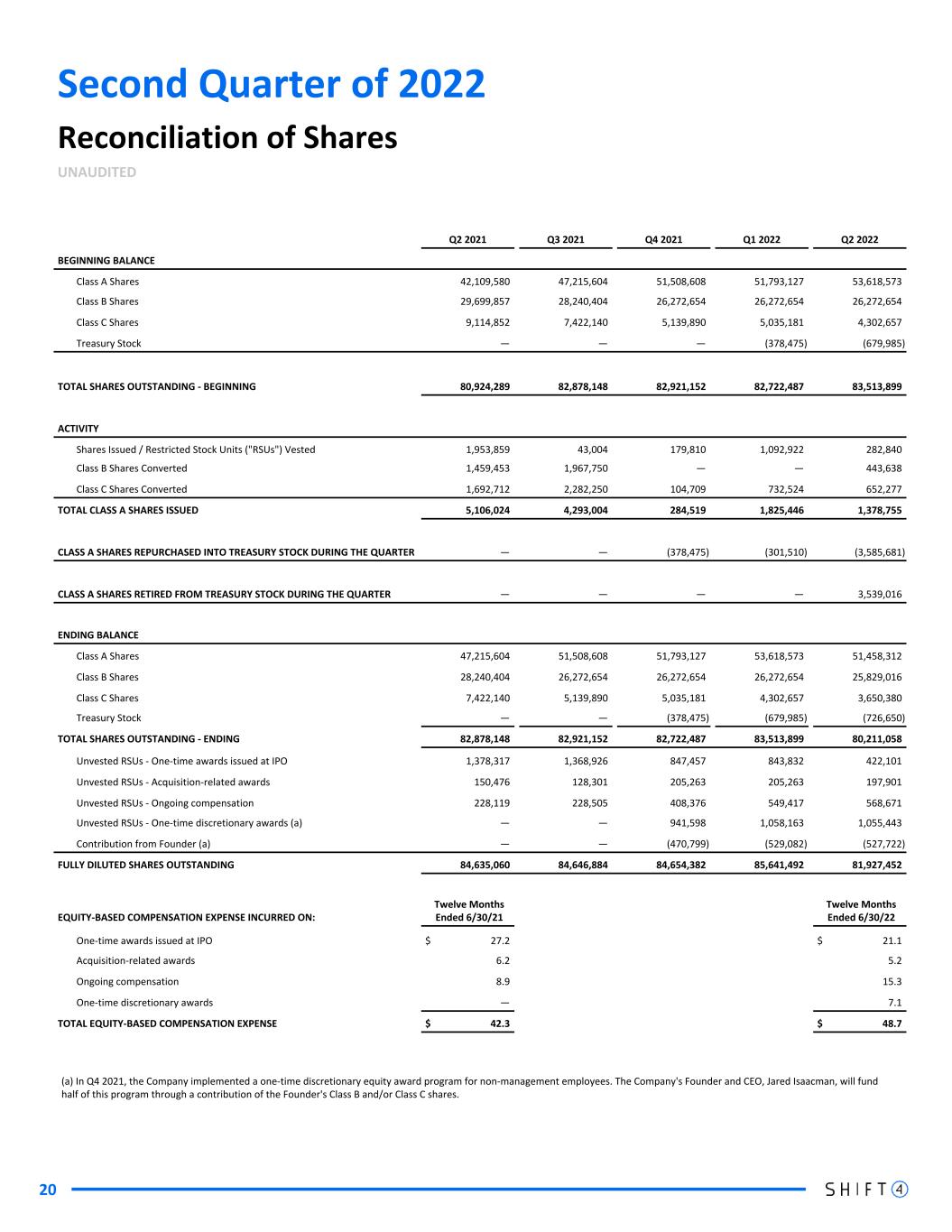

Second Quarter of 2022 20 Reconciliation of Shares UNAUDITED Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 BEGINNING BALANCE Class A Shares 42,109,580 47,215,604 51,508,608 51,793,127 53,618,573 Class B Shares 29,699,857 28,240,404 26,272,654 26,272,654 26,272,654 Class C Shares 9,114,852 7,422,140 5,139,890 5,035,181 4,302,657 Treasury Stock — — — (378,475) (679,985) TOTAL SHARES OUTSTANDING - BEGINNING 80,924,289 82,878,148 82,921,152 82,722,487 83,513,899 ACTIVITY Shares Issued / Restricted Stock Units ("RSUs") Vested 1,953,859 43,004 179,810 1,092,922 282,840 Class B Shares Converted 1,459,453 1,967,750 — — 443,638 Class C Shares Converted 1,692,712 2,282,250 104,709 732,524 652,277 TOTAL CLASS A SHARES ISSUED 5,106,024 4,293,004 284,519 1,825,446 1,378,755 CLASS A SHARES REPURCHASED INTO TREASURY STOCK DURING THE QUARTER — — (378,475) (301,510) (3,585,681) CLASS A SHARES RETIRED FROM TREASURY STOCK DURING THE QUARTER — — — — 3,539,016 ENDING BALANCE Class A Shares 47,215,604 51,508,608 51,793,127 53,618,573 51,458,312 Class B Shares 28,240,404 26,272,654 26,272,654 26,272,654 25,829,016 Class C Shares 7,422,140 5,139,890 5,035,181 4,302,657 3,650,380 Treasury Stock — — (378,475) (679,985) (726,650) TOTAL SHARES OUTSTANDING - ENDING 82,878,148 82,921,152 82,722,487 83,513,899 80,211,058 Unvested RSUs - One-time awards issued at IPO 1,378,317 1,368,926 847,457 843,832 422,101 Unvested RSUs - Acquisition-related awards 150,476 128,301 205,263 205,263 197,901 Unvested RSUs - Ongoing compensation 228,119 228,505 408,376 549,417 568,671 Unvested RSUs - One-time discretionary awards (a) — — 941,598 1,058,163 1,055,443 Contribution from Founder (a) — — (470,799) (529,082) (527,722) FULLY DILUTED SHARES OUTSTANDING 84,635,060 84,646,884 84,654,382 85,641,492 81,927,452 EQUITY-BASED COMPENSATION EXPENSE INCURRED ON: Twelve Months Ended 6/30/21 Twelve Months Ended 6/30/22 One-time awards issued at IPO $ 27.2 $ 21.1 Acquisition-related awards 6.2 5.2 Ongoing compensation 8.9 15.3 One-time discretionary awards — 7.1 TOTAL EQUITY-BASED COMPENSATION EXPENSE $ 42.3 $ 48.7 (a) In Q4 2021, the Company implemented a one-time discretionary equity award program for non-management employees. The Company's Founder and CEO, Jared Isaacman, will fund half of this program through a contribution of the Founder's Class B and/or Class C shares.