false2024Q30001794669--12-31P6Y3M18DP12Y4M24DP3YP10YP3Y446xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purefour:modeliso4217:EURfour:performanceObligationfour:contractiso4217:USDfour:Unit00017946692024-01-012024-09-300001794669us-gaap:CommonClassAMember2024-11-050001794669us-gaap:CommonClassBMember2024-11-050001794669us-gaap:CommonClassCMember2024-11-0500017946692024-09-3000017946692023-12-310001794669four:ResidualCommissionBuyoutsMember2024-09-300001794669four:ResidualCommissionBuyoutsMember2023-12-310001794669four:CapitalizedAcquisitionCostsMember2024-09-300001794669four:CapitalizedAcquisitionCostsMember2023-12-310001794669us-gaap:OtherIntangibleAssetsMember2024-09-300001794669us-gaap:OtherIntangibleAssetsMember2023-12-310001794669us-gaap:CommonClassAMember2023-12-310001794669us-gaap:CommonClassAMember2024-09-300001794669us-gaap:CommonClassBMember2023-12-310001794669us-gaap:CommonClassBMember2024-09-300001794669us-gaap:CommonClassCMember2023-12-310001794669us-gaap:CommonClassCMember2024-09-3000017946692024-07-012024-09-3000017946692023-07-012023-09-3000017946692023-01-012023-09-300001794669us-gaap:CommonClassAMember2024-07-012024-09-300001794669us-gaap:CommonClassAMember2023-07-012023-09-300001794669us-gaap:CommonClassAMember2024-01-012024-09-300001794669us-gaap:CommonClassAMember2023-01-012023-09-300001794669us-gaap:CommonClassCMember2024-07-012024-09-300001794669us-gaap:CommonClassCMember2023-07-012023-09-300001794669us-gaap:CommonClassCMember2024-01-012024-09-300001794669us-gaap:CommonClassCMember2023-01-012023-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-12-310001794669us-gaap:AdditionalPaidInCapitalMember2023-12-310001794669us-gaap:TreasuryStockCommonMember2023-12-310001794669us-gaap:RetainedEarningsMember2023-12-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001794669us-gaap:NoncontrollingInterestMember2023-12-310001794669us-gaap:RetainedEarningsMember2024-01-012024-03-310001794669us-gaap:NoncontrollingInterestMember2024-01-012024-03-3100017946692024-01-012024-03-310001794669us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-03-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-03-310001794669us-gaap:AdditionalPaidInCapitalMember2024-03-310001794669us-gaap:TreasuryStockCommonMember2024-03-310001794669us-gaap:RetainedEarningsMember2024-03-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001794669us-gaap:NoncontrollingInterestMember2024-03-3100017946692024-03-310001794669us-gaap:RetainedEarningsMember2024-04-012024-06-300001794669us-gaap:NoncontrollingInterestMember2024-04-012024-06-3000017946692024-04-012024-06-300001794669us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001794669us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-04-012024-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-04-012024-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-04-012024-06-300001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-06-300001794669us-gaap:AdditionalPaidInCapitalMember2024-06-300001794669us-gaap:TreasuryStockCommonMember2024-06-300001794669us-gaap:RetainedEarningsMember2024-06-300001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001794669us-gaap:NoncontrollingInterestMember2024-06-3000017946692024-06-300001794669us-gaap:RetainedEarningsMember2024-07-012024-09-300001794669us-gaap:NoncontrollingInterestMember2024-07-012024-09-300001794669us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001794669us-gaap:TreasuryStockCommonMember2024-07-012024-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-07-012024-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-07-012024-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-07-012024-09-300001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-09-300001794669us-gaap:AdditionalPaidInCapitalMember2024-09-300001794669us-gaap:TreasuryStockCommonMember2024-09-300001794669us-gaap:RetainedEarningsMember2024-09-300001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001794669us-gaap:NoncontrollingInterestMember2024-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2022-12-310001794669us-gaap:AdditionalPaidInCapitalMember2022-12-310001794669us-gaap:TreasuryStockCommonMember2022-12-310001794669us-gaap:RetainedEarningsMember2022-12-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001794669us-gaap:NoncontrollingInterestMember2022-12-3100017946692022-12-310001794669us-gaap:RetainedEarningsMember2023-01-012023-03-310001794669us-gaap:NoncontrollingInterestMember2023-01-012023-03-3100017946692023-01-012023-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-03-310001794669us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-01-012023-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-01-012023-03-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-03-310001794669us-gaap:AdditionalPaidInCapitalMember2023-03-310001794669us-gaap:TreasuryStockCommonMember2023-03-310001794669us-gaap:RetainedEarningsMember2023-03-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001794669us-gaap:NoncontrollingInterestMember2023-03-3100017946692023-03-310001794669us-gaap:RetainedEarningsMember2023-04-012023-06-300001794669us-gaap:NoncontrollingInterestMember2023-04-012023-06-3000017946692023-04-012023-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-012023-06-300001794669us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001794669us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-04-012023-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-04-012023-06-300001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-06-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-06-300001794669us-gaap:AdditionalPaidInCapitalMember2023-06-300001794669us-gaap:TreasuryStockCommonMember2023-06-300001794669us-gaap:RetainedEarningsMember2023-06-300001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001794669us-gaap:NoncontrollingInterestMember2023-06-3000017946692023-06-300001794669us-gaap:RetainedEarningsMember2023-07-012023-09-300001794669us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001794669us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-07-012023-09-300001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-09-300001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-09-300001794669us-gaap:AdditionalPaidInCapitalMember2023-09-300001794669us-gaap:TreasuryStockCommonMember2023-09-300001794669us-gaap:RetainedEarningsMember2023-09-300001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001794669us-gaap:NoncontrollingInterestMember2023-09-3000017946692023-09-300001794669four:SeniorNotesDueTwoThousandTwentyFiveMember2024-09-300001794669four:A2027ConvertibleNotesMemberus-gaap:ConvertibleDebtMember2024-09-300001794669four:TheGivingBlockIncMember2024-09-300001794669four:TheGivingBlockIncMember2023-12-310001794669four:ConvertibleNotesDueTwoThousandTwentyFiveAndConvertibleNotesDueTwoThousandTwentySevenMember2019-11-052019-11-050001794669four:CreditFacilityMemberfour:SettlementLineCreditAgreementMemberus-gaap:LineOfCreditMember2024-09-300001794669four:SettlementLineCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-09-300001794669four:SettlementLineCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:FederalFundsEffectiveSwapRateMember2024-01-012024-09-300001794669four:SettlementLineCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:PrimeRateMember2024-01-012024-09-300001794669four:SettlementLineCreditAgreementMemberus-gaap:LineOfCreditMember2024-01-012024-09-300001794669four:VectronSystemsAGMember2024-09-300001794669four:VectronSystemsAGMember2024-06-142024-06-140001794669four:VectronSystemsAGMember2024-09-300001794669four:VectronSystemsAGMember2024-06-140001794669four:VectronSystemsAGMember2024-01-012024-09-300001794669four:AcardoMember2024-06-140001794669four:AcardoMember2024-01-012024-09-300001794669four:VectronSystemsAGMemberfour:AcquiredTechnologyMember2024-06-142024-06-140001794669four:VectronSystemsAGMemberfour:MerchantRelationshipsMember2024-06-142024-06-140001794669four:VectronSystemsAGMemberus-gaap:TradeNamesMember2024-06-142024-06-140001794669four:RevelSystemsInc.Member2024-06-130001794669four:RevelSystemsInc.Member2024-06-132024-06-130001794669four:RevelSystemsInc.Memberfour:AcquiredTechnologyMember2024-06-132024-06-130001794669four:RevelSystemsInc.Memberfour:MerchantRelationshipsMember2024-06-132024-06-130001794669four:RevelSystemsInc.Memberus-gaap:TradeNamesMember2024-06-132024-06-130001794669four:PaymentsBasedRevenueMember2024-07-012024-09-300001794669four:PaymentsBasedRevenueMember2023-07-012023-09-300001794669four:PaymentsBasedRevenueMember2024-01-012024-09-300001794669four:PaymentsBasedRevenueMember2023-01-012023-09-300001794669four:SubscriptionAndOtherRevenuesMember2024-07-012024-09-300001794669four:SubscriptionAndOtherRevenuesMember2023-07-012023-09-300001794669four:SubscriptionAndOtherRevenuesMember2024-01-012024-09-300001794669four:SubscriptionAndOtherRevenuesMember2023-01-012023-09-300001794669four:RevelSystemsInc.Member2024-01-012024-09-300001794669four:ResidualCommissionBuyoutsMember2024-07-012024-09-300001794669us-gaap:OtherIntangibleAssetsMember2024-07-012024-09-300001794669four:CapitalizedAcquisitionCostsMember2024-07-012024-09-300001794669four:EquipmentUnderLeaseMember2024-07-012024-09-300001794669us-gaap:PropertyPlantAndEquipmentMember2024-07-012024-09-300001794669four:ResidualCommissionBuyoutsMember2023-07-012023-09-300001794669us-gaap:OtherIntangibleAssetsMember2023-07-012023-09-300001794669four:CapitalizedAcquisitionCostsMember2023-07-012023-09-300001794669four:EquipmentUnderLeaseMember2023-07-012023-09-300001794669us-gaap:PropertyPlantAndEquipmentMember2023-07-012023-09-300001794669four:ResidualCommissionBuyoutsMember2024-01-012024-09-300001794669us-gaap:OtherIntangibleAssetsMember2024-01-012024-09-300001794669four:CapitalizedAcquisitionCostsMember2024-01-012024-09-300001794669four:EquipmentUnderLeaseMember2024-01-012024-09-300001794669us-gaap:PropertyPlantAndEquipmentMember2024-01-012024-09-300001794669four:ResidualCommissionBuyoutsMember2023-01-012023-09-300001794669us-gaap:OtherIntangibleAssetsMember2023-01-012023-09-300001794669four:CapitalizedAcquisitionCostsMember2023-01-012023-09-300001794669four:EquipmentUnderLeaseMember2023-01-012023-09-300001794669us-gaap:PropertyPlantAndEquipmentMember2023-01-012023-09-300001794669four:AcquiredIntangibleAssetsMember2024-07-012024-09-300001794669four:NonAcquiredIntangibleAssetsMember2024-07-012024-09-300001794669four:AcquiredIntangibleAssetsMember2023-07-012023-09-300001794669four:NonAcquiredIntangibleAssetsMember2023-07-012023-09-300001794669four:AcquiredIntangibleAssetsMember2024-01-012024-09-300001794669four:NonAcquiredIntangibleAssetsMember2024-01-012024-09-300001794669four:AcquiredIntangibleAssetsMember2023-01-012023-09-300001794669four:NonAcquiredIntangibleAssetsMember2023-01-012023-09-300001794669four:ResidualCommissionBuyoutsFromAssetAcquisitionsMember2024-09-300001794669four:ResidualCommissionBuyoutsFromBusinessCombinationsMember2024-09-300001794669four:ResidualCommissionBuyoutsFromAssetAcquisitionsMember2023-12-310001794669four:ResidualCommissionBuyoutsFromBusinessCombinationsMember2023-12-310001794669four:MerchantRelationshipsMember2024-09-300001794669four:AcquiredTechnologyMember2024-09-300001794669us-gaap:TrademarksAndTradeNamesMember2024-09-300001794669four:CapitalizedSoftwareDevelopmentCostsMember2024-09-300001794669four:FinaroBankingLicenseMember2024-09-300001794669four:MerchantRelationshipsMember2023-12-310001794669four:AcquiredTechnologyMember2023-12-310001794669us-gaap:TrademarksAndTradeNamesMember2023-12-310001794669four:CapitalizedSoftwareDevelopmentCostsMember2023-12-310001794669four:FinaroBankingLicenseMember2023-12-310001794669four:EquipmentUnderLeaseMember2024-01-012024-09-300001794669four:EquipmentUnderLeaseMember2024-09-300001794669four:EquipmentHeldForLeaseMember2024-09-300001794669four:EquipmentUnderLeaseMember2023-01-012023-12-310001794669four:EquipmentUnderLeaseMember2023-12-310001794669four:EquipmentHeldForLeaseMember2023-12-310001794669us-gaap:EquipmentMember2024-09-300001794669us-gaap:EquipmentMember2023-12-310001794669us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-09-300001794669us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001794669us-gaap:LeaseholdImprovementsMember2024-09-300001794669us-gaap:LeaseholdImprovementsMember2023-12-310001794669us-gaap:FurnitureAndFixturesMember2024-09-300001794669us-gaap:FurnitureAndFixturesMember2023-12-310001794669us-gaap:VehiclesMember2024-09-300001794669us-gaap:VehiclesMember2023-12-310001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMember2024-09-300001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMember2024-01-012024-09-300001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMember2023-12-310001794669four:ConvertibleNotesDueTwoThousandTwentyFiveMemberus-gaap:SeniorNotesMember2024-01-012024-09-300001794669four:ConvertibleNotesDueTwoThousandTwentyFiveMemberus-gaap:SeniorNotesMember2024-09-300001794669four:ConvertibleNotesDueTwoThousandTwentyFiveMemberus-gaap:SeniorNotesMember2023-12-310001794669four:ConvertibleNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2024-01-012024-09-300001794669four:ConvertibleNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2024-09-300001794669four:ConvertibleNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2023-12-310001794669four:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMemberus-gaap:SeniorNotesMember2024-09-300001794669four:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMemberus-gaap:SeniorNotesMember2024-01-012024-09-300001794669four:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMemberus-gaap:SeniorNotesMember2023-12-310001794669us-gaap:SeniorNotesMember2024-09-300001794669us-gaap:SeniorNotesMember2023-12-310001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-08-012024-08-310001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMember2024-08-012024-08-310001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2024-08-012024-08-310001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMembersrt:MinimumMember2024-08-012024-08-310001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300001794669us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2024-09-300001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-01-290001794669us-gaap:LineOfCreditMember2024-01-012024-09-300001794669four:VariableRateComponentOneMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-09-300001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:FederalFundsEffectiveSwapRateMember2024-01-012024-09-300001794669four:VariableRateComponentTwoMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-09-300001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:PrimeRateMember2024-01-012024-09-300001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-09-300001794669four:OnlinePaymentsGroupAGMember2022-09-290001794669four:OnlinePaymentsGroupAGMember2022-09-292022-09-290001794669four:OnlinePaymentsGroupAGMember2024-09-280001794669four:OnlinePaymentsGroupAGMember2024-09-300001794669four:ContingentConsiderationLiabilityAcquisitionsMember2023-12-310001794669four:ContingentConsiderationLiabilityResidualCommissionBuyoutsMember2023-12-310001794669four:ContingentConsiderationLiabilityAcquisitionsMember2024-01-012024-09-300001794669four:ContingentConsiderationLiabilityResidualCommissionBuyoutsMember2024-01-012024-09-300001794669four:ContingentConsiderationLiabilityAcquisitionsMember2024-09-300001794669four:ContingentConsiderationLiabilityResidualCommissionBuyoutsMember2024-09-300001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMember2024-09-300001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMember2024-09-300001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMember2023-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMember2023-12-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentyFiveMember2024-09-300001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentyFiveMember2024-09-300001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentyFiveMember2023-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentyFiveMember2023-12-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentySevenMember2024-09-300001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentySevenMember2024-09-300001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentySevenMember2023-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentySevenMember2023-12-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMember2024-09-300001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMember2024-09-300001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMember2023-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMember2023-12-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-09-300001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-09-300001794669us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001794669four:ValuationAllowanceReleaseOnShift4PaymentsMember2024-07-012024-09-300001794669four:ValuationAllowanceReleaseOnCertainCorporateSubsidiariesMember2024-07-012024-09-300001794669four:ValuationAllowanceReleaseOnCertainCorporateSubsidiariesMember2024-01-012024-09-300001794669four:LegalEntityRestructuringMember2023-01-012023-09-300001794669four:AcquiredDeferredTaxLiabilitiesFromFocusMember2023-01-012023-09-300001794669four:ValuationAllowanceReleaseOnShift4PaymentsMember2024-01-012024-09-300001794669four:RookHoldingsIncorporationMember2023-12-310001794669us-gaap:RelatedPartyMember2024-07-012024-09-300001794669us-gaap:RelatedPartyMember2024-01-012024-09-300001794669us-gaap:RelatedPartyMember2023-07-012023-09-300001794669us-gaap:RelatedPartyMember2023-01-012023-09-300001794669us-gaap:RelatedPartyMember2024-09-300001794669us-gaap:RelatedPartyMember2023-12-3100017946692021-11-300001794669four:RookHoldingsIncorporationMember2024-09-300001794669us-gaap:RelatedPartyMemberfour:VPFContractsWithDealerMember2021-09-012021-09-300001794669us-gaap:RelatedPartyMemberus-gaap:CommonClassAMemberfour:VPFContractWithDealerNumberOneMember2021-09-012021-09-300001794669us-gaap:RelatedPartyMemberus-gaap:CommonClassAMemberfour:VPFContractWithDealerNumberTwoMember2021-09-012021-09-300001794669us-gaap:RelatedPartyMemberfour:VPFContractWithDealerNumberTwoMember2021-09-300001794669us-gaap:RelatedPartyMemberfour:VPFContractWithDealerNumberOneMember2021-09-300001794669us-gaap:RelatedPartyMemberus-gaap:CommonClassBMembersrt:MaximumMemberfour:VariablePrepaidForwardContractMember2021-09-300001794669us-gaap:CommonClassBMember2024-01-012024-09-3000017946692024-05-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncMember2024-09-300001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncMember2024-01-012024-09-300001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncMember2023-12-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncMember2023-01-012023-12-310001794669four:Shift4PaymentsLLCMemberfour:RookHoldingsIncorporationMember2024-09-300001794669four:Shift4PaymentsLLCMemberfour:RookHoldingsIncorporationMember2024-01-012024-09-300001794669four:Shift4PaymentsLLCMemberfour:RookHoldingsIncorporationMember2023-12-310001794669four:Shift4PaymentsLLCMemberfour:RookHoldingsIncorporationMember2023-01-012023-12-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncAndRookHoldingsIncorporationMember2024-09-300001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncAndRookHoldingsIncorporationMember2024-01-012024-09-300001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncAndRookHoldingsIncorporationMember2023-12-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncAndRookHoldingsIncorporationMember2023-01-012023-12-3100017946692022-06-012022-06-300001794669four:RestrictedStockUnitsAndPerformanceBasedRestrictedStockUnitsMember2023-12-310001794669four:RestrictedStockUnitsAndPerformanceBasedRestrictedStockUnitsMember2024-01-012024-09-300001794669four:RestrictedStockUnitsAndPerformanceBasedRestrictedStockUnitsMember2024-09-300001794669us-gaap:MemberUnitsMemberus-gaap:CommonClassAMember2024-07-012024-09-300001794669us-gaap:MemberUnitsMemberus-gaap:CommonClassAMember2023-07-012023-09-300001794669us-gaap:MemberUnitsMemberus-gaap:CommonClassAMember2024-01-012024-09-300001794669us-gaap:MemberUnitsMemberus-gaap:CommonClassAMember2023-01-012023-09-300001794669us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2024-07-012024-09-300001794669us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2023-07-012023-09-300001794669us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2024-01-012024-09-300001794669us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2023-01-012023-09-300001794669four:ContingentSharesMemberus-gaap:CommonClassAMember2024-07-012024-09-300001794669four:ContingentSharesMemberus-gaap:CommonClassAMember2023-07-012023-09-300001794669four:ContingentSharesMemberus-gaap:CommonClassAMember2024-01-012024-09-300001794669four:ContingentSharesMemberus-gaap:CommonClassAMember2023-01-012023-09-300001794669us-gaap:StockCompensationPlanMember2024-07-012024-09-300001794669us-gaap:StockCompensationPlanMember2023-07-012023-09-300001794669us-gaap:StockCompensationPlanMember2024-01-012024-09-300001794669us-gaap:StockCompensationPlanMember2023-01-012023-09-300001794669us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001794669us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001794669us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001794669us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001794669four:GivexCorpMemberus-gaap:SubsequentEventMember2024-11-082024-11-080001794669four:JamesWhalenMember2024-01-012024-09-300001794669four:JamesWhalenMember2024-07-012024-09-300001794669four:JamesWhalenMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-Q

__________________________________________________

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

or

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission File Number: 001-39313

__________________________________

SHIFT4 PAYMENTS, INC.

(Exact name of registrant as specified in its charter)

__________________________________

| | | | | | | | |

| Delaware | | 84-3676340 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

3501 Corporate Parkway Center Valley, Pennsylvania | | 18034 |

| (Address of principal executive offices) | | (Zip Code) |

(888) 276-2108

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | FOUR | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | o |

| Emerging growth company | o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of November 5, 2024, there were 68,664,969 shares of the registrant’s Class A common stock, $0.0001 par value per share, outstanding, 19,801,028 shares of the registrant’s Class B common stock, $0.0001 par value per share, outstanding and 1,635,770 shares of the registrant’s Class C common stock, $0.0001 par value per share, outstanding.

SHIFT4 PAYMENTS, INC.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Quarterly Report”) contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“the Exchange Act”). All statements other than statements of historical fact contained in this Quarterly Report, including, without limitation, statements relating to our position as a leader within our industry; our future results of operations and financial position, business strategy and plans; the impact of changes in TRA liability (as defined herein); the anticipated benefits of and costs associated with recent acquisitions; and objectives of management for future operations and activities, including, among others, statements regarding expected growth, international expansion, future capital expenditures, debt covenant compliance, financing activities, debt service obligations, and the timing of any of the foregoing, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions, though not all forward-looking statements can be identified by such terms or expressions. The forward-looking statements in this Quarterly Report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Quarterly Report and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including, but not limited to, those factors described in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed on February 29, 2024 (the “2023 Form 10-K”).

Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties.

You should read this Quarterly Report and the documents that we reference herein completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

PART I: FINANCIAL INFORMATION

Item 1. Financial Statements (unaudited)

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)(in millions, except share and per share amounts) | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 1,426.4 | | | $ | 455.0 | |

| Restricted cash | — | | | 84.4 | |

| Settlement assets | 283.2 | | | 321.2 | |

| Accounts receivable, net | 317.8 | | | 256.8 | |

| Inventory | 7.1 | | | 3.4 | |

| Prepaid expenses and other current assets | 60.1 | | | 32.5 | |

| Total current assets | 2,094.6 | | | 1,153.3 | |

| Noncurrent assets | | | |

| Equipment for lease, net | 156.9 | | | 123.1 | |

| Property, plant and equipment, net | 27.4 | | | 28.6 | |

| Right-of-use assets | 30.6 | | | 22.8 | |

| Investments in securities | 78.9 | | | 62.2 | |

| Collateral held by the card networks | 39.1 | | | 37.7 | |

| Goodwill | 1,324.0 | | | 1,111.3 | |

| Residual commission buyouts, net | 167.3 | | | 229.6 | |

| Capitalized customer acquisition costs, net | 63.3 | | | 51.7 | |

| Other intangible assets, net | 672.1 | | | 548.8 | |

| Deferred tax assets | 370.9 | | | — | |

| Other noncurrent assets | 23.8 | | | 18.7 | |

| | | |

| Total assets | $ | 5,048.9 | | | $ | 3,387.8 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities | | | |

| Settlement liabilities | $ | 278.3 | | | $ | 315.2 | |

| Accounts payable | 252.0 | | | 204.6 | |

| Accrued expenses and other current liabilities | 138.1 | | | 82.1 | |

| Deferred revenue | 22.1 | | | 20.6 | |

| Bank deposits | — | | | 72.3 | |

| Current lease liabilities | 8.7 | | | 7.8 | |

| Current TRA liability | 4.2 | | | 1.8 | |

| Total current liabilities | 703.4 | | | 704.4 | |

| Noncurrent liabilities | | | |

| Long-term debt | 2,838.0 | | | 1,750.2 | |

| Noncurrent TRA liability | 365.9 | | | 3.3 | |

| Deferred tax liabilities | 32.7 | | | 28.7 | |

| Noncurrent lease liabilities | 25.4 | | | 18.8 | |

| Other noncurrent liabilities | 35.7 | | | 14.0 | |

| | | |

| Total liabilities | 4,001.1 | | | 2,519.4 | |

| Commitments and contingencies (Note 15) | | | |

| Stockholders' equity | | | |

Preferred stock, $0.0001 par value, 20,000,000 shares authorized at September 30, 2024 and December 31, 2023, none issued and outstanding | — | | | — | |

Class A common stock, $0.0001 par value per share, 300,000,000 shares authorized, 66,942,326 and 60,664,171 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | — | | | — | |

Class B common stock, $0.0001 par value per share, 100,000,000 shares authorized, 19,801,028 and 23,831,883 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively. | — | | | — | |

Class C common stock, $0.0001 par value per share, 100,000,000 shares authorized, 1,635,770 and 1,694,915 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively. | — | | | — | |

| Additional paid-in capital | 1,048.7 | | | 985.9 | |

| | | |

| Accumulated other comprehensive income | 20.6 | | | 14.1 | |

| Retained deficit | (257.5) | | | (346.7) | |

| Total stockholders' equity attributable to Shift4 Payments, Inc. | 811.8 | | | 653.3 | |

| Noncontrolling interests | 236.0 | | | 215.1 | |

| Total stockholders' equity | 1,047.8 | | | 868.4 | |

| Total liabilities and stockholders' equity | $ | 5,048.9 | | | $ | 3,387.8 | |

See accompanying notes to unaudited condensed consolidated financial statements. |

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) (in millions, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

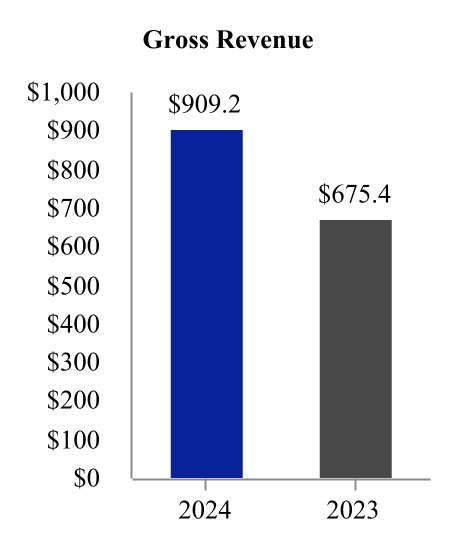

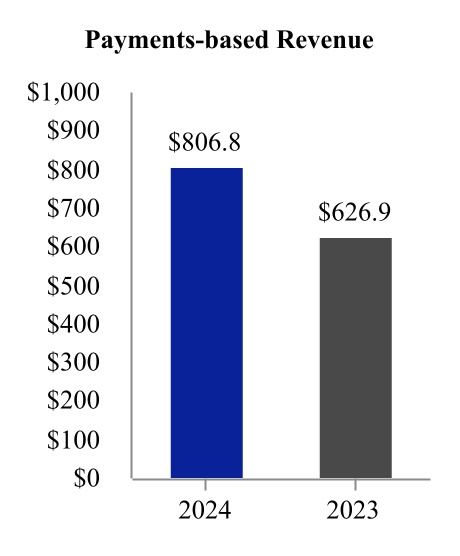

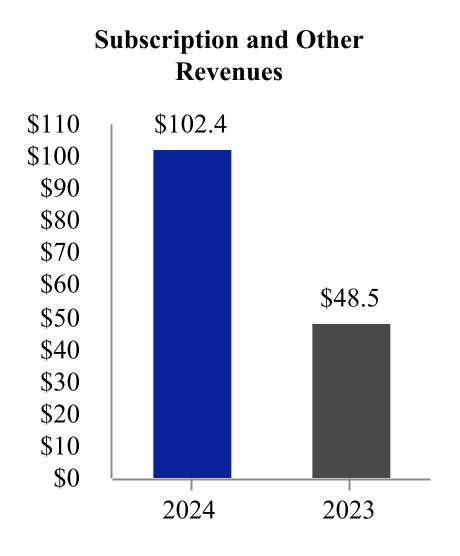

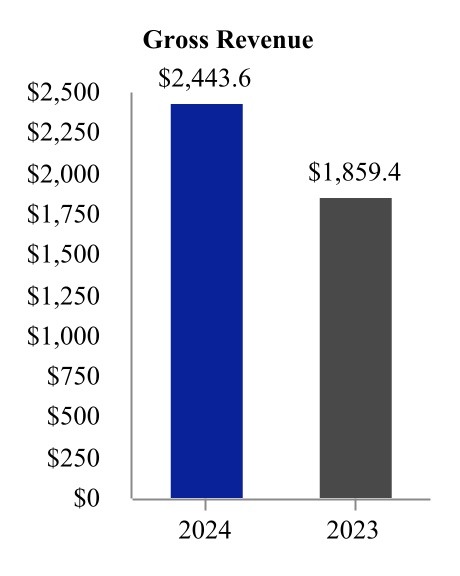

| Gross revenue | $ | 909.2 | | | $ | 675.4 | | | $ | 2,443.6 | | | $ | 1,859.4 | |

| Cost of sales (exclusive of certain depreciation and amortization expense shown separately below) | (641.9) | | | (495.1) | | | (1,756.7) | | | (1,366.8) | |

| General and administrative expenses | (118.2) | | | (76.3) | | | (335.4) | | | (244.1) | |

| Revaluation of contingent liabilities | (1.5) | | | (8.9) | | | (3.9) | | | (21.5) | |

| Depreciation and amortization expense (a) | (51.6) | | | (40.0) | | | (143.1) | | | (111.2) | |

| Professional expenses | (9.4) | | | (5.7) | | | (29.0) | | | (17.2) | |

| | | | | | | |

| Advertising and marketing expenses | (6.2) | | | (4.7) | | | (14.5) | | | (11.2) | |

| | | | | | | |

| Income from operations | 80.4 | | | 44.7 | | | 161.0 | | | 87.4 | |

| | | | | | | |

| Interest income | 9.7 | | | 9.6 | | | 20.1 | | | 26.0 | |

| Other income (expense), net | (1.5) | | | — | | | 0.3 | | | (0.3) | |

| Unrealized gain on investments in securities | 10.8 | | | 2.6 | | | 21.6 | | | 11.5 | |

| Change in TRA liability | (289.4) | | | (1.5) | | | (294.2) | | | (2.8) | |

| Interest expense | (18.3) | | | (8.0) | | | (34.5) | | | (24.1) | |

| Income (loss) before income taxes | (208.3) | | | 47.4 | | | (125.7) | | | 97.7 | |

| Income tax benefit (expense) | 280.5 | | | (0.9) | | | 280.9 | | | 6.0 | |

| Net income | 72.2 | | | 46.5 | | | 155.2 | | | 103.7 | |

| Less: Net income attributable to noncontrolling interests | (18.4) | | | (13.9) | | | (41.6) | | | (31.2) | |

| Net income attributable to Shift4 Payments, Inc. | $ | 53.8 | | | $ | 32.6 | | | $ | 113.6 | | | $ | 72.5 | |

| | | | | | | |

| Basic net income per share | | | | | | | |

| Class A net income per share - basic | $ | 0.78 | | | $ | 0.56 | | | $ | 1.68 | | | $ | 1.24 | |

| Class A weighted average common stock outstanding - basic | 66,791,329 | | | 56,537,008 | | | 65,230,377 | | | 56,233,959 | |

| Class C net income per share - basic | $ | 0.78 | | | $ | 0.56 | | | $ | 1.68 | | | $ | 1.24 | |

| Class C weighted average common stock outstanding - basic | 1,659,314 | | | 1,759,273 | | | 1,681,264 | | | 2,019,063 | |

| | | | | | | |

| Diluted net income per share | | | | | | | |

| Class A net income per share - diluted | $ | 0.74 | | | $ | 0.55 | | | $ | 1.59 | | | $ | 1.22 | |

| Class A weighted average common stock outstanding - diluted | 89,356,938 | | | 57,673,083 | | | 89,514,680 | | | 57,697,393 | |

| Class C net income per share - diluted | $ | 0.74 | | | $ | 0.55 | | | $ | 1.59 | | | $ | 1.22 | |

| Class C weighted average common stock outstanding - diluted | 1,659,314 | | | 1,759,273 | | | 1,681,264 | | | 2,019,063 | |

| See accompanying notes to unaudited condensed consolidated financial statements. |

(a)Depreciation and amortization expense includes depreciation of equipment under lease of $14.1 million and $39.0 million for the three and nine months ended September 30, 2024, respectively, and $9.3 million and $24.7 million for the three and nine months ended September 30, 2023, respectively.

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited) (in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 72.2 | | | $ | 46.5 | | | $ | 155.2 | | | $ | 103.7 | |

| Other comprehensive gain (loss) | | | | | | | |

| Unrealized gain (loss) on foreign currency translation adjustment | 35.8 | | | (5.6) | | | 7.3 | | | (2.7) | |

| | | | | | | |

| | | | | | | |

| Comprehensive income | 108.0 | | | 40.9 | | | 162.5 | | | 101.0 | |

| Less: Comprehensive income attributable to noncontrolling interests | (26.5) | | | (12.3) | | | (42.4) | | | (30.5) | |

| Comprehensive income attributable to Shift4 Payments, Inc. | $ | 81.5 | | | $ | 28.6 | | | $ | 120.1 | | | $ | 70.5 | |

| See accompanying notes to unaudited condensed consolidated financial statements. |

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited) (in millions, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | Additional Paid-In Capital | | Treasury Stock | | Retained Deficit | | Accumulated Other Comprehensive Income | | Noncontrolling Interests | | Total Equity |

| Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | | Shares | | Amount | | | | |

| Balances at December 31, 2023 | 60,664,171 | | | $ | — | | | 23,831,883 | | | $ | — | | | 1,694,915 | | | $ | — | | | $ | 985.9 | | | — | | | $ | — | | | $ | (346.7) | | | $ | 14.1 | | | $ | 215.1 | | | $ | 868.4 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 20.6 | | | — | | | 7.9 | | | 28.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (0.3) | | | (0.3) | |

| Equity-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 22.8 | | | — | | | — | | | — | | | — | | | — | | | 22.8 | |

| Vesting of restricted stock units, net of tax withholding | 151,053 | | | — | | | — | | | — | | | — | | | — | | | (11.6) | | | — | | | — | | | — | | | — | | | 2.5 | | | (9.1) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (10.6) | | | (3.9) | | | (14.5) | |

| Balances at March 31, 2024 | 60,815,224 | | | — | | | 23,831,883 | | | — | | | 1,694,915 | | | — | | | 997.1 | | | — | | | — | | | (326.1) | | | 3.5 | | | 221.3 | | | 895.8 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 39.2 | | | — | | | 15.3 | | | 54.5 | |

| Recognition of Vectron noncontrolling interest | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 25.9 | | | 25.9 | |

| Repurchases of Class A common stock to treasury stock | — | | | — | | | — | | | — | | | — | | | — | | | (1.0) | | | (230,400) | | | (15.9) | | | — | | | — | | | 1.0 | | | (15.9) | |

| Issuance of Class A common stock, net of tax withholding | 1,230,309 | | | — | | | — | | | — | | | — | | | — | | | 1.6 | | | — | | | — | | | — | | | — | | | 0.4 | | | 2.0 | |

| Retirement of treasury stock | (230,400) | | | — | | | — | | | — | | | — | | | — | | | (5.0) | | | 230,400 | | | 15.9 | | | (10.9) | | | — | | | — | | | — | |

| Exchange of shares held by Rook | 109,976 | | | — | | | (80,915) | | | — | | | (29,061) | | | — | | | 0.1 | | | — | | | — | | | — | | | — | | | (0.1) | | | — | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1.7) | | | (1.7) | |

| Equity-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 14.3 | | | — | | | — | | | — | | | — | | | — | | | 14.3 | |

| Vesting of restricted stock units, net of tax withholding | 42,139 | | | — | | | — | | | — | | | — | | | — | | | (1.4) | | | — | | | — | | | — | | | — | | | (0.7) | | | (2.1) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (10.6) | | | (3.4) | | | (14.0) | |

| Balances at June 30, 2024 | 61,967,248 | | | — | | | 23,750,968 | | | — | | | 1,665,854 | | | — | | | 1,005.7 | | | — | | | — | | | (297.8) | | | (7.1) | | | 258.0 | | | 958.8 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 53.8 | | | — | | | 18.4 | | | 72.2 | |

| Purchases of shares of Vectron common stock, net of foreign currency translation | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (0.1) | | | (0.1) | |

| Repurchases of Class A common stock to treasury stock | — | | | — | | | — | | | — | | | — | | | — | | | 3.5 | | | (298,488) | | | (20.0) | | | — | | | — | | | (3.5) | | | (20.0) | |

| Issuance of Class A common stock, net of tax withholding | 1,203,807 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Retirement of treasury stock | (298,488) | | | — | | | — | | | — | | | — | | | — | | | (6.5) | | | 298,488 | | | 20.0 | | | (13.5) | | | — | | | — | | | — | |

| Exchange of shares held by Rook | 3,980,024 | | | — | | | (3,949,940) | | | — | | | (30,084) | | | — | | | 38.9 | | | — | | | — | | | — | | | — | | | (38.9) | | | — | |

| Equity impact of tax receivable agreement for exchanges, net of deferred taxes arising from changes in ownership | — | | | — | | | — | | | — | | | — | | | — | | | (2.2) | | | — | | | — | | | — | | | — | | | — | | | (2.2) | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (4.6) | | | (4.6) | |

| Equity-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 14.3 | | | — | | | — | | | — | | | — | | | — | | | 14.3 | |

| Vesting of restricted stock units, net of tax withholding | 89,735 | | | — | | | — | | | — | | | — | | | — | | | (5.0) | | | — | | | — | | | — | | | — | | | (1.4) | | | (6.4) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 27.7 | | | 8.1 | | | 35.8 | |

| Balances at September 30, 2024 | 66,942,326 | | | $ | — | | | 19,801,028 | | | $ | — | | | 1,635,770 | | | $ | — | | | $ | 1,048.7 | | | — | | | $ | — | | | $ | (257.5) | | | $ | 20.6 | | | $ | 236.0 | | | $ | 1,047.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | Additional Paid-In Capital | | Treasury Stock | | Retained Deficit | | Accumulated Other Comprehensive Income | | Noncontrolling Interests | | Total Equity |

| Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | | Shares | | Amount | | | | |

| Balances at December 31, 2022 | 54,153,218 | | | $ | — | | | 25,829,016 | | | $ | — | | | 2,889,811 | | | $ | — | | | $ | 702.6 | | | — | | | $ | — | | | $ | (363.6) | | | $ | 8.3 | | | $ | 133.3 | | | $ | 480.6 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 14.8 | | | — | | | 5.6 | | | 20.4 | |

| Issuance of Class A common stock and contingent share earnout in connection with an acquisition | 27,780 | | | — | | | — | | | — | | | — | | | — | | | 5.5 | | | — | | | — | | | — | | | — | | | 2.1 | | | 7.6 | |

| Exchange of shares held by Rook | 2,465,770 | | | — | | | (1,666,665) | | | — | | | (799,105) | | | — | | | 4.9 | | | — | | | — | | | — | | | — | | | (4.9) | | | — | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1.8) | | | (1.8) | |

| Equity-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 21.9 | | | — | | | — | | | — | | | — | | | — | | | 21.9 | |

| Vesting of restricted stock units, net of tax withholding | 123,846 | | | — | | | — | | | — | | | — | | | — | | | (4.7) | | | — | | | — | | | — | | | — | | | (0.6) | | | (5.3) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2.1 | | | 0.9 | | | 3.0 | |

| Balances at March 31, 2023 | 56,770,614 | | | — | | | 24,162,351 | | | — | | | 2,090,706 | | | — | | | 730.2 | | | — | | | — | | | (348.8) | | | 10.4 | | | 134.6 | | | 526.4 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 25.1 | | | — | | | 11.7 | | | 36.8 | |

| Issuance of Class A common stock | 295,699 | | | — | | | — | | | — | | | — | | | — | | | 6.4 | | | — | | | — | | | — | | | — | | | 4.6 | | | 11.0 | |

| Repurchases of Class A common stock to treasury stock | — | | | — | | | — | | | — | | | — | | | — | | | 22.7 | | | (1,515,000) | | | (97.3) | | | — | | | — | | | (22.7) | | | (97.3) | |

| Retirement of treasury stock | (1,515,000) | | | — | | | — | | | — | | | — | | | — | | | (33.4) | | | 1,515,000 | | | 97.3 | | | (63.9) | | | — | | | — | | | — | |

| Exchange of shares held by Rook | 661,901 | | | — | | | (330,468) | | | — | | | (331,433) | | | — | | | 1.9 | | | — | | | — | | | — | | | — | | | (1.9) | | | — | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (0.4) | | | (0.4) | |

| Equity-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 13.1 | | | — | | | — | | | — | | | — | | | — | | | 13.1 | |

| Vesting of restricted stock units, net of tax withholding | 253,919 | | | — | | | — | | | — | | | — | | | — | | | (7.1) | | | — | | | — | | | — | | | — | | | (3.2) | | | (10.3) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (0.1) | | | — | | | (0.1) | |

| Balances at June 30, 2023 | 56,467,133 | | | — | | | 23,831,883 | | | — | | | 1,759,273 | | | — | | | 733.8 | | | — | | | — | | | (387.6) | | | 10.3 | | | 122.7 | | | 479.2 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 32.6 | | | — | | | 13.9 | | | 46.5 | |

| Contingent share earnout in connection with an acquisition | — | | | — | | | — | | | — | | | — | | | — | | | 8.1 | | | — | | | — | | | — | | | — | | | 5.7 | | | 13.8 | |

| Excise tax | — | | | — | | | — | | | — | | | — | | | — | | | 0.1 | | | — | | | — | | | — | | | — | | | — | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (0.5) | | | (0.5) | |

| Equity-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 12.4 | | | — | | | — | | | — | | | — | | | — | | | 12.4 | |

| Vesting of restricted stock units, net of tax withholding | 77,706 | | | — | | | — | | | — | | | — | | | — | | | (5.5) | | | — | | | — | | | — | | | — | | | 0.6 | | | (4.9) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (4.0) | | | (1.6) | | | (5.6) | |

| Balances at September 30, 2023 | 56,544,839 | | | $ | — | | | 23,831,883 | | | $ | — | | | 1,759,273 | | | $ | — | | | $ | 748.9 | | | — | | | $ | — | | | $ | (355.0) | | | $ | 6.3 | | | $ | 140.8 | | | $ | 541.0 | |

| See accompanying notes to unaudited condensed consolidated financial statements. |

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) (in millions)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Operating activities | | | |

| Net income | $ | 155.2 | | | $ | 103.7 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | |

| Depreciation and amortization | 213.1 | | | 152.7 | |

| Equity-based compensation expense | 51.4 | | | 46.4 | |

| Revaluation of contingent liabilities | 3.9 | | | 21.5 | |

| | | |

| Unrealized gain on investments in securities | (21.6) | | | (11.5) | |

| Change in TRA liability | 294.2 | | | 2.8 | |

| Amortization of capitalized financing costs | 6.6 | | | 6.2 | |

| Provision for bad debts | 6.4 | | | 7.4 | |

| Deferred income taxes | (300.1) | | | (8.6) | |

| Unrealized foreign exchange gains | (0.5) | | | — | |

| Other noncash items | (1.1) | | | 1.5 | |

| Change in operating assets and liabilities | | | |

| Settlement activity, net | (14.4) | | | — | |

| Accounts receivable | (46.0) | | | (43.8) | |

| Prepaid expenses and other assets | (18.5) | | | (5.4) | |

| Inventory | 7.0 | | | 5.7 | |

| Capitalized customer acquisition costs | (30.0) | | | (25.6) | |

| Accounts payable | 24.9 | | | 15.8 | |

| Accrued expenses and other liabilities | 35.5 | | | 19.0 | |

| Payments on contingent liabilities in excess of initial fair value | (0.3) | | | (2.8) | |

| Right-of-use assets and lease liabilities, net | (0.6) | | | 0.1 | |

| Deferred revenue | (10.2) | | | (2.1) | |

| Net cash provided by operating activities | 354.9 | | | 283.0 | |

| | | |

| Investing activities | | | |

| Acquisitions, net of cash acquired | (305.9) | | | (36.3) | |

| Acquisition of equipment to be leased | (75.9) | | | (62.7) | |

| Capitalized software development costs | (48.4) | | | (29.3) | |

| Acquisition of property, plant and equipment | (5.5) | | | (11.3) | |

| Residual commission buyouts | (3.6) | | | (9.5) | |

| Purchase of intangible assets | — | | | (2.0) | |

| Proceeds from sale of investments in securities | 4.1 | | | — | |

| | | |

| Net cash used in investing activities | (435.2) | | | (151.1) | |

| | | |

| Financing activities | | | |

| Proceeds from long-term debt | 1,100.0 | | | — | |

| Deferred financing costs | (16.3) | | | — | |

| Repurchases of Class A common stock | (35.9) | | | (96.8) | |

| Payments for withholding tax related to vesting of restricted stock units | (17.6) | | | (20.5) | |

| Payments on contingent liabilities | (1.5) | | | (4.3) | |

| Distributions to noncontrolling interests | (6.6) | | | (2.7) | |

| Net change in bank deposits | (70.8) | | | — | |

| Other financing activities | (0.7) | | | — | |

| | | |

| Net cash provided by (used in) financing activities | 950.6 | | | (124.3) | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | 3.3 | | | (0.8) | |

| Change in cash and cash equivalents and restricted cash | 873.6 | | | 6.8 | |

| | | |

| Cash and cash equivalents and restricted cash, beginning of period | 721.8 | | | 776.5 | |

| Cash and cash equivalents and restricted cash, end of period | $ | 1,595.4 | | | $ | 783.3 | |

| See accompanying notes to unaudited condensed consolidated financial statements. |

SHIFT4 PAYMENTS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited) (in millions, except share and per share amounts)

1.Organization, Basis of Presentation and Significant Accounting Policies

Organization

Shift4 Payments, Inc. (“Shift4 Payments” or “the Company”) was incorporated in Delaware in order to carry on the business of Shift4 Payments, LLC and its consolidated subsidiaries. The Company is a leading independent provider of software and payment processing solutions in the United States (“U.S.”) based on total volume of payments processed.

Basis of Presentation

The accompanying interim condensed consolidated financial statements of the Company are unaudited. These interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the U.S. (“U.S. GAAP”) and the applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) for interim financial information. These financial statements do not include all information and footnotes required by U.S. GAAP for complete financial statements. The December 31, 2023 Condensed Consolidated Balance Sheet was derived from audited financial statements as of that date, but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements.

In the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments consisting only of normal recurring adjustments necessary to state fairly the financial position, results of operations and cash flows for the periods presented in conformity with U.S. GAAP applicable to interim periods. The results of operations for the interim periods presented are not necessarily indicative of results for the full year or future periods. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the related notes thereto as of and for the fiscal year ended December 31, 2023, as disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”).

The unaudited condensed consolidated financial statements include the accounts of Shift4 Payments, Inc. and its wholly-owned subsidiaries. Shift4 Payments, Inc. consolidates the financial results of Shift4 Payments, LLC, which is considered a variable interest entity. Shift4 Payments, Inc. is the primary beneficiary and sole managing member of Shift4 Payments, LLC and has decision making authority that significantly affects the economic performance of the entity. As a result, the Company consolidates Shift4 Payments, LLC and reports a noncontrolling interest representing the economic interest in Shift4 Payments, LLC held by Rook Holdings Inc. (“Rook”). All intercompany balances and transactions have been eliminated in consolidation.

The assets and liabilities of Shift4 Payments, LLC represent substantially all of the consolidated assets and liabilities of Shift4 Payments, Inc. with the exception of certain cash balances, amounts payable under the Tax Receivable Agreement (“TRA”), and the aggregate principal amount of $690.0 million of 2025 Convertible Notes and $632.5 million of 2027 Convertible Notes (together, the “Convertible Notes”) that are held by Shift4 Payments, Inc. directly. As of September 30, 2024 and December 31, 2023, $17.3 million and $3.6 million of cash, respectively, was directly held by Shift4 Payments, Inc. As of September 30, 2024 and December 31, 2023, the TRA liability was $370.1 million and $5.1 million, respectively. See Note 13 for further information on the increase in TRA liability during the three months ended September 30, 2024. In connection with the issuance of the Convertible Notes, Shift4 Payments, Inc. entered into Intercompany Convertible Notes with Shift4 Payments, LLC, whereby Shift4 Payments, Inc. provided the net proceeds from the issuance of the Convertible Notes to Shift4 Payments, LLC in the amount of $1,322.5 million. Shift4 Payments, Inc., which was incorporated on November 5, 2019, has not had any material operations on a standalone basis since its inception, and all of the operations of the Company are carried out by Shift4 Payments, LLC and its subsidiaries.

Change in Presentation of Consolidated Balance Sheets

Prior year balances have been adjusted to present “Current TRA liability” on its own line item rather than within “Accrued expenses and other current liabilities” on the Company’s unaudited Condensed Consolidated Balance Sheets to conform to the current period presentation.

Prior year balances have been adjusted to present “Noncurrent TRA liability” on its own line item rather than within “Other noncurrent liabilities” on the Company’s unaudited Condensed Consolidated Balance Sheets to conform to the current period presentation.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the Company’s unaudited condensed consolidated financial statements and accompanying notes. Significant estimates inherent in the preparation of the accompanying unaudited condensed consolidated financial statements include estimates of fair value of acquired assets and liabilities through business combinations, fair value of contingent liabilities related to earnout payments, deferred income tax valuation allowances, amounts associated with the Company’s tax receivable agreement with Rook and certain affiliates of Searchlight Capital Partners, L.P. (together, the “Continuing Equity Owners”), fair value of debt instruments, allowance for doubtful accounts, income taxes, investments in securities and noncontrolling interests. Estimates are based on past experience and other considerations reasonable under the circumstances. Actual results may differ from these estimates.

Significant Accounting Policies

The Company’s significant accounting policies are discussed in Note 1 to Shift4 Payments, Inc.’s consolidated financial statements as of and for the year ended December 31, 2023 in the 2023 Form 10-K. There have been no significant changes to these policies which have had a material impact on the Company’s unaudited condensed consolidated financial statements and related notes during the nine months ended September 30, 2024.

Cash and Cash Equivalents and Restricted Cash

Highly liquid investments with maturities of three months or less at the date of purchase are considered to be cash equivalents and are stated at cost, which approximates fair value. The Company’s cash equivalents consist of highly liquid investments in money market funds.

On September 30, 2024 the Company entered into the Settlement Line Credit Agreement (the “Settlement Line Agreement”), by and between Shift4 LLC, as the borrower, and Citizens Bank, N.A. (“Citizens”), as the lender, providing for a settlement line of credit with an aggregate available amount of up to $100.0 million (the “Settlement Line”). The purpose of the Settlement Line is to provide financing for certain settlement obligations of Shift4 LLC’s merchants and to eliminate the requirement for cash collateral under the sponsorship agreement with Citizens (the “Sponsorship Agreement”), which was amended in conjunction with the closing of the Settlement Line Agreement. There were no borrowings under the Settlement Line as of September 30, 2024. The Settlement Line is scheduled to mature on September 29, 2025, subject to extensions. Draws under the Settlement Line bear interest at a rate per annum equal to either (x) a daily simple SOFR based rate (subject to a 0.0% floor), plus an applicable margin of 0.75%, or (y) to the extent required by the Settlement Line Agreement upon the occurrence of certain specified events, an alternate base rate (equal to the highest of the Federal Funds Effective Rate plus 0.50%, the daily simple SOFR rate (subject to a 0.0% floor) plus 1.00%, and the prime rate announced by Citizens from time to time). In addition to making periodic interest payments on the principal amount of outstanding draws under the Settlement Line, the Company is required to pay an unused fee under the Settlement Line in respect of the unused availability thereunder at a rate equal to 0.15% per annum.

In the fourth quarter of 2023, the Company acquired Credorax, Inc. d/b/a Finaro (“Finaro”). Finaro’s principal activities consist of the provision of integrated acquiring and payment processing services to merchants located in Europe and the United Kingdom (the “U.K.”). Unlike the Company’s U.S. business, Finaro operates as a full acquirer, and without a sponsor bank like the Company has historically operated with in the U.S. As a result, the Company’s European and U.K. business includes settlement processing assets and liabilities. These assets primarily include settlement-related cash and funds receivable from card networks. Cash and cash equivalents held on behalf of merchants and other payees are included within “Settlement assets” on the unaudited Condensed Consolidated Balance Sheet. The changes in settlement cash and cash equivalents are included within “Settlement activity, net” within Operating activities on the Company’s unaudited Condensed Consolidated Statements of Cash Flows. The following table provides a reconciliation between cash and cash equivalents on the unaudited Condensed Consolidated Balance Sheets and the unaudited Condensed Consolidated Statements of Cash Flows:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Cash and cash equivalents | $ | 1,426.4 | | | $ | 455.0 | |

| Restricted cash | — | | | 84.4 | |

| Cash and cash equivalents included in Settlement assets | 169.0 | | | 182.4 | |

| Total cash and cash equivalents and restricted cash on the unaudited Condensed Consolidated Statements of Cash Flows | $ | 1,595.4 | | | $ | 721.8 | |

The Company maintains its cash with what are widely considered to be high credit quality financial institutions. U.S. cash balances are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250 thousand per bank. The Company maintains cash and cash equivalent balances in excess of FDIC limits.

Settlement Assets and Liabilities

Settlement assets and liabilities are balances related to the settlement process which involves the transferring of funds between card issuers, merchants and other third parties. The Company currently operates under two different models: (1) a sponsorship model and (2) a direct member model. In the U.S., the Company operates under the sponsorship model and outside the U.S. the Company primarily operates under the direct member model. The Company’s operations outside the U.S. are primarily related to the business of Finaro, which was acquired in the fourth quarter of 2023.

Sponsorship Model

In the U.S., the Company operates under the sponsorship model. In order for the Company to provide payment processing services, Visa, MasterCard and other payment networks require sponsorship by a member clearing bank. The Company has an agreement with banks and financial institutions (the “Sponsoring Member”), to provide sponsorship services to the Company. The sponsorship services allow the Company to route transactions under the Sponsoring Members’ membership to clear card transactions through card networks. Under this model, the standards of the payment networks restrict the Company from performing funds settlement and require that these funds be in the possession of the Sponsoring Member until the merchant is funded. Accordingly, settlement assets and obligations resulting from the submission of settlement files to the network or cash received from the network in advance of funding the network are the responsibility of the Sponsoring Member and are not recorded on the Company’s unaudited Condensed Consolidated Balance Sheets.

Direct Member Model

The Company’s European and U.K. business (previously known as Finaro) operates as a full acquirer and without a sponsor bank. Under the direct member model, the Company’s Consolidated Balance Sheets include settlement assets and liabilities that represent balances arising from the settlement process which involves the transferring of funds between card issuers, payment networks, processors, and merchants, as well as collateral held to manage merchant credit risk. As a processor, the Company facilitates the clearing and settlement activity for the merchant and records settlement assets and liabilities on the Consolidated Balance Sheets upon processing a payment transaction. Settlement assets represent cash received or amounts receivable primarily from payment networks or bank partners. Settlement liabilities primarily represent amounts payable to merchants. Settlement assets are in excess of Settlement liabilities due to prefunding provided to certain merchants.

Amounts included on the unaudited Condensed Consolidated Balance Sheets as Collateral held by card networks relate to collateral required by the card networks to operate as a direct member.

Recent Accounting Pronouncements

Accounting Pronouncements Adopted

In June 2022, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2022-03, Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions, to clarify that a contractual restriction on the sale of an equity security is not considered part of the unit of account of the equity security and, therefore, is not considered in measuring the fair value of the equity security. ASU 2022-03 also clarifies that an entity cannot recognize and measure a contractual sale restriction as a separate unit of account. The amendments in ASU 2022-03 became effective for the Company on January 1, 2024 on a prospective basis. The adoption did not have a significant impact on the Company’s unaudited condensed consolidated financial statements.

Accounting Pronouncements Not Yet Adopted

In November 2024, the FASB issued ASU 2024-03, Income Statement – Reporting Comprehensive Income – Expense Disaggregation Disclosures (Topic 220): Disaggregation of Income Statement Expenses, which requires additional disclosure of certain amounts included in the expense captions presented on the Statements of Operations as well as disclosures about selling expenses. ASU 2024-03 is effective on a prospective basis, with the option for retrospective application, for annual periods beginning after December 15, 2026 and interim reporting periods beginning after December 15, 2027, with early adoption permitted. The Company is in the process of assessing the impact the adoption of this guidance will have on the Company’s financial statement disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes: Improvements to Income Tax Disclosures, which provides qualitative and quantitative updates to the rate reconciliation and income taxes paid disclosures, among others, in order to enhance the transparency of income tax disclosures, including consistent categories and greater disaggregation of information in the rate reconciliation and disaggregation by jurisdiction of income taxes paid. ASU 2023-09 is effective on a prospective basis, with the option for retrospective application, for annual periods beginning after December 15, 2024, with early adoption permitted. The Company does not plan to early adopt ASU 2023-09 and is evaluating the impact of the amendments on the Company’s unaudited condensed consolidated financial statements.

2.Acquisitions

Each of the following acquisitions was accounted for as a business combination using the acquisition method of accounting. The respective purchase prices were allocated to the assets acquired and liabilities assumed based on the estimated fair values at the date of acquisition. The excess of the purchase price over the fair value of the net assets acquired was allocated to goodwill and represents the future economic benefits arising from other assets acquired, which cannot be individually identified or separately recognized.

Vectron

On June 14, 2024, the Company acquired a majority stake in Vectron Systems AG (“Vectron”). Based in Germany, Vectron is a supplier of POS systems to the restaurant and hospitality verticals that management believes will provide the Company with local product expertise and a European distribution network of POS resellers. Throughout the remainder of June and July 2024, the Company purchased additional shares of Vectron’s common stock through a public tender offer and open market purchases. As of September 30, 2024, the Company owned approximately 75% of Vectron’s common stock, for which it paid $62.7 million of total purchase consideration, net of cash acquired. The Company is in the process of gaining operational control of Vectron via a domination and profit and loss transfer agreement (DPLTA). The Company consolidates 100% of Vectron’s assets, liabilities, revenues and expenses and records a noncontrolling interest balance for the 25% economic interest in Vectron not held by the Company. Total purchase consideration was as follows:

| | | | | |

| Cash | $ | 66.9 | |

| Contingent consideration (a) | 2.9 | |

| Total purchase consideration | 69.8 | |

| Less: cash acquired | (7.1) | |

| Total purchase consideration, net of cash acquired | 62.7 | |

| Noncontrolling interest as of September 30, 2024 | 24.9 | |

| Fair value of net assets acquired | $ | 87.6 | |

| |

|

(a) The Company agreed to a cash earnout due to certain former shareholders of Vectron based on the achievement against certain operational metrics through 2027. The actual earn out can range between zero and €7.0 million. The fair value of the earnout was included in the initial purchase consideration and will be revalued and recorded quarterly until the end of the earnout period as a fair value adjustment within “Revaluation of contingent liabilities” in the Company’s unaudited Condensed Consolidated Statements of Operations. As of September 30, 2024, the fair value of the earnout was $3.1 million, which is recognized in “Other noncurrent liabilities” on the Company’s unaudited Condensed Consolidated Balance Sheets. |

The following table summarizes the fair value assigned to the assets acquired and liabilities assumed at the acquisition date. These amounts reflect various preliminary fair value estimates and assumptions, and are subject to change within the measurement period as valuations are finalized. The primary area of preliminary purchase price allocation subject to change relates to the valuation of accounts receivable, prepaid expenses and other current assets, other intangible assets, accounts payable, accrued expenses and other current liabilities, and residual goodwill.

| | | | | |

| Accounts receivable | $ | 8.2 | |

| Inventory | 3.5 | |

| Prepaid expenses and other current assets | 6.3 | |

| Goodwill (a) | 80.8 | |

| Other intangible assets | 30.0 | |

| Property, plant and equipment, net | 1.5 | |

| Right-of-use assets | 8.9 | |

| Other noncurrent assets | 2.5 | |

| Accounts payable | (4.3) | |

| Accrued expenses and other current liabilities | (6.5) | |

| Deferred revenue | (4.6) | |

| Current lease liabilities | (1.2) | |

| Deferred tax liabilities | (11.4) | |

| Noncurrent lease liabilities | (7.9) | |

| Other noncurrent liabilities (b) | (18.2) | |

| Net assets acquired | $ | 87.6 | |

| |

| (a) Goodwill is not deductible for tax purposes. |

(b) In connection with the Company’s majority stake in Vectron and due to Vectron’s acquisition of Acardo Group AG (“Acardo”) in December 2022, the Company became party to an earnout agreement with certain former shareholders of Acardo. The earnout is payable in multiple tranches, with up to €25.0 million payable in 2026. This amount is based on a multiple of the average of Acardo’s earnings before interest and taxes (“EBIT”) achieved in 2024 and 2025. Additionally, a percentage of Acardo’s net income for fiscal years 2023, 2024 and 2025 are payable in 2024, 2025 and 2026, respectively. Each portion of the earnout is expected to be paid in cash. The fair value of the earnout was included in the initial purchase consideration and will be revalued quarterly until the end of the earnout period as a fair value adjustment within “Revaluation of contingent liabilities” in the Company’s unaudited Condensed Consolidated Statements of Operations. As of September 30, 2024, the fair value of the earnout was $15.1 million, which was recognized in “Other noncurrent liabilities” on the Company’s unaudited Condensed Consolidated Balance Sheets. |

The fair values of other intangible assets were estimated using inputs classified as Level 3 under the income approach using the relief-from-royalty method for acquired technology and the trade name, and the multi-period excess earnings method for merchant relationships. This transaction was not taxable for income tax purposes. The estimated life of acquired technology, merchant relationships and trade name are six, twelve and seven years, respectively.

The acquisition of Vectron did not have a material impact on the Company’s unaudited condensed consolidated financial statements.

Revel

On June 13, 2024, the Company completed the acquisition of Revel Systems, Inc. (“Revel”) by acquiring 100% of its common stock for $245.3 million of total purchase consideration, net of cash acquired. Revel offers a cloud-based POS system primarily for multi-location merchants, focusing on restaurants, as well as back office and marketing tools that management believes will strengthen the Company’s presence within the restaurant and retail markets. Total purchase consideration was as follows:

| | | | | |

| Cash | $ | 255.3 | |

| Total purchase consideration | 255.3 | |

| Less: cash acquired | (10.0) | |

| Total purchase consideration, net of cash acquired | $ | 245.3 | |

| |

|

The following table summarizes the fair value assigned to the assets acquired and liabilities assumed at the acquisition date. These amounts reflect various preliminary fair value estimates and assumptions, and are subject to change within the measurement period as valuations are finalized. The primary area of preliminary purchase price allocation subject to change relates to the valuation of accounts receivable, prepaid expenses and other current assets, other intangible assets, accounts payable, accrued expenses and other current liabilities, and residual goodwill.

| | | | | |

| Accounts receivable | $ | 8.7 | |

| Inventory | 1.8 | |

| Prepaid expenses and other current assets | 4.3 | |

| Right-of-use assets | 1.5 | |

| Goodwill (a) | 123.9 | |

| Other intangible assets | 118.9 | |

| Deferred tax assets | 7.9 | |

| Other noncurrent assets | 0.3 | |