Q3 2025 SHAREHOLDER LETTER INVESTORS.SHIFT4.COM first cover options (2 of each): -Nobu Restaurants -Hyatt Vacation Club -Hertz -Max Mara Exhibit 99.1

Non-GAAP Financial Measures and Key Performance Indicators Forward-Looking Statements We use supplemental measures of our performance which are derived from our consolidated financial information but which are not presented in our consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). These non-GAAP financial measures include: gross revenue less network fees, which includes interchange and adjustment fees; non- GAAP net income; non-GAAP EPS; free cash flow; Adjusted Free Cash Flow; earnings before interest expense, interest income, income taxes, depreciation, and amortization (“EBITDA”); Adjusted EBITDA; Adjusted EBITDA conversion rate; and Adjusted EBITDA margin. Gross revenue less network fees represents a key performance metric that management uses to measure changes in the mix and value derived from our customer base as we continue to execute our strategy to expand our reach to serve larger, complex merchants. Non-GAAP net income represents net income adjusted for certain non-cash and other nonrecurring items that management believes are not indicative of ongoing operations, such as amortization of acquired intangible assets, acquisition, restructuring and integration costs, revaluation of contingent liabilities, loss on extinguishment of debt, impairment of intangible assets, gain (loss) on investments in securities, change in TRA liability, equity-based compensation expense, and foreign exchange and other nonrecurring items. Adjusted EBITDA is the primary financial performance measure used by management to evaluate its business and monitor results of operations. Adjusted EBITDA represents EBITDA further adjusted for certain non- cash and other nonrecurring items that management believes are not indicative of ongoing operations. These adjustments include acquisition, restructuring and integration costs, revaluation of contingent liabilities, loss on extinguishment of debt, gain (loss) on investments in securities, changes in TRA liability, equity-based compensation expense, and foreign exchange and other nonrecurring items. Adjusted EBITDA Margin represents Adjusted EBITDA divided by gross revenue less network fees. Free cash flow represents net cash provided by operating activities adjusted for certain non- discretionary capital expenditures. Adjusted Free Cash Flow represents free cash flow further adjusted for certain transactions that are not indicative of future operating cash flows, including acquisition, restructuring and integration costs, other nonrecurring expenses, and nonrecurring strategic capital expenditures that are not indicative of ongoing activities. We believe Adjusted Free Cash Flow is useful to measure the funds generated in a given period that are available to invest in the business, to repurchase stock and to make strategic decisions. The Adjusted EBITDA conversion rate is calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA. We use non-GAAP financial measures to supplement financial information presented on a GAAP basis. We believe that excluding certain items from our GAAP results allows management to better understand our consolidated financial performance and, in the case of Adjusted Free Cash Flow, our liquidity, from period to period and better project our future consolidated financial performance as forecasts are developed at a level of detail different from that used to prepare GAAP-based financial measures. Moreover, we believe these non-GAAP financial measures provide our stakeholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and, in the case of Adjusted Free Cash Flow, our liquidity, and enabling them to make more meaningful period to period comparisons. There are limitations to the use of the non-GAAP financial measures presented in this letter. Our non-GAAP financial measures may not be comparable to similarly titled measures of other companies. Other companies, including companies in our industry, may calculate non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this letter. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the substantial and increasingly intense competition worldwide in the financial services, payments and payment technology industries; potential changes in the competitive landscape, including disintermediation from other participants in the payments chain; the effect of global economic, political and other conditions on trends in consumer, business and government spending; fluctuations in inflation; our ability to anticipate and respond to changing industry trends and the needs and preferences of our merchants and consumers; our reliance on third-party vendors to provide products and services; risks associated with acquisitions; dispositions, and other strategic transactions; risks associated with our Series A Mandatory Convertible Preferred Stock; our inability to protect our IT systems and confidential information, as well as the IT systems of third parties we rely on, from continually evolving cybersecurity risks, security breaches or other technological risks; compliance with governmental regulation and other legal obligations, particularly related to privacy, data protection and information security, marketing across different markets where we conduct our business; risks associated with a The non-GAAP financial measures are not meant to be considered as indicators of performance, or in the case of Adjusted Free Cash Flow, as an indicator of liquidity, in isolation from or as a substitute for financial information prepared in accordance with GAAP, and should be read only in conjunction with financial information presented on a GAAP basis. Reconciliations of EBITDA, Adjusted EBITDA, gross revenue less network fees, non-GAAP net income, non-GAAP EPS, free cash flow and Adjusted Free Cash Flow to, in each case, its most directly comparable GAAP financial measure are presented in Appendix - Financial Information. For the full year 2025, we are unable to provide a reconciliation of Gross revenue less network fees, Adjusted EBITDA, and Adjusted Free Cash Flow to Gross Profit, Net Income, and net cash provided by operating activities, respectively, the nearest comparable GAAP measures, without unreasonable efforts. We encourage you to review the reconciliations in conjunction with the presentation of the non-GAAP financial measures for each of the periods presented. In future fiscal periods, we may exclude such items and may incur income and expenses similar to these excluded items. In addition, key performance indicators include volume, Blended Spread and margin. Volume is defined as the total dollar amount of payments that we deliver for settlement on behalf of our merchants. Included in volume are dollars routed via our international payments platform, alternative payment methods, including cryptocurrency, stored value, gift cards and stock donations, plus volume we route to third party merchant acquirers on behalf of strategic enterprise merchant relationships. We do maintain transaction processing on certain legacy platforms that are not defined as volume. Blended Spread represents the average yield Shift4 earns on the average volume processed for a given period after network fees. Blended Spread is calculated as payments-based revenue less gateway revenue and network fees for a given period divided by the volume processed for the same period. variety of laws and regulations, including those relating to financial services, money-laundering, anti-bribery, sanctions, and counter-terrorist financing, consumer protection and cryptocurrencies; our ability to continue to expand our share of the existing payment processing markets or expand into new markets; additional risks associated with our expansion into international operations, including compliance with and changes in foreign regulations governmental policies, as well as exposure to foreign exchange rates; our ability to integrate and interoperate our services and products with a variety of operating systems, software, devices, and web browsers; our dependence, in part, on our merchant and software partner relationships and strategic partnerships with various institutions to operate and grow our business; and the significant influence Jared Isaacman, our Executive Chairman and founder, has over us, including control over decisions that require the approval of stockholders, including a change in control, and the timing of any of the foregoing. These and other important factors discussed under the caption “Risk Factors” in Part I, Item 1A. in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, Part II, Item 1A. in our Quarterly Report on Form 10-Q for the period ended September 30, 2025, and our other filings with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this letter. Any such forward-looking statements represent management’s estimates as of the date of this letter. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. 1 This letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Shift4 Payments, Inc. (“we,” “our,” the “Company,” or “Shift4”) intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this letter, other than statements of historical fact, including, without limitation, statements relating to our position as a leader within our industry; our future results of operations and financial position, business strategy and plans; the anticipated benefits of and costs associated with recent acquisitions; and objectives of management for future operations and activities, including, among others, statements regarding expected growth, international expansion, future capital expenditures, debt covenant compliance, financing activities, debt service obligations including the settlement of conversions of our 2025 Convertible Notes, our financial outlook and guidance for 2025 or any other period, including key performance indicators, anticipated synergies as a result of the Global Blue acquisition, and the timing of any of the foregoing are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions, though not all forward-looking statements can be identified by such terms or expressions.

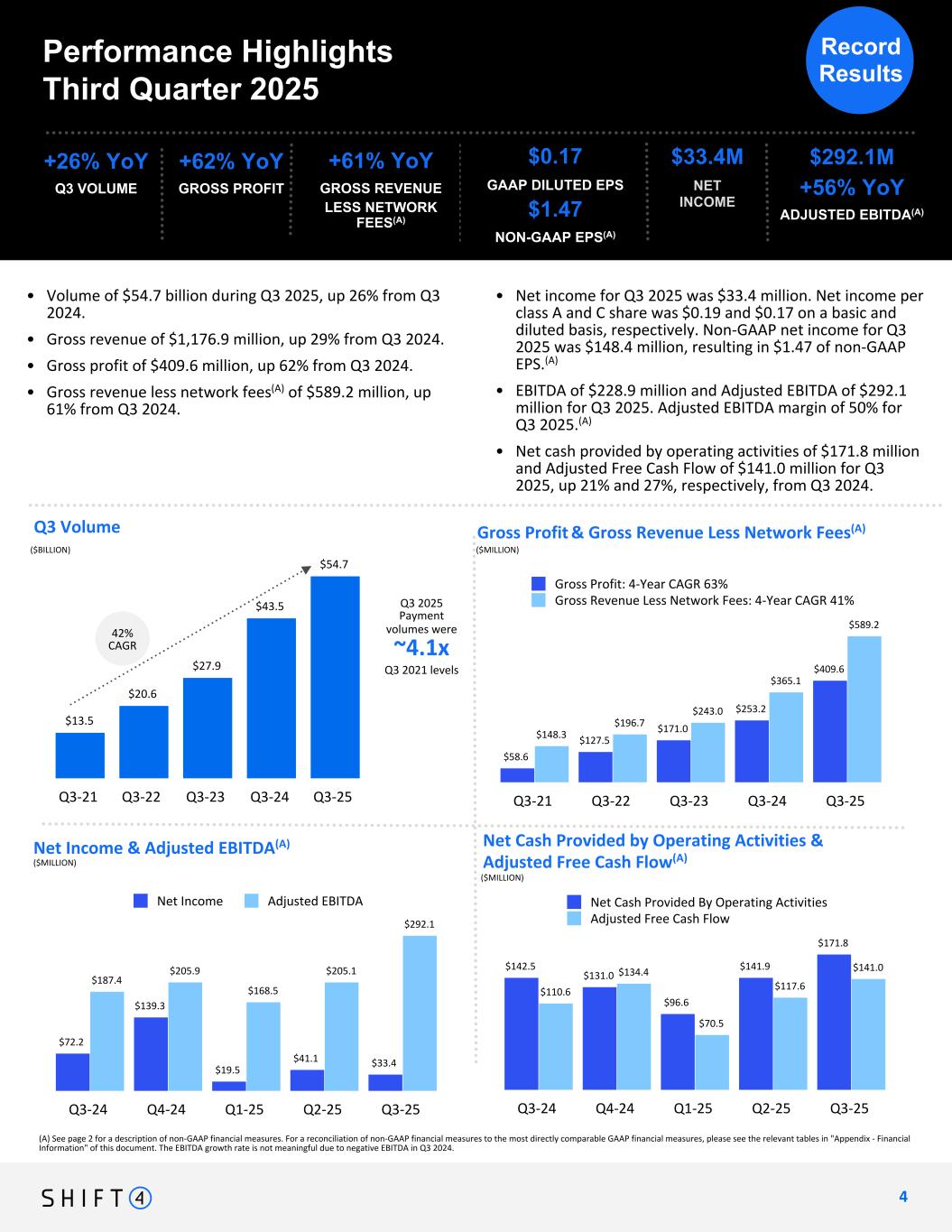

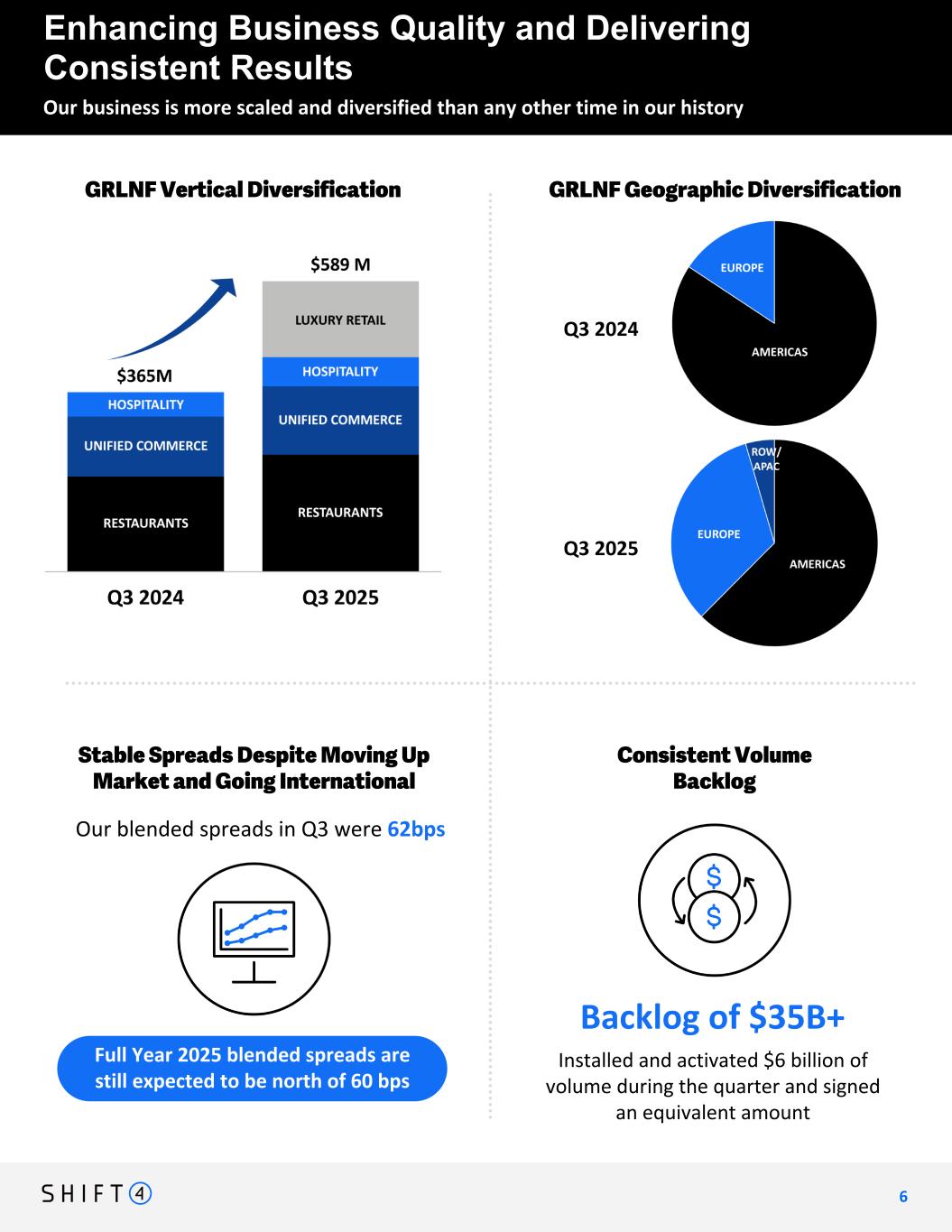

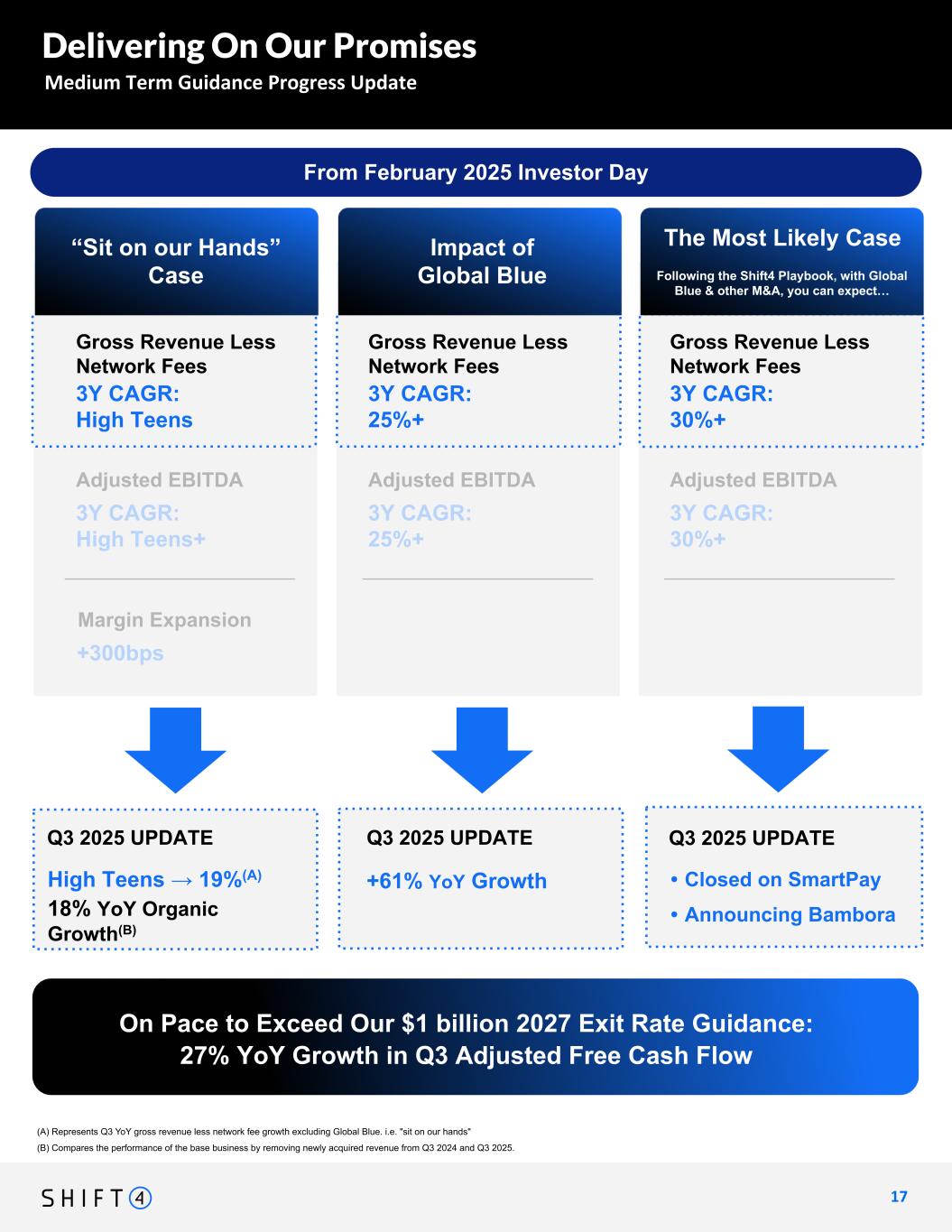

Dear Fellow Shareholders, Jared Isaacman CEO jared@shift4.com As you will see in the pages ahead, we had another reasonably strong quarter despite what I would characterize as a complex economic backdrop. Compared to the third quarter of last year, we grew gross profit 62%, gross revenues less network fees 61% and at strong adjusted EBITDA margins of 50%. Non-GAAP net income per share for the quarter was $1.47. When excluding the impact of Global Blue, gross revenue less network fees grew 19%. Whether it be “sitting on our hands” growth of 19% or 61% when including Global Blue, or our “most-likely” medium term outlook when considering continued capital allocation, you should see that we are well on our way to delivering on our 3 year commitments. These results highlight the durability of our unique operating model. As we’ve said many times in the past, we have: 1. Strong products that are uniquely positioned to serve large verticals 2. A capital allocation philosophy that prioritizes the maximum return on investment 3. An operating discipline to obsess over what can be improved While this has been a reality of our business for many years, it is only recently that we have begun to take those products into new geographies and follow our customers around the globe. The results of these early endeavors are highly encouraging, as evidenced by both the new customer wins and new geographies unlocked each quarter. One of the most common questions we get from investors is how to unpack the strategy into its parts and, more importantly, how do they know its working? I would encourage you to read the following pages thoroughly, but also with an eye towards the following: • Our financial performance is delivered as a combination of growth, profitability and a strong balance sheet. We are owners, not renters. (Page 4) • Our products attract enviable and demanding customers. We go out of our way to highlight pages of wins each and every quarter. (Pages 8-14) • We grow countries, capabilities, and headcount quite quickly without compromising strong margins. (Page 4) • We continue to find unique opportunities to invest in our core strengths, all informed by an owner’s mindset. (Page 18) • When we execute on M&A, it follows a proven formula to deliver customers and capabilities at highly attractive prices. (Pages 18) • All of this is happening while the quality of the business is improving. Our revenues are more diversified, by both vertical and geography than at any point in our history. (Page 6) V4 - DRAFTS CIRCULATED VIA EMAIL (WORD DOC) 2 2

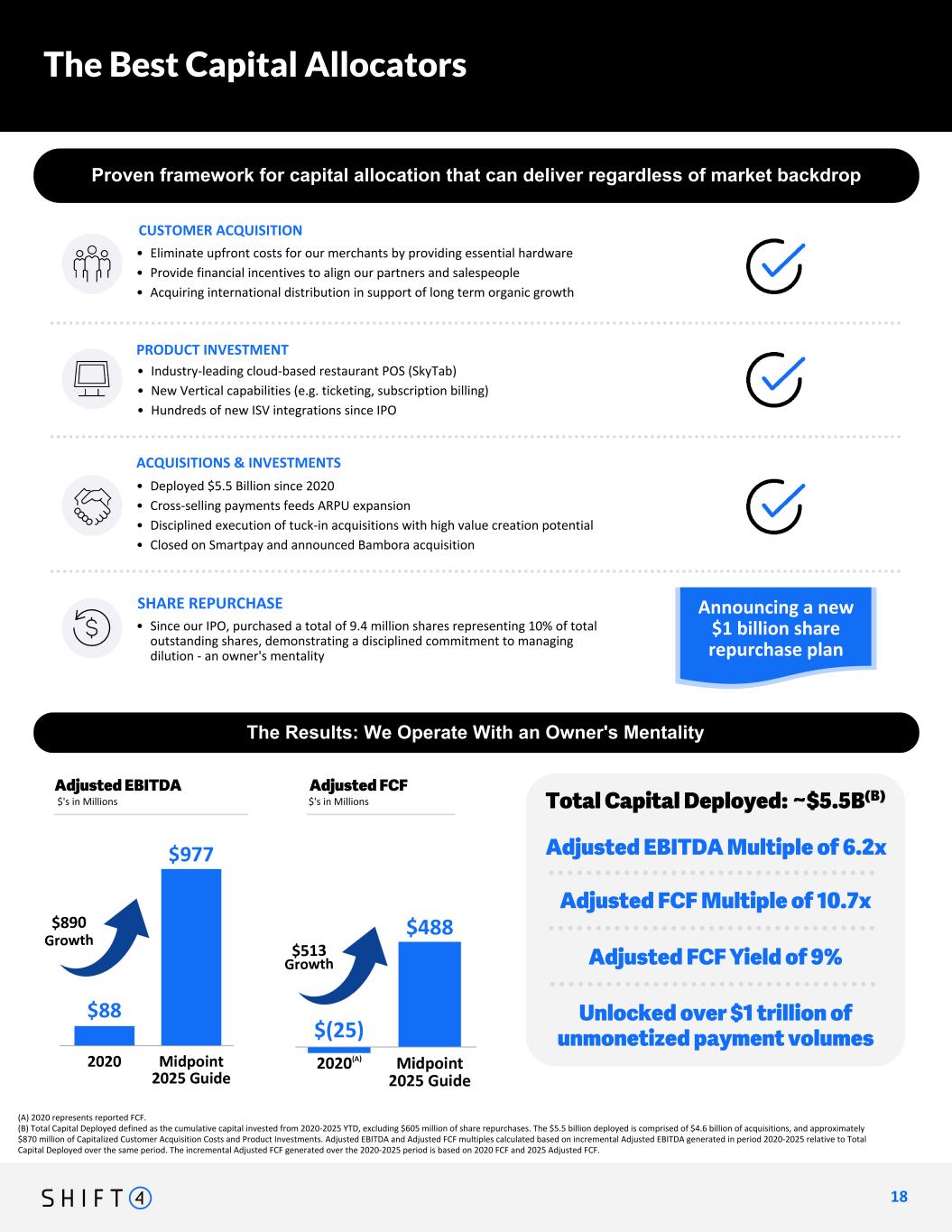

3 3 Said more simply, these pages may look similar to prior quarters because the strategy is unchanged. The results of that strategy mean we are a higher quality and more diversified business than ever before. It is this improved business mix that helps us navigate a varied consumer behaving differently across business verticals and geographies. In Q3 and early Q4 we experienced modestly worsening same-store-sales from our restaurant and hotel customers, but increased contribution from new verticals and geographies. As we’ve said in the past, while not immune to consumer spending levels, our massive cross-sell funnel affords us more resiliency during periods of economic uncertainty. As stated above, we remain on track to achieving our medium term guidance levels of over 30% compound annual growth rate and provided a detailed update on page 17 of our materials. Global Blue will represent a step-function increase in the pace of progress for Shift4. It has a highly unique product capability that is deeply intertwined with commerce, world class customers and an excellent team operating all over the world. During the quarter they continued to deliver strong performance, win new customers and maintain resilience despite a modestly weakening consumers in Japan and Europe. On page 5 you can find a detailed summary of Global Blue’s contribution to our performance. I will close by reminding you all that capital allocation is a core competency of our business. This forces us to prioritize where the next dollar is spent, and with urgency, as the free cash flow of the business improves each quarter. Nothing has changed with regard to this philosophy. New products and geographies present themselves often, M&A opportunities come and go, and our own equity fluctuates; often as a result of what our competitors are doing as opposed to our results. To this end, our board has authorized a new $1 billion stock repurchase program, which is the largest in our history. As always, we appreciate the support and welcome feedback. Boldly Forward, Taylor Lauber Chief Executive Officer tlauber@shift4.com V5 - DRAFTS CIRCULATED VIA EMAIL (WORD DOC)

Q3 2025 Payment volumes were ~4.1x Q3 2021 levels $13.5 $20.6 $27.9 $43.5 $54.7 Q3-21 Q3-22 Q3-23 Q3-24 Q3-25 (A) See page 2 for a description of non-GAAP financial measures. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, please see the relevant tables in "Appendix - Financial Information" of this document. The EBITDA growth rate is not meaningful due to negative EBITDA in Q3 2024. 4 Q3 Volume Gross Profit & Gross Revenue Less Network Fees(A) ($BILLION) Performance Highlights Third Quarter 2025 +26% YoY Q3 VOLUME 42% CAGR Net Income & Adjusted EBITDA(A) Net Cash Provided by Operating Activities & Adjusted Free Cash Flow(A)($MILLION) ($MILLION) ($MILLION) +62% YoY GROSS PROFIT • $0.17 GAAP DILUTED EPS $1.47 NON-GAAP EPS(A) • $292.1M +56% YoY ADJUSTED EBITDA(A) • Volume of $54.7 billion during Q3 2025, up 26% from Q3 2024. • Gross revenue of $1,176.9 million, up 29% from Q3 2024. • Gross profit of $409.6 million, up 62% from Q3 2024. • Gross revenue less network fees(A) of $589.2 million, up 61% from Q3 2024. • Net income for Q3 2025 was $33.4 million. Net income per class A and C share was $0.19 and $0.17 on a basic and diluted basis, respectively. Non-GAAP net income for Q3 2025 was $148.4 million, resulting in $1.47 of non-GAAP EPS.(A) • EBITDA of $228.9 million and Adjusted EBITDA of $292.1 million for Q3 2025. Adjusted EBITDA margin of 50% for Q3 2025.(A) • Net cash provided by operating activities of $171.8 million and Adjusted Free Cash Flow of $141.0 million for Q3 2025, up 21% and 27%, respectively, from Q3 2024. Record Results 4 $72.2 $139.3 $19.5 $41.1 $33.4 $187.4 $205.9 $168.5 $205.1 $292.1 Net Income Adjusted EBITDA Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $58.6 $127.5 $171.0 $253.2 $409.6 $148.3 $196.7 $243.0 $365.1 $589.2 Gross Profit: 4-Year CAGR 63% Gross Revenue Less Network Fees: 4-Year CAGR 41% Q3-21 Q3-22 Q3-23 Q3-24 Q3-25 $142.5 $131.0 $96.6 $141.9 $171.8 $110.6 $134.4 $70.5 $117.6 $141.0 Net Cash Provided By Operating Activities Adjusted Free Cash Flow Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 +61% YoY GROSS REVENUE LESS NETWORK FEES(A) $33.4M NET INCOME

Business performance on track with upside as value creation begins to be realized in 2026 Global Blue: Luxury Retail Update 5 5 WIP Global Blue Q3 2025 Financial Reconciliation ($’s in Millions) EBITDA Contribution $68M Tax Free Shopping Sales-in-Store (“SiS”) ($’s in Millions) +5% +13% -11% Total TFS SiS Constant Currency Margin of 43% Disaggregated Revenue classifications: TFS & Payments: Payments Based Revenue PPS: Subscription and Other Revenues Global SiS increase +5% YoY in Q3 2025 led by strength in Europe but offset by headwinds in APAC with emphasis in Japan Three currency pairs most influencing Tax-Free Shopping: USD/EUR, CNY/EUR and CNY/JPM Currency movements have two impacts: translation impact and demand impact However, the “demand” impact more than offsets the “translation” impact. Example: any positive translation impact from weaker USD more than offset by reduced demand. Constant currency only normalizes for the “translation” impact and ignores the “demand” impact Global Blue GRLNF Contribution EBITDA Contribution $68M Tax-Free Shopping Update: Stable Sales in Store (SiS) Quarter Despite FX Headwinds in Asia +5% +13% -11% Margin of 43% Disaggregated Revenue classifications: TFS, DCC, & Acquiring: Payments Based Revenue PPS: Subscription and Other Revenues Asia SiS recovery in September to flat YoY September exit of flat YoY FX Insight: Impact of Currency on Q3 Results Currency impact on demand outweighed the currency translation impact on Q3 financial results

Our business is more scaled and diversified than any other time in our history Enhancing Business Quality and Delivering Consistent Results 6 6 GRLNF Vertical Diversification GRLNF Geographic Diversification Consistent Volume Backlog Stable Spreads Despite Moving Up Market and Going International Full Year 2025 blended spreads are still expected to be north of 60 bps Backlog of $35B+ TBU "Our blended spreads in Q2 were 63bps" [graphic] Our blended spreads in Q3 were 62bps WIP KEEP Increased Volume and Improved Diversity Scaling and diversifying overlaying bar chart showing the GRLNF and EBITDA contribution from GB Move Up Market Average size of merchant based on volume is 363% of 2021 levels. bar chart depicting our GRLNF diversification Q3 2024 Q3 2025 Installed and activated $6 billion of volume during the quarter and signed an equivalent amount

7 7 We Are Taking Our Industry Leading Products Into New Geographic Markets Around the World #2 in Restaurants (Menchie's) World class technology, sophisticated distribution, and an overall lower cost of ownership #1 in Hotels (Alterra) One Hand to Shake: the only hospitality platform to deliver the entire payments value chain under one roof #1 in Sports & Entertainment (Yankees) The most comprehensive owned solution in the sector - everything from concessions to merchandise Growing opportunity in Unified Commerce We are ready to grow beyond our leading verticals across the globe, and are better positioned than ever after our acquisition of Global Blue Tag line for the bottom: "We are uniquely advantaged by our category-leading products, our extensive library of software integrations, and our now $1 trillion + cross sell payments funnel. We have both a proven formula and the firepower to keep running our Shift4 Playbook all around the world for years into the future" Our growth is supported by an over $1 trillion payments cross-sell funnel, and an extensive library of software integrations #2 in Restaurants in U.S. #1 in Hospitality in U.S. #1 in Sports & Entertainment in U.S. #1 in Luxury Retail Globally World class technology, sophisticated distribution, and an overall lower cost of ownership One Hand to Shake: the only hospitality platform to deliver the entire payments value chain under one roof The most comprehensive owned solution in the sector - everything from concessions to merchandise Two-sided digital payments network serving affluent consumers shopping at premier luxury brands worldwide Update / Adjust intro page? Growing Opportunity in Unified Commerce We are ready to grow beyond our leading verticals across the globe, and are better positioned than ever after our acquisition of Global Blue

8 Over 55,000 Search "Shift4" on X (f.k.a. Twitter) to see dozens of installs every day! since coming out of beta, and on pace to exceed 35,000 installs in 2024 alone SkyTab installs Shift4 continues to gain market share in restaurants, winning new restaurants every day Restaurant Update Adding 1,300 international restaurant and SMB wins per month

Continuing to expand market share in hospitality vertical Hospitality Update 9 9 tinuing to expand market share in hospitality vertical Shift4 has partnered with Hyatt Vacation Club to power payments for their 20+ resorts in beautiful, hand-picked vacation destinations across the globe. Shift4 is now powering payments for Collared Martin Hospitality’s boutique hotel properties and restaurants in Nantucket, Martha’s Vineyard, and Long Island. Collared Martin Hospitality Charlesmark Hotel offers a European-style boutique hotel and cocktail lounge experience in the heart of Back Bay, a historic upscale neighborhood in Boston, MA. Charlesmark Hotel Located in West Hollywood, The Sun Rose offers an unforgettable luxury hotel experience with premier dining, drinks, and spa on the famous Sunset Strip. Shift4 has partnered with Carpe Viam Destinations, a global vacation club, to power payments for its member-exclusive travel experiences around the world. Carpe Viam Destinations WIP The Sun Rose

Continuing to expand market share in hospitality vertical Hospitality Update 1 0 10 tinuing to expand market share in hospitality vertical Set among the trendy boutiques and upscale shops of Chapel Street, this chic all-suite hotel includes original artwork in each suite, a trendy steakhouse and a modern Australian restaurant. Fairmont El San Juan Hotel Coast Lonsdale Quay in North Vancouver, CA, offers relaxing waterfront hotel rooms and suites with modern amenities and amazing ocean views. Coast Lonsdale Quay A modern hotel located in the Central Business District near Federation Square and the Melbourne Museum. The Olsen (Melbourne)Mantra on Little Bourke (Melbourne) Set in Adelaide's Central Business District, this modern high-rise hotel is a quick walk to the Adelaide Convention Center. A luxury hotel located in Box Hill dedicated to the contemporary Australian artist Zhong Chen whose original artworks are located throughout its suites and public spaces. Peppers Waymouth (Adelaide) The Chen (Melbourne) Located on the award-winning Isla Verde Beach, Fairmont El San Juan Hotel offers luxury vacation experiences with an authentic Puerto Rican atmosphere.

1 1 11 Shift4 is processing payments for food & beverage concessions at SHI Stadium through SkyTab Venue. Rutgers University Arizona State University Sun Devils Unified Commerce: Sports and Entertainment Update Powering payments through POS, mobile ordering, ticketing, and more Shift4 is powering payments for food & beverage concessions at Mountain America Stadium through SkyTab Venue. North Carolina StateClemson University Shift4 is processing payments for food & beverage concessions at Memorial Stadium through SkyTab Venue. Shift4 is powering payments for retail merchandise sales at Carter–Finley Stadium. Shift4 is powering payments for food & beverage concessions at Paycor Stadium through SkyTab Venue. TBU WITH WINS FOR THIS QUARTER (WILL HAVE ALL WINS COLLECTED BY FRIDAY 10/10)

Texas State 1 2 12 University of Iowa Western Kentucky University Cleveland State University Vikings Shift4 is powering ticket sales for games at Houchens Industries-L.T. Smith Stadium. Shift4 is powering payments for food & beverage concessions at Kinnick Stadium through SkyTab Venue. Unified Commerce: Sports and Entertainment Update Powering payments through POS, mobile ordering, ticketing, and more Shift4 is processing payments for food & beverage concessions at UFCU Stadium through SkyTab Venue. Shift4 is processing payments for food & beverage concessions at Wolstein Center through SkyTab. 6 wins: MGM music hall san jose sharks spectacle live destin-ft walton convention center walter e washington convention center las vegas lights Syracuse University Shift4 is processing ticketing payments for games at War Memorial Stadium. University of Arkansas Little Rock Shift4 has partnered with Syracuse University to power their mobile app payments at JMA Wireless Dome. TBU WITH WINS FOR THIS QUARTER (WILL HAVE ALL WINS COLLECTED BY FRIDAY 10/10)

Shift4 continues to move Boldly Forward towards becoming a truly global company 1 3 13 Unified Commerce: Luxury Retail Update Two-sided digital paym nts network serving affluent consumers shopping at remier luxury brands worldwide 75K Retailers with 400K+ Locations 15M+ International Shoppers LUXURY RETAIL WINS Global Leader in Luxury Retail Payments Technology ~$500B+ EMBEDDED PAYMENTS VOLUME • TFS Take Rates [xx]bps+ • TFS Revenue Growth +[XX]% • Total Merchant Payments Volumes [x-x]x TFS SiS Q3 2025 €[xx]B Tax Free Shopping SiS [xx]% YoY growth Galeria Tapestry Leica Groupe Printemps Leica Camera is a global manufacturer of high-end cameras and lenses, Leica Camera joins Global Blue’s Network to Enhance the Tax-Free Shopping Journey for International Shoppers. Tapestry, a Global House of Iconic Brands (Coach, Kate Spade New York) has partnered with Global Blue to elevate the Tax-Free Shopping journey of its international shoppers. Galeria, the biggest department store chain in Germany has chosen Global Blue to accompany international shoppers in their Tax-Free Shopping journey. Lululemon is a leading technical athletic apparel brand and Global Blue will power all Lululemon’s European retail stores with Tax-Free Shopping. Lululemon Printemps is a French leading Department Store Group for Fashion, Luxury and Beauty. Global Blue has won the tender and will be powering Tax Free Shopping in 12 shops including the Parisian flagship Printemps Haussmann.

Unified Commerce Continuing to gain momentum in our Unified Commerce vertical 1 4 14 NON-PROFITS CRYPTO GAMING We expect to be live in all 24 sportsbook locations by year end TRANSPORTATION TBU WITH WINS FOR THIS QUARTER TBU WITH WINS FOR THIS QUARTER Shift4 has partnered with Hertz and is now powering both card-present and card-not-present payments for over 60 rental car locations.

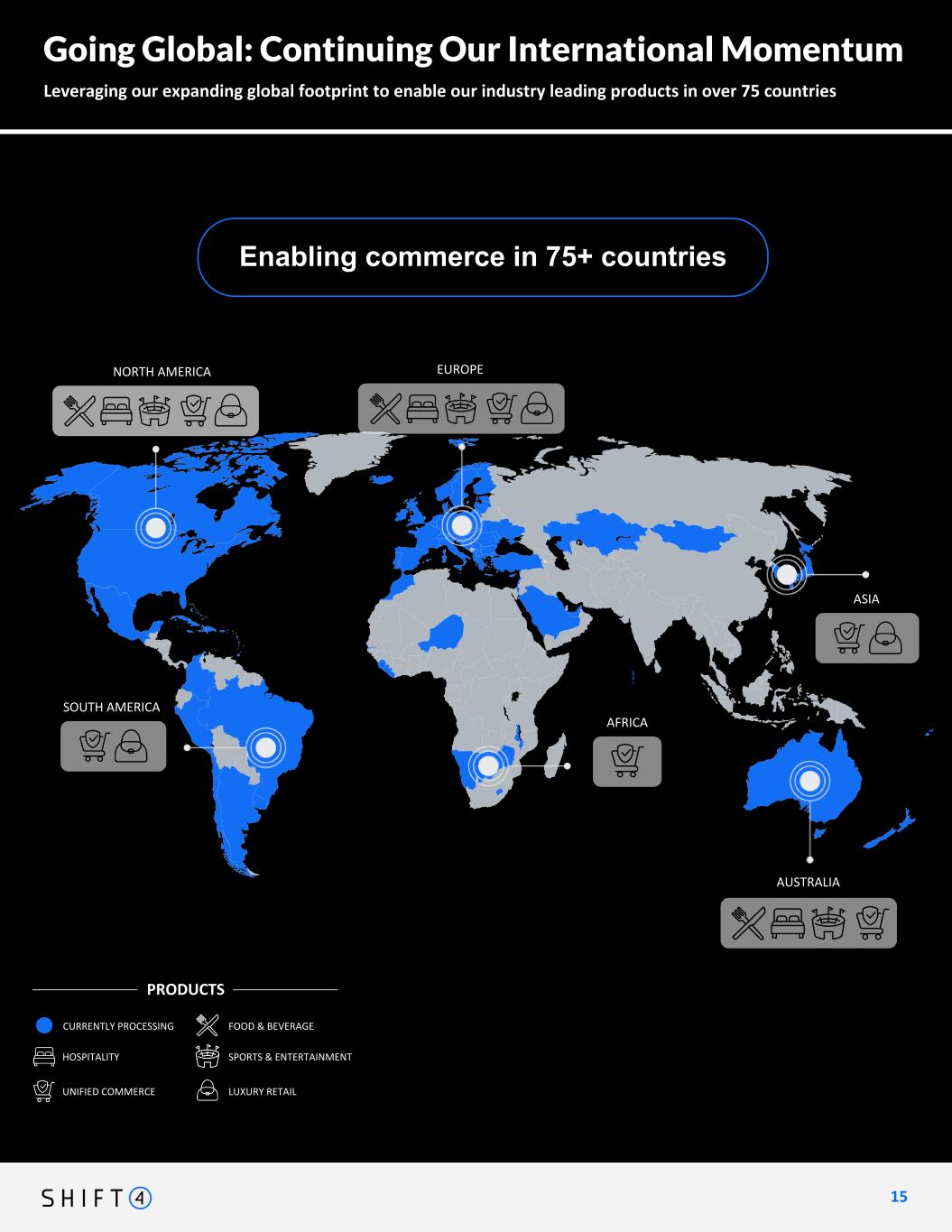

Shift4 continues to move Boldly Forward towards becoming a truly global company 1 5 15 Going Global: Continuing Our International Momentum Enabling commerce in 75+ countries Leveraging our expanding global footprint to enable our industry leading products in over 75 countries UPDATED MAP PAGE Show we are live processing in 6 continents. went live with BYD in Latam as latest proof point of growing unified commerce platform. blue chips are coming to work with us becausee of our geo coverage and balance of card present and CNP + possibly hit curb again WHAT we need to include: -new map (map from investor day + the dark blue countries "coming soon" from this one" -callout with "We have closed on our landmark acquisition of Global Blue, expanding our footprint to 75+ countries" maybe above the map, and then maybe another one below with "Global B ue has accelerated our international expansion, and we will continue to follow our strategic partner into new geographies" CURRENTLY PROCESSING COMING SOON Global Blue has accelerated our international expansion INCLUDE GEO UPDATE? (may not be new territories) NORTH AMERICA EUROPE ASIA SOUTH AMERICA AFRICA AUSTRALIA FOOD & BEVERAGE LUXURY RETAIL HOSPITALITY SPORTS & ENTERTAINMENT UNIFIED COMMERCE CURRENTLY PROCESSING FOOD & BEVERAGE GLOBAL LUXURY RETAIL HOSPITALITY SPORTS & ENTERTAINMENT UNIFIED COMMERCE PRODUCTS

Fulfilling our promise towards our “Most Likely” Medium Term guidance scenario 1 6 16 Capital Allocation: Bambora and Smartpay VERTICALS ACQUISITION STRATEGY Represents $90 billion of gateway volume Adds one of the largest ACH/EFT providers in North America and hundreds of software integrations Textbook Shift4 gateway conversion playbook Expected to close in early 2026 Closed on November 4, 2025 Australia and NZ distribution to supercharge in region growth Over 40,000 merchants Affords Shift4 with go-to-market payments and SkyTab POS distribution Top off the funnel and Delete the Parts GEOGRAPHY Bambora: Signing Announcement SmartPay: Closing Announcement VERTICALS ACQUISITION STRATEGY Top off the funnel and Delete the Parts GEOGRAPHY VERTICALS ACQUISITION STRATEGY Top off the funnel and Delete the Parts GEOGRAPHY International Expansion

+61% YoY Growth Medium Term Guidance Progress Update 1 7 17 Delivering On Our Promises The Most Likely Case 3Y CAGR: 30%+ Adjusted EBITDA Gross Revenue Less Network Fees 3Y CAGR: 30%+ Following the Shift4 Playbook, with Global Blue & other M&A, you can expect… 3Y CAGR: High Teens Adjusted EBITDA Gross Revenue Less Network Fees “Sit on our Hands” Case 3Y CAGR: High Teens+ Margin Expansion +300bps Impact of Global Blue 3Y CAGR: 25%+ Adjusted EBITDA Gross Revenue Less Network Fees 3Y CAGR: 25%+ • Closed on SmartPay • Announcing Bambora Q3 2025 UPDATE Q3 2025 UPDATE Q3 2025 UPDATE (A) Represents Q3 YoY gross revenue less network fee growth excluding Global Blue. i.e. "sit on our hands" (B) Compares the performance of the base business by removing newly acquired revenue from Q3 2024 and Q3 2025. On Pace to Exceed Our $1 billion 2027 Exit Rate Guidance: 27% YoY Growth in Q3 Adjusted Free Cash Flow From February 2025 Investor Day High Teens → 19%(A) 18% YoY Organic Growth(B)

(A) 2020 represents reported FCF. (B) Total Capital Deployed defined as the cumulative capital invested from 2020-2025 YTD, excluding $605 million of share repurchases. The $5.5 billion deployed is comprised of $4.6 billion of acquisitions, and approximately $870 million of Capitalized Customer Acquisition Costs and Product Investments. Adjusted EBITDA and Adjusted FCF multiples calculated based on incremental Adjusted EBITDA generated in period 2020-2025 relative to Total Capital Deployed over the same period. The incremental Adjusted FCF generated over the 2020-2025 period is based on 2020 FCF and 2025 Adjusted FCF. 1 8 18 Proven framework for capital allocation that can deliver regardless of market backdrop The Best Capital Allocators CUSTOMER ACQUISITION • Industry-leading cloud-based restaurant POS (SkyTab) • New Vertical capabilities (e.g. ticketing, subscription billing) • Hundreds of new ISV integrations since IPO PRODUCT INVESTMENT • Eliminate upfront costs for our merchants by providing essential hardware • Provide financial incentives to align our partners and salespeople • Acquiring international distribution in support of long term organic growth The Results: We Operate With an Owner's Mentality Adjusted EBITDA Adjusted FCF Adjusted EBITDA Multiple of 6.2x Adjusted FCF Multiple of 10.7x Adjusted FCF Yield of 9% Total Capital Deployed: ~$5.5B(B)$'s in Millions $'s in Millions ACQUISITIONS & INVESTMENTS • Deployed $5.5 Billion since 2020 • Cross-selling payments feeds ARPU expansion • Disciplined execution of tuck-in acquisitions with high value creation potential • Closed on Smartpay and announced Bambora acquisition SHARE REPURCHASE • Since our IPO, purchased a total of 9.4 million shares representing 10% of total outstanding shares, demonstrating a disciplined commitment to managing dilution - an owner's mentality NEW PAGE - we are excellent capital allocators vs. growth (e.g. when compared to Toast) could also include some of jared's comments: -we will have over 1B EBITDA next year -deleveraging path -stock buybacks Shift4 continues to move Boldly Forward towards becoming a truly global company [Capital Allocation Page] [subtitle] Announcing a new $1 billion share repurchase plan NEW $1 billion buyback authorization Unlocked over $1 trillion of unmonetized payment volumes NEW $1 billion buyback authorization $890 $5331 Growth $513 Growth

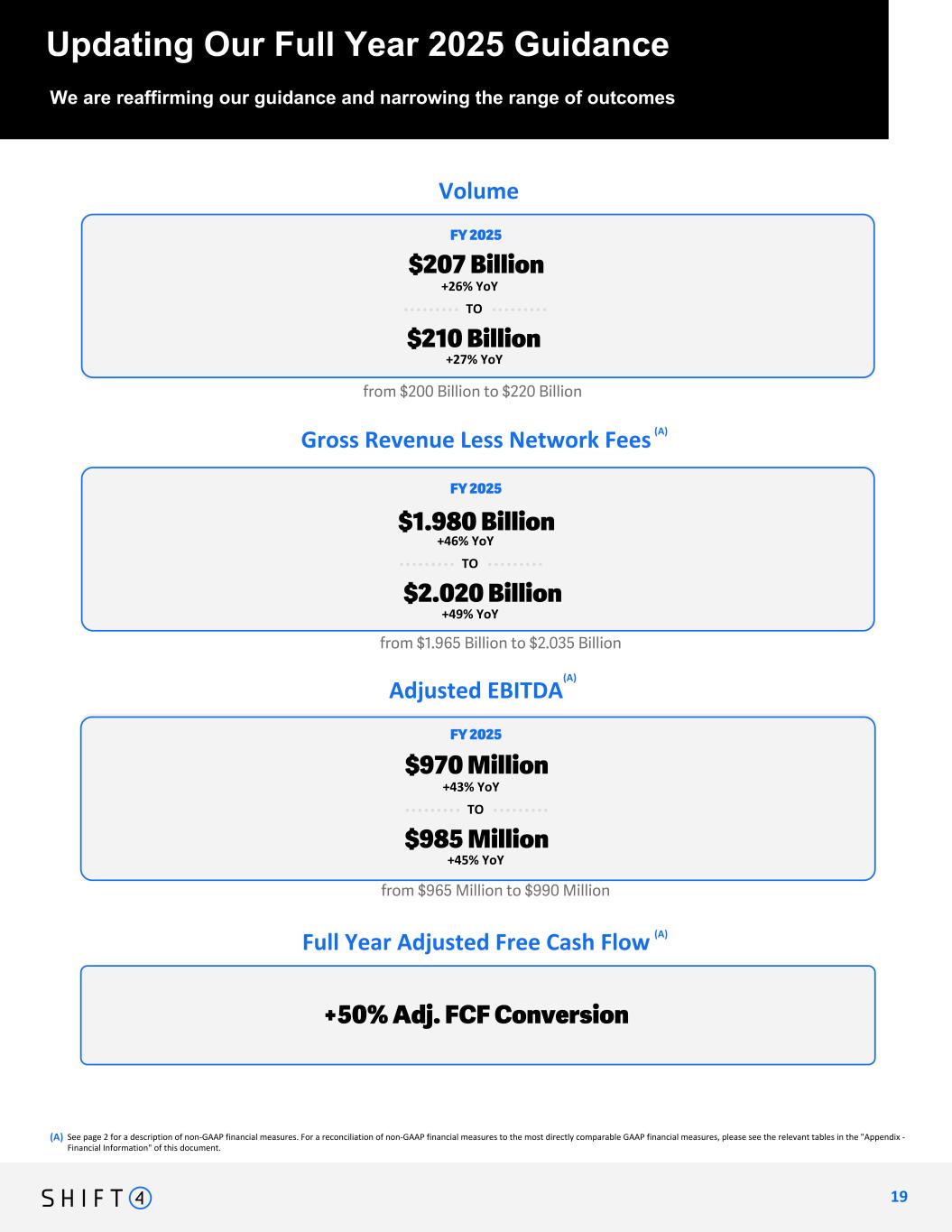

See page 2 for a description of non-GAAP financial measures. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, please see the relevant tables in the "Appendix - Financial Information" of this document. Updating Our Full Year 2025 Guidance 1 9 19 Intended Message: Adjusted for contribution from Finaro/Appetize, we're looking at 31% YoY GRLNF growth in Q4 $1.30 Billion +38% YoY +44% YoY $1.35 BillionGross Revenue Less Network Fees Full Year Adjusted Free Cash Flow $167 Billion +53% YoY +61% YoY $175 Billion Volume $640 Million +39% YoY +47% YoY $675 MillionAdjusted EBITDA TO TO TO FY 2024 Guidance 59%+ Adj. FCF Conversion Organic revenue remains on track to grow well north of 25% YoY (A) $415 M TO Q2 2025 Q2 2025 Full Year Adjusted Free Cash Flow +50% Adj. FCF Conversion Volume $57.0 B $60.0 B TO Q4 2025 $207 Billion $210 Billion TO FY 2025 +26% YoY +27% YoY Gross Revenue Less Network Fees $1.980 Billion $2.020 Billion TO FY 2025 +46% YoY +49% YoY Adjusted EBITDA $970 Million $985 Million TO FY 2025 +43% YoY +45% YoY $610 M $640 M TO Q4 2025 $305 M $315 M TO Q4 2025 from $200 Billion to $220 Billion from $1.965 Billion to $2.035 Billion from $965 Million to $990 Million See page 2 for a description of non-GAAP financial measures. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, please see the relevant tables in the "Appendix - Financial Information" of this document. (A) (A) (A) (A) We are reaffirming our guidance and narrowing the range of outcomes

Appendix - Financial Information 20

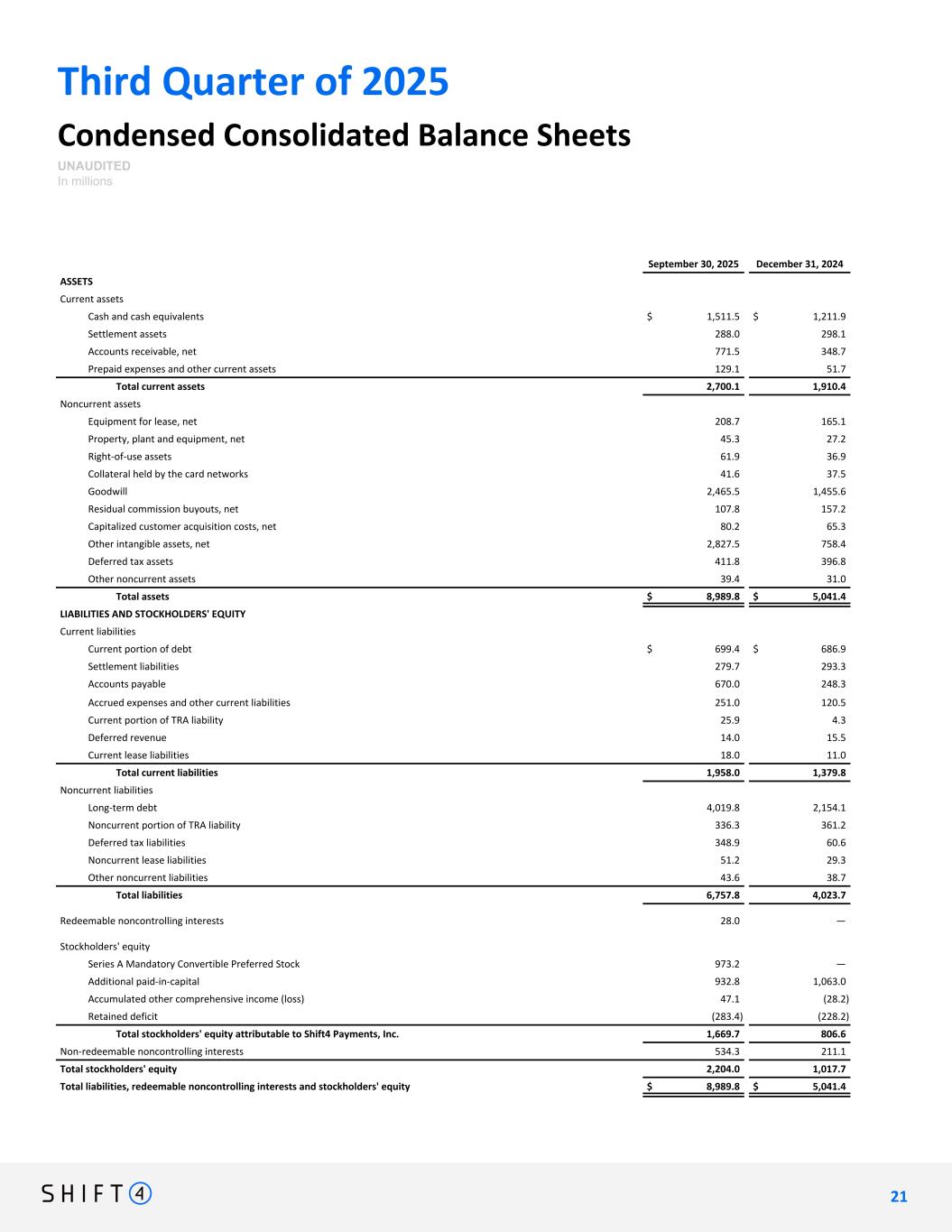

Third Quarter of 2025 Condensed Consolidated Balance Sheets UNAUDITED In millions September 30, 2025 December 31, 2024 ASSETS Current assets Cash and cash equivalents $ 1,511.5 $ 1,211.9 Settlement assets 288.0 298.1 Accounts receivable, net 771.5 348.7 Prepaid expenses and other current assets 129.1 51.7 Total current assets 2,700.1 1,910.4 Noncurrent assets Equipment for lease, net 208.7 165.1 Property, plant and equipment, net 45.3 27.2 Right-of-use assets 61.9 36.9 Collateral held by the card networks 41.6 37.5 Goodwill 2,465.5 1,455.6 Residual commission buyouts, net 107.8 157.2 Capitalized customer acquisition costs, net 80.2 65.3 Other intangible assets, net 2,827.5 758.4 Deferred tax assets 411.8 396.8 Other noncurrent assets 39.4 31.0 Total assets $ 8,989.8 $ 5,041.4 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Current portion of debt $ 699.4 $ 686.9 Settlement liabilities 279.7 293.3 Accounts payable 670.0 248.3 Accrued expenses and other current liabilities 251.0 120.5 Current portion of TRA liability 25.9 4.3 Deferred revenue 14.0 15.5 Current lease liabilities 18.0 11.0 Total current liabilities 1,958.0 1,379.8 Noncurrent liabilities Long-term debt 4,019.8 2,154.1 Noncurrent portion of TRA liability 336.3 361.2 Deferred tax liabilities 348.9 60.6 Noncurrent lease liabilities 51.2 29.3 Other noncurrent liabilities 43.6 38.7 Total liabilities 6,757.8 4,023.7 Redeemable noncontrolling interests 28.0 — Stockholders' equity Series A Mandatory Convertible Preferred Stock 973.2 — Additional paid-in-capital 932.8 1,063.0 Accumulated other comprehensive income (loss) 47.1 (28.2) Retained deficit (283.4) (228.2) Total stockholders' equity attributable to Shift4 Payments, Inc. 1,669.7 806.6 Non-redeemable noncontrolling interests 534.3 211.1 Total stockholders' equity 2,204.0 1,017.7 Total liabilities, redeemable noncontrolling interests and stockholders' equity $ 8,989.8 $ 5,041.4 2 1 21

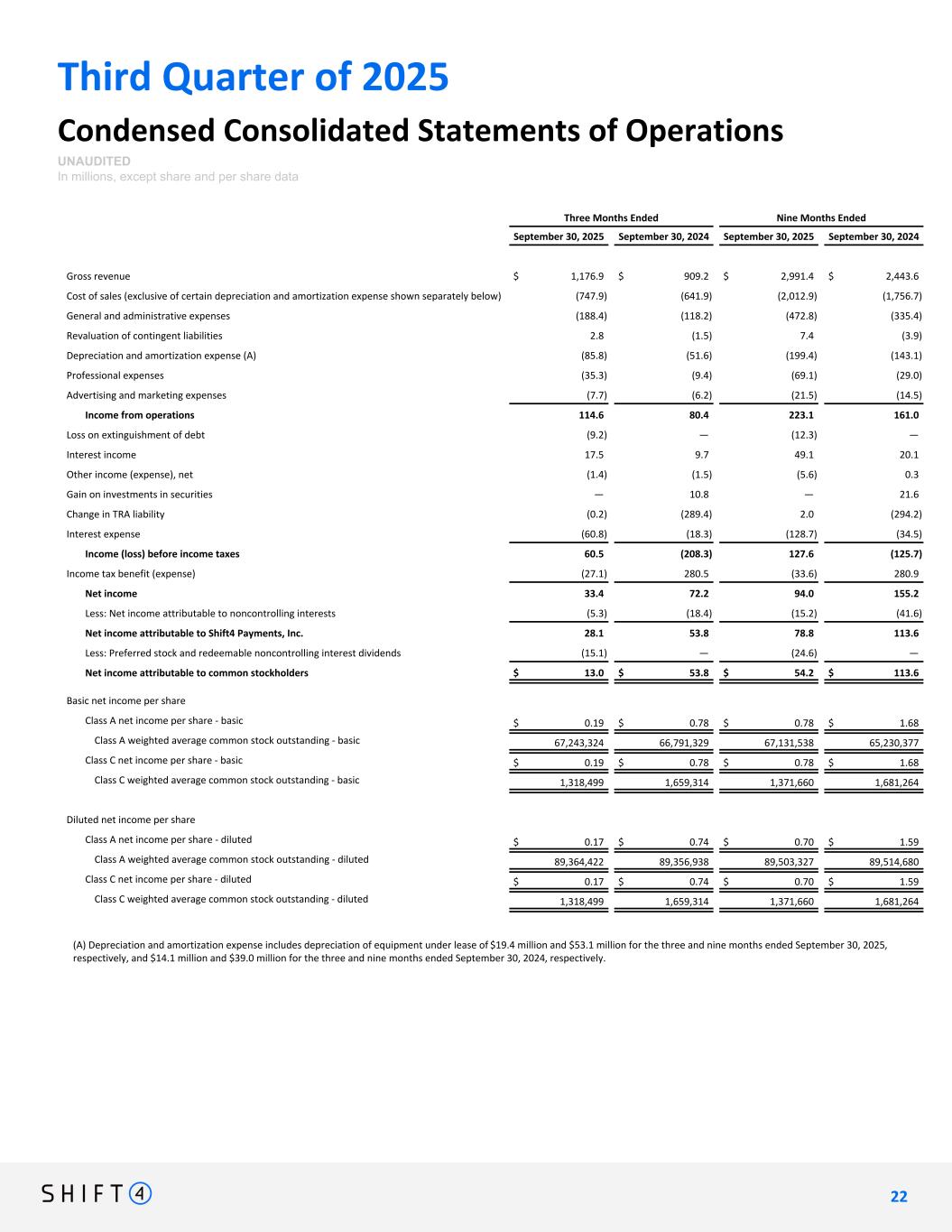

Third Quarter of 2025 Condensed Consolidated Statements of Operations UNAUDITED In millions, except share and per share data Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Gross revenue $ 1,176.9 $ 909.2 $ 2,991.4 $ 2,443.6 Cost of sales (exclusive of certain depreciation and amortization expense shown separately below) (747.9) (641.9) (2,012.9) (1,756.7) General and administrative expenses (188.4) (118.2) (472.8) (335.4) Revaluation of contingent liabilities 2.8 (1.5) 7.4 (3.9) Depreciation and amortization expense (A) (85.8) (51.6) (199.4) (143.1) Professional expenses (35.3) (9.4) (69.1) (29.0) Advertising and marketing expenses (7.7) (6.2) (21.5) (14.5) Income from operations 114.6 80.4 223.1 161.0 Loss on extinguishment of debt (9.2) — (12.3) — Interest income 17.5 9.7 49.1 20.1 Other income (expense), net (1.4) (1.5) (5.6) 0.3 Gain on investments in securities — 10.8 — 21.6 Change in TRA liability (0.2) (289.4) 2.0 (294.2) Interest expense (60.8) (18.3) (128.7) (34.5) Income (loss) before income taxes 60.5 (208.3) 127.6 (125.7) Income tax benefit (expense) (27.1) 280.5 (33.6) 280.9 Net income 33.4 72.2 94.0 155.2 Less: Net income attributable to noncontrolling interests (5.3) (18.4) (15.2) (41.6) Net income attributable to Shift4 Payments, Inc. 28.1 53.8 78.8 113.6 Less: Preferred stock and redeemable noncontrolling interest dividends (15.1) — (24.6) — Net income attributable to common stockholders $ 13.0 $ 53.8 $ 54.2 $ 113.6 Basic net income per share Class A net income per share - basic $ 0.19 $ 0.78 $ 0.78 $ 1.68 Class A weighted average common stock outstanding - basic 67,243,324 66,791,329 67,131,538 65,230,377 Class C net income per share - basic $ 0.19 $ 0.78 $ 0.78 $ 1.68 Class C weighted average common stock outstanding - basic 1,318,499 1,659,314 1,371,660 1,681,264 Diluted net income per share Class A net income per share - diluted $ 0.17 $ 0.74 $ 0.70 $ 1.59 Class A weighted average common stock outstanding - diluted 89,364,422 89,356,938 89,503,327 89,514,680 Class C net income per share - diluted $ 0.17 $ 0.74 $ 0.70 $ 1.59 Class C weighted average common stock outstanding - diluted 1,318,499 1,659,314 1,371,660 1,681,264 (A) Depreciation and amortization expense includes depreciation of equipment under lease of $19.4 million and $53.1 million for the three and nine months ended September 30, 2025, respectively, and $14.1 million and $39.0 million for the three and nine months ended September 30, 2024, respectively. 2 2 22

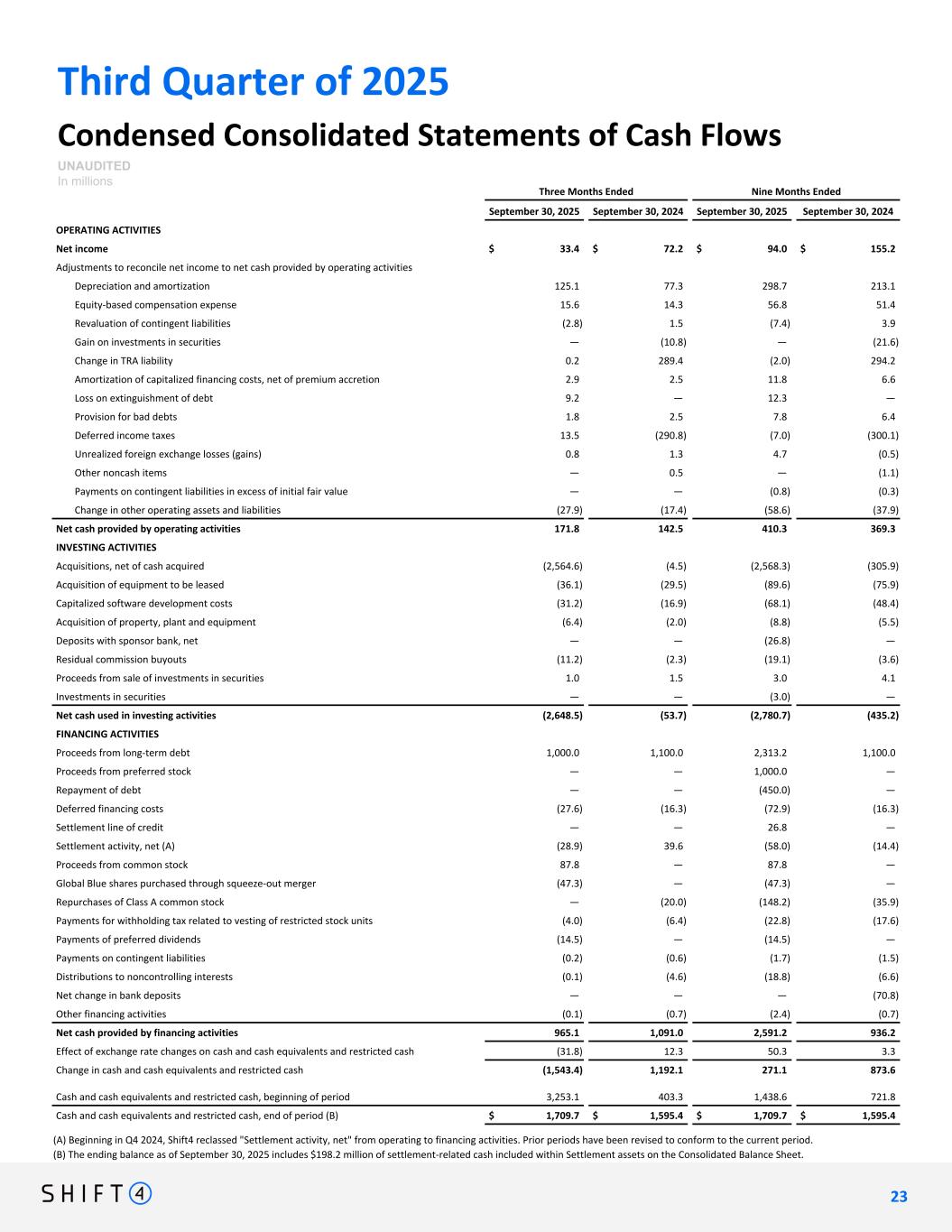

Third Quarter of 2025 Condensed Consolidated Statements of Cash Flows UNAUDITED In millions Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 OPERATING ACTIVITIES Net income $ 33.4 $ 72.2 $ 94.0 $ 155.2 Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization 125.1 77.3 298.7 213.1 Equity-based compensation expense 15.6 14.3 56.8 51.4 Revaluation of contingent liabilities (2.8) 1.5 (7.4) 3.9 Gain on investments in securities — (10.8) — (21.6) Change in TRA liability 0.2 289.4 (2.0) 294.2 Amortization of capitalized financing costs, net of premium accretion 2.9 2.5 11.8 6.6 Loss on extinguishment of debt 9.2 — 12.3 — Provision for bad debts 1.8 2.5 7.8 6.4 Deferred income taxes 13.5 (290.8) (7.0) (300.1) Unrealized foreign exchange losses (gains) 0.8 1.3 4.7 (0.5) Other noncash items — 0.5 — (1.1) Payments on contingent liabilities in excess of initial fair value — — (0.8) (0.3) Change in other operating assets and liabilities (27.9) (17.4) (58.6) (37.9) Net cash provided by operating activities 171.8 142.5 410.3 369.3 INVESTING ACTIVITIES Acquisitions, net of cash acquired (2,564.6) (4.5) (2,568.3) (305.9) Acquisition of equipment to be leased (36.1) (29.5) (89.6) (75.9) Capitalized software development costs (31.2) (16.9) (68.1) (48.4) Acquisition of property, plant and equipment (6.4) (2.0) (8.8) (5.5) Deposits with sponsor bank, net — — (26.8) — Residual commission buyouts (11.2) (2.3) (19.1) (3.6) Proceeds from sale of investments in securities 1.0 1.5 3.0 4.1 Investments in securities — — (3.0) — Net cash used in investing activities (2,648.5) (53.7) (2,780.7) (435.2) FINANCING ACTIVITIES Proceeds from long-term debt 1,000.0 1,100.0 2,313.2 1,100.0 Proceeds from preferred stock — — 1,000.0 — Repayment of debt — — (450.0) — Deferred financing costs (27.6) (16.3) (72.9) (16.3) Settlement line of credit — — 26.8 — Settlement activity, net (A) (28.9) 39.6 (58.0) (14.4) Proceeds from common stock 87.8 — 87.8 — Global Blue shares purchased through squeeze-out merger (47.3) — (47.3) — Repurchases of Class A common stock — (20.0) (148.2) (35.9) Payments for withholding tax related to vesting of restricted stock units (4.0) (6.4) (22.8) (17.6) Payments of preferred dividends (14.5) — (14.5) — Payments on contingent liabilities (0.2) (0.6) (1.7) (1.5) Distributions to noncontrolling interests (0.1) (4.6) (18.8) (6.6) Net change in bank deposits — — — (70.8) Other financing activities (0.1) (0.7) (2.4) (0.7) Net cash provided by financing activities 965.1 1,091.0 2,591.2 936.2 Effect of exchange rate changes on cash and cash equivalents and restricted cash (31.8) 12.3 50.3 3.3 Change in cash and cash equivalents and restricted cash (1,543.4) 1,192.1 271.1 873.6 Cash and cash equivalents and restricted cash, beginning of period 3,253.1 403.3 1,438.6 721.8 Cash and cash equivalents and restricted cash, end of period (B) $ 1,709.7 $ 1,595.4 $ 1,709.7 $ 1,595.4 2 3 23 (A) Beginning in Q4 2024, Shift4 reclassed "Settlement activity, net" from operating to financing activities. Prior periods have been revised to conform to the current period. (B) The ending balance as of September 30, 2025 includes $198.2 million of settlement-related cash included within Settlement assets on the Consolidated Balance Sheet.

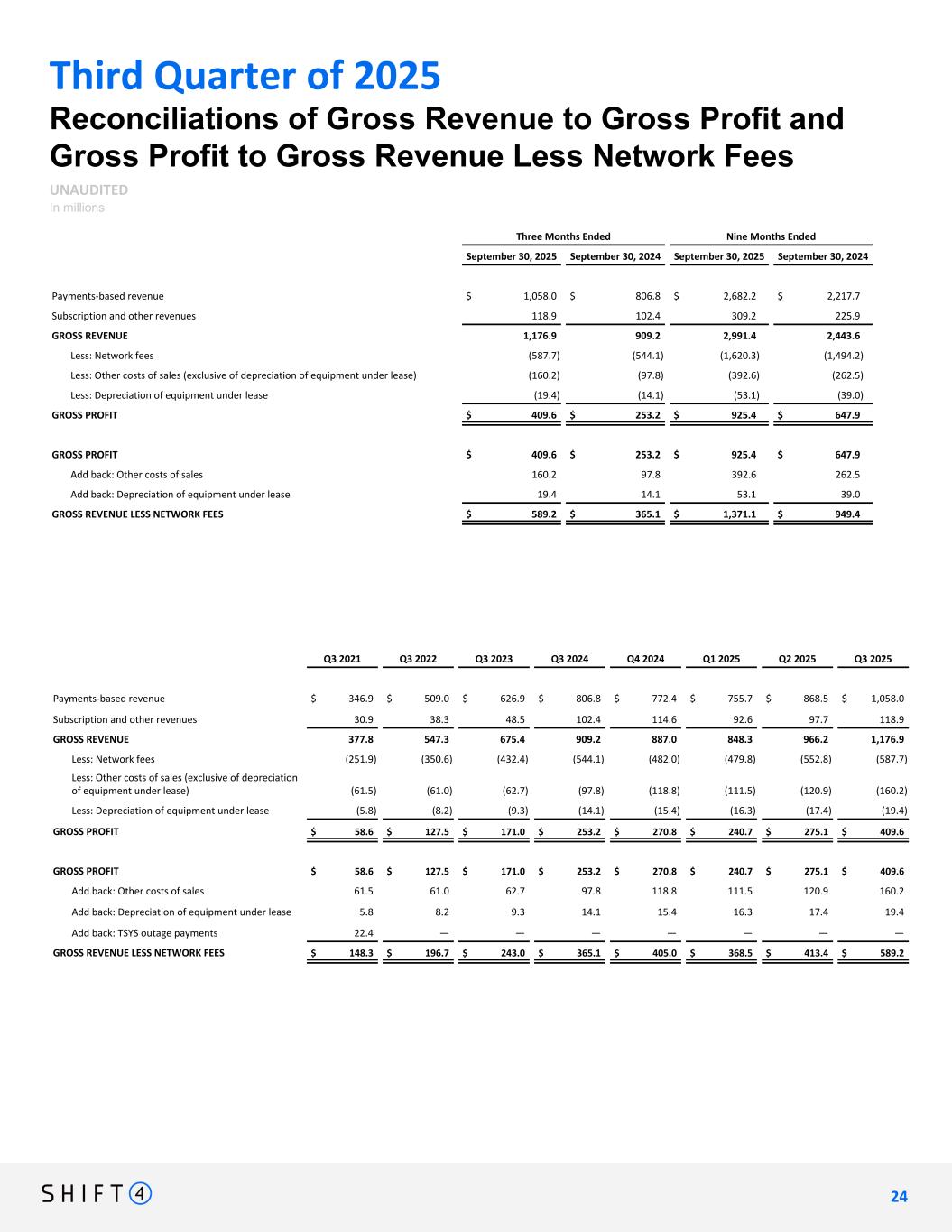

Third Quarter of 2025 Reconciliations of Gross Revenue to Gross Profit and Gross Profit to Gross Revenue Less Network Fees UNAUDITED In millions Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Payments-based revenue $ 1,058.0 $ 806.8 $ 2,682.2 $ 2,217.7 Subscription and other revenues 118.9 102.4 309.2 225.9 GROSS REVENUE 1,176.9 909.2 2,991.4 2,443.6 Less: Network fees (587.7) (544.1) (1,620.3) (1,494.2) Less: Other costs of sales (exclusive of depreciation of equipment under lease) (160.2) (97.8) (392.6) (262.5) Less: Depreciation of equipment under lease (19.4) (14.1) (53.1) (39.0) GROSS PROFIT $ 409.6 $ 253.2 $ 925.4 $ 647.9 GROSS PROFIT $ 409.6 $ 253.2 $ 925.4 $ 647.9 Add back: Other costs of sales 160.2 97.8 392.6 262.5 Add back: Depreciation of equipment under lease 19.4 14.1 53.1 39.0 GROSS REVENUE LESS NETWORK FEES $ 589.2 $ 365.1 $ 1,371.1 $ 949.4 Q3 2021 Q3 2022 Q3 2023 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Payments-based revenue $ 346.9 $ 509.0 $ 626.9 $ 806.8 $ 772.4 $ 755.7 $ 868.5 $ 1,058.0 Subscription and other revenues 30.9 38.3 48.5 102.4 114.6 92.6 97.7 118.9 GROSS REVENUE 377.8 547.3 675.4 909.2 887.0 848.3 966.2 1,176.9 Less: Network fees (251.9) (350.6) (432.4) (544.1) (482.0) (479.8) (552.8) (587.7) Less: Other costs of sales (exclusive of depreciation of equipment under lease) (61.5) (61.0) (62.7) (97.8) (118.8) (111.5) (120.9) (160.2) Less: Depreciation of equipment under lease (5.8) (8.2) (9.3) (14.1) (15.4) (16.3) (17.4) (19.4) GROSS PROFIT $ 58.6 $ 127.5 $ 171.0 $ 253.2 $ 270.8 $ 240.7 $ 275.1 $ 409.6 GROSS PROFIT $ 58.6 $ 127.5 $ 171.0 $ 253.2 $ 270.8 $ 240.7 $ 275.1 $ 409.6 Add back: Other costs of sales 61.5 61.0 62.7 97.8 118.8 111.5 120.9 160.2 Add back: Depreciation of equipment under lease 5.8 8.2 9.3 14.1 15.4 16.3 17.4 19.4 Add back: TSYS outage payments 22.4 — — — — — — — GROSS REVENUE LESS NETWORK FEES $ 148.3 $ 196.7 $ 243.0 $ 365.1 $ 405.0 $ 368.5 $ 413.4 $ 589.2 2 4 24

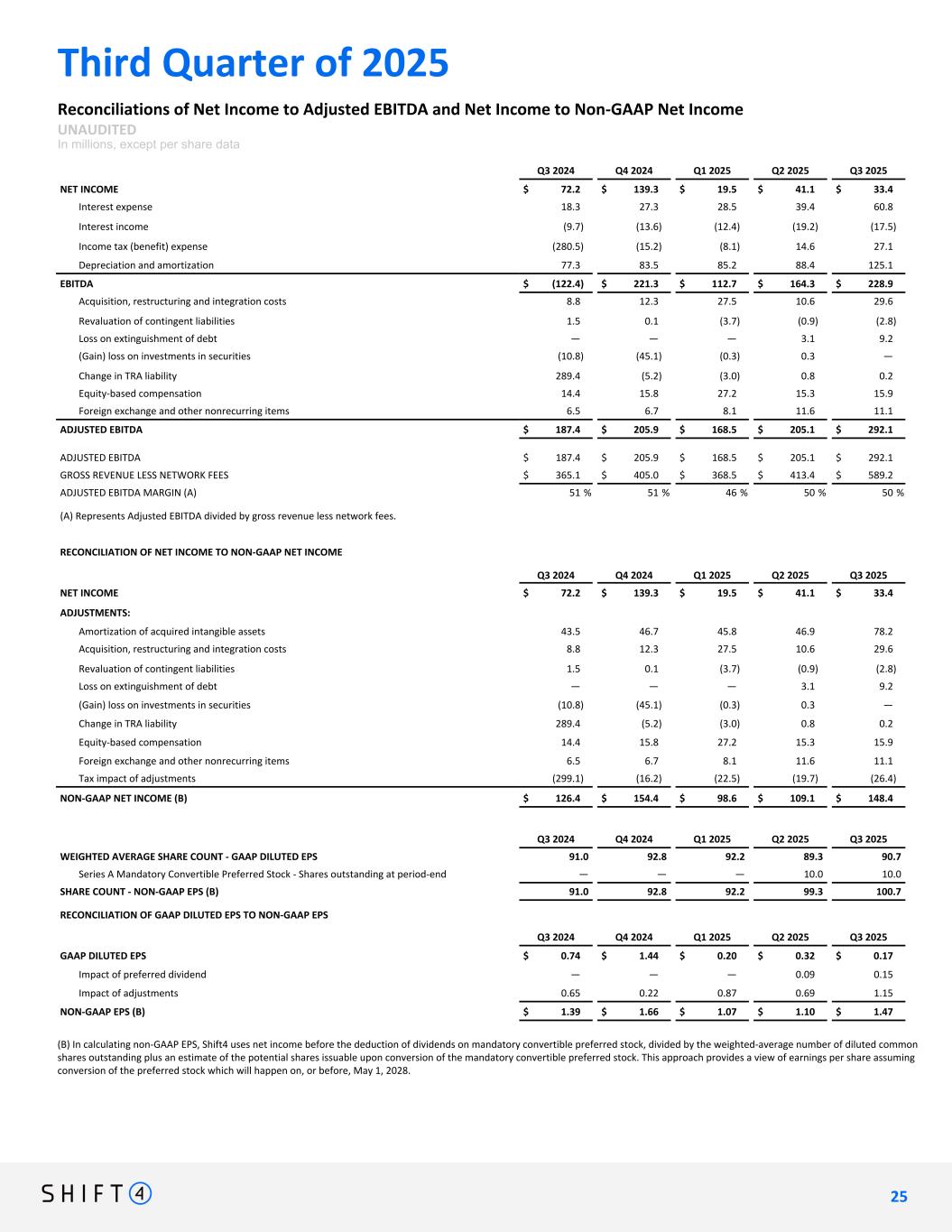

Third Quarter of 2025 Reconciliations of Net Income to Adjusted EBITDA and Net Income to Non-GAAP Net Income UNAUDITED In millions, except per share data Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 NET INCOME $ 72.2 $ 139.3 $ 19.5 $ 41.1 $ 33.4 Interest expense 18.3 27.3 28.5 39.4 60.8 Interest income (9.7) (13.6) (12.4) (19.2) (17.5) Income tax (benefit) expense (280.5) (15.2) (8.1) 14.6 27.1 Depreciation and amortization 77.3 83.5 85.2 88.4 125.1 EBITDA $ (122.4) $ 221.3 $ 112.7 $ 164.3 $ 228.9 Acquisition, restructuring and integration costs 8.8 12.3 27.5 10.6 29.6 Revaluation of contingent liabilities 1.5 0.1 (3.7) (0.9) (2.8) Loss on extinguishment of debt — — — 3.1 9.2 (Gain) loss on investments in securities (10.8) (45.1) (0.3) 0.3 — Change in TRA liability 289.4 (5.2) (3.0) 0.8 0.2 Equity-based compensation 14.4 15.8 27.2 15.3 15.9 Foreign exchange and other nonrecurring items 6.5 6.7 8.1 11.6 11.1 ADJUSTED EBITDA $ 187.4 $ 205.9 $ 168.5 $ 205.1 $ 292.1 ADJUSTED EBITDA $ 187.4 $ 205.9 $ 168.5 $ 205.1 $ 292.1 GROSS REVENUE LESS NETWORK FEES $ 365.1 $ 405.0 $ 368.5 $ 413.4 $ 589.2 ADJUSTED EBITDA MARGIN (A) 51 % 51 % 46 % 50 % 50 % (A) Represents Adjusted EBITDA divided by gross revenue less network fees. RECONCILIATION OF NET INCOME TO NON-GAAP NET INCOME Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 NET INCOME $ 72.2 $ 139.3 $ 19.5 $ 41.1 $ 33.4 ADJUSTMENTS: Amortization of acquired intangible assets 43.5 46.7 45.8 46.9 78.2 Acquisition, restructuring and integration costs 8.8 12.3 27.5 10.6 29.6 Revaluation of contingent liabilities 1.5 0.1 (3.7) (0.9) (2.8) Loss on extinguishment of debt — — — 3.1 9.2 (Gain) loss on investments in securities (10.8) (45.1) (0.3) 0.3 — Change in TRA liability 289.4 (5.2) (3.0) 0.8 0.2 Equity-based compensation 14.4 15.8 27.2 15.3 15.9 Foreign exchange and other nonrecurring items 6.5 6.7 8.1 11.6 11.1 Tax impact of adjustments (299.1) (16.2) (22.5) (19.7) (26.4) NON-GAAP NET INCOME (B) $ 126.4 $ 154.4 $ 98.6 $ 109.1 $ 148.4 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 WEIGHTED AVERAGE SHARE COUNT - GAAP DILUTED EPS 91.0 92.8 92.2 89.3 90.7 Series A Mandatory Convertible Preferred Stock - Shares outstanding at period-end — — — 10.0 10.0 SHARE COUNT - NON-GAAP EPS (B) 91.0 92.8 92.2 99.3 100.7 RECONCILIATION OF GAAP DILUTED EPS TO NON-GAAP EPS Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 GAAP DILUTED EPS $ 0.74 $ 1.44 $ 0.20 $ 0.32 $ 0.17 Impact of preferred dividend — — — 0.09 0.15 Impact of adjustments 0.65 0.22 0.87 0.69 1.15 NON-GAAP EPS (B) $ 1.39 $ 1.66 $ 1.07 $ 1.10 $ 1.47 2 5 25 (B) In calculating non-GAAP EPS, Shift4 uses net income before the deduction of dividends on mandatory convertible preferred stock, divided by the weighted-average number of diluted common shares outstanding plus an estimate of the potential shares issuable upon conversion of the mandatory convertible preferred stock. This approach provides a view of earnings per share assuming conversion of the preferred stock which will happen on, or before, May 1, 2028.

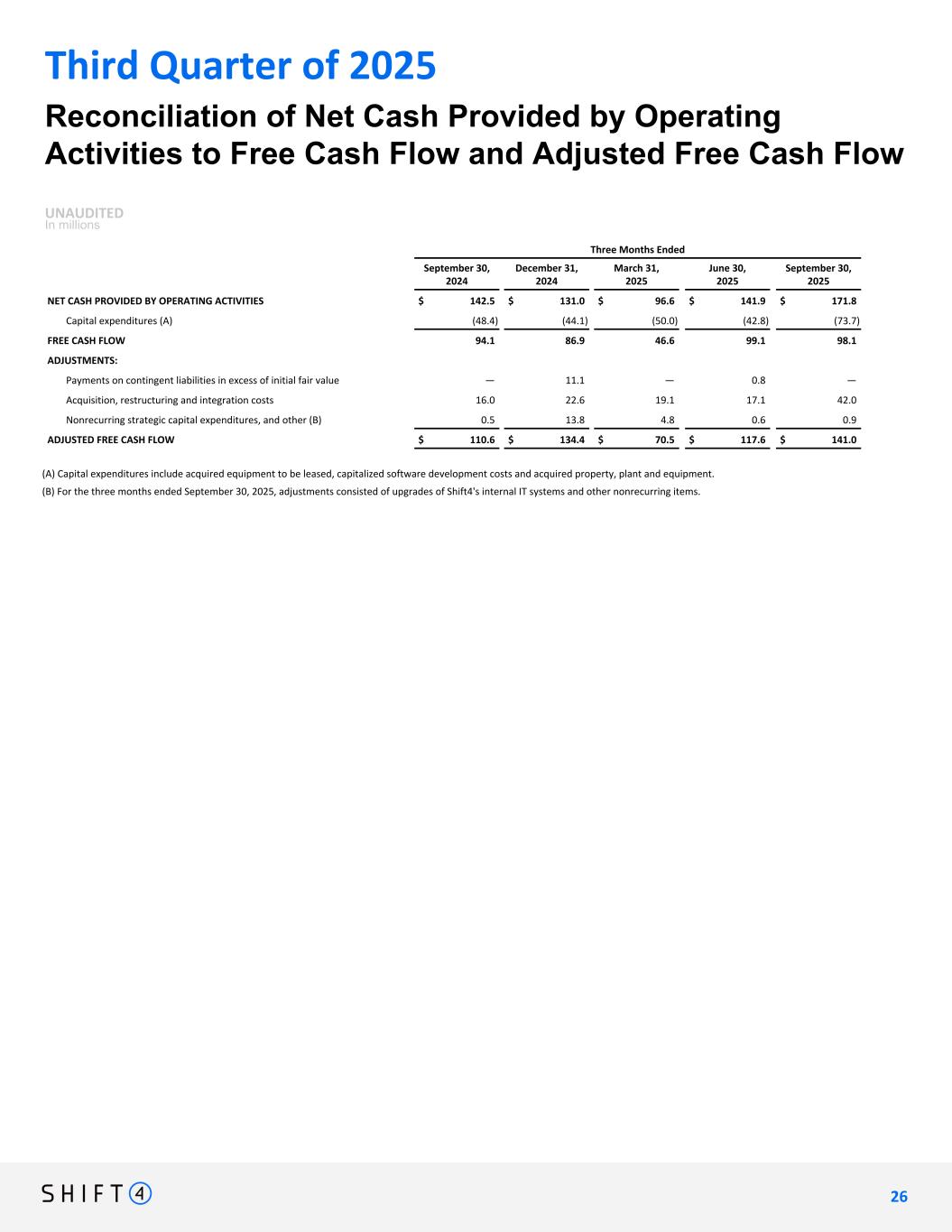

Three Months Ended September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 NET CASH PROVIDED BY OPERATING ACTIVITIES $ 142.5 $ 131.0 $ 96.6 $ 141.9 $ 171.8 Capital expenditures (A) (48.4) (44.1) (50.0) (42.8) (73.7) FREE CASH FLOW 94.1 86.9 46.6 99.1 98.1 ADJUSTMENTS: Payments on contingent liabilities in excess of initial fair value — 11.1 — 0.8 — Acquisition, restructuring and integration costs 16.0 22.6 19.1 17.1 42.0 Nonrecurring strategic capital expenditures, and other (B) 0.5 13.8 4.8 0.6 0.9 ADJUSTED FREE CASH FLOW $ 110.6 $ 134.4 $ 70.5 $ 117.6 $ 141.0 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow and Adjusted Free Cash Flow UNAUDITED In millions Third Quarter of 2025 (A) Capital expenditures include acquired equipment to be leased, capitalized software development costs and acquired property, plant and equipment. (B) For the three months ended September 30, 2025, adjustments consisted of upgrades of Shift4's internal IT systems and other nonrecurring items. 2 6 26

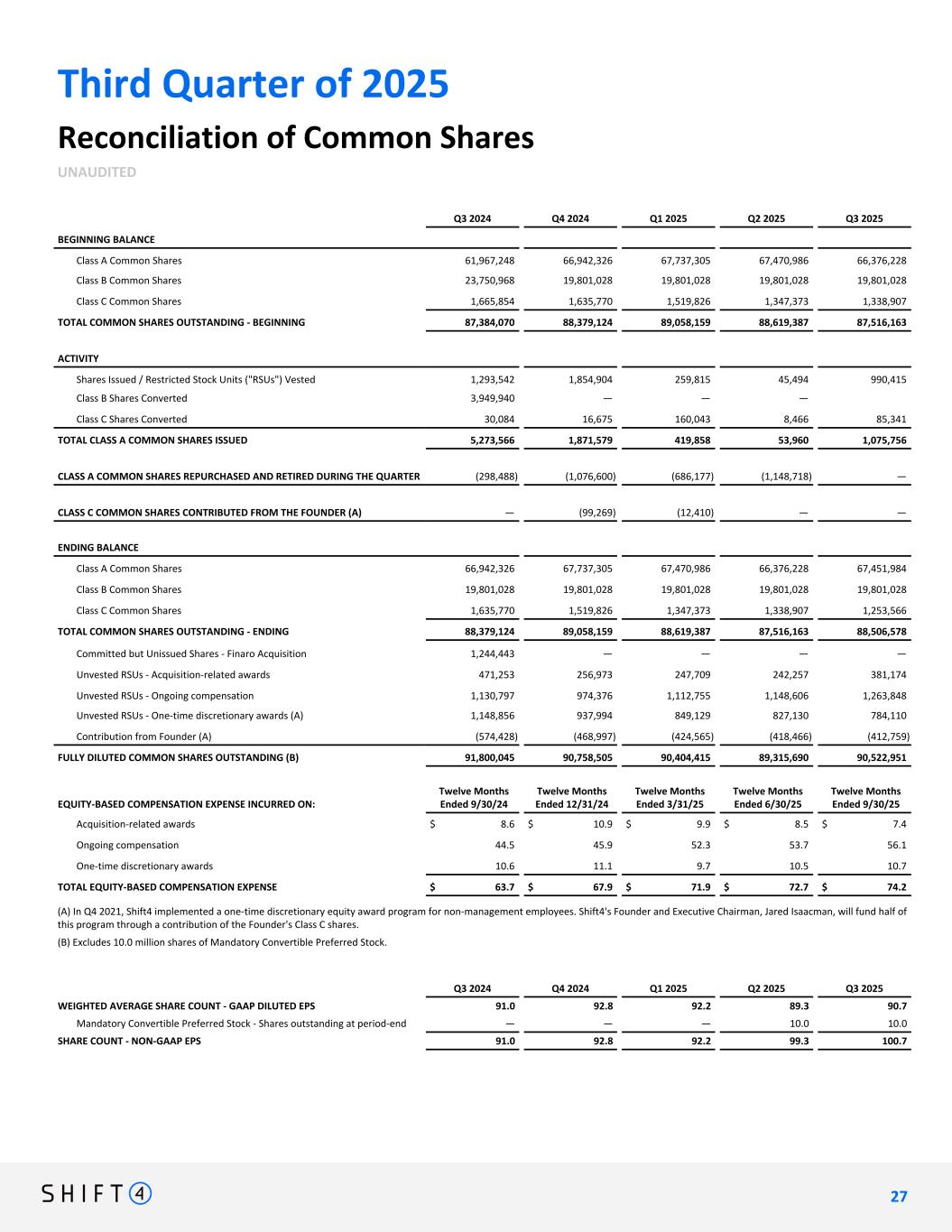

(A) In Q4 2021, Shift4 implemented a one-time discretionary equity award program for non-management employees. Shift4's Founder and Executive Chairman, Jared Isaacman, will fund half of this program through a contribution of the Founder's Class C shares. (B) Excludes 10.0 million shares of Mandatory Convertible Preferred Stock. Third Quarter of 2025 Reconciliation of Common Shares UNAUDITED Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 BEGINNING BALANCE Class A Common Shares 61,967,248 66,942,326 67,737,305 67,470,986 66,376,228 Class B Common Shares 23,750,968 19,801,028 19,801,028 19,801,028 19,801,028 Class C Common Shares 1,665,854 1,635,770 1,519,826 1,347,373 1,338,907 TOTAL COMMON SHARES OUTSTANDING - BEGINNING 87,384,070 88,379,124 89,058,159 88,619,387 87,516,163 ACTIVITY Shares Issued / Restricted Stock Units ("RSUs") Vested 1,293,542 1,854,904 259,815 45,494 990,415 Class B Shares Converted 3,949,940 — — — Class C Shares Converted 30,084 16,675 160,043 8,466 85,341 TOTAL CLASS A COMMON SHARES ISSUED 5,273,566 1,871,579 419,858 53,960 1,075,756 CLASS A COMMON SHARES REPURCHASED AND RETIRED DURING THE QUARTER (298,488) (1,076,600) (686,177) (1,148,718) — CLASS C COMMON SHARES CONTRIBUTED FROM THE FOUNDER (A) — (99,269) (12,410) — — ENDING BALANCE Class A Common Shares 66,942,326 67,737,305 67,470,986 66,376,228 67,451,984 Class B Common Shares 19,801,028 19,801,028 19,801,028 19,801,028 19,801,028 Class C Common Shares 1,635,770 1,519,826 1,347,373 1,338,907 1,253,566 TOTAL COMMON SHARES OUTSTANDING - ENDING 88,379,124 89,058,159 88,619,387 87,516,163 88,506,578 Committed but Unissued Shares - Finaro Acquisition 1,244,443 — — — — Unvested RSUs - Acquisition-related awards 471,253 256,973 247,709 242,257 381,174 Unvested RSUs - Ongoing compensation 1,130,797 974,376 1,112,755 1,148,606 1,263,848 Unvested RSUs - One-time discretionary awards (A) 1,148,856 937,994 849,129 827,130 784,110 Contribution from Founder (A) (574,428) (468,997) (424,565) (418,466) (412,759) FULLY DILUTED COMMON SHARES OUTSTANDING (B) 91,800,045 90,758,505 90,404,415 89,315,690 90,522,951 EQUITY-BASED COMPENSATION EXPENSE INCURRED ON: Twelve Months Ended 9/30/24 Twelve Months Ended 12/31/24 Twelve Months Ended 3/31/25 Twelve Months Ended 6/30/25 Twelve Months Ended 9/30/25 Acquisition-related awards $ 8.6 $ 10.9 $ 9.9 $ 8.5 $ 7.4 Ongoing compensation 44.5 45.9 52.3 53.7 56.1 One-time discretionary awards 10.6 11.1 9.7 10.5 10.7 TOTAL EQUITY-BASED COMPENSATION EXPENSE $ 63.7 $ 67.9 $ 71.9 $ 72.7 $ 74.2 2 7 27 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 WEIGHTED AVERAGE SHARE COUNT - GAAP DILUTED EPS 91.0 92.8 92.2 89.3 90.7 Mandatory Convertible Preferred Stock - Shares outstanding at period-end — — — 10.0 10.0 SHARE COUNT - NON-GAAP EPS 91.0 92.8 92.2 99.3 100.7