false2025Q10001794669--12-31P1YP10YP15YP6Y3M18DP12Y4M24DP3YP10Yxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureiso4217:EURfour:performanceObligationfour:segment00017946692025-01-012025-03-310001794669us-gaap:CommonClassAMember2025-04-220001794669us-gaap:CommonClassBMember2025-04-220001794669us-gaap:CommonClassCMember2025-04-2200017946692025-03-3100017946692024-12-310001794669four:ResidualCommissionBuyoutsMember2025-03-310001794669four:ResidualCommissionBuyoutsMember2024-12-310001794669four:CapitalizedAcquisitionCostsMember2025-03-310001794669four:CapitalizedAcquisitionCostsMember2024-12-310001794669us-gaap:OtherIntangibleAssetsMember2025-03-310001794669us-gaap:OtherIntangibleAssetsMember2024-12-310001794669us-gaap:CommonClassAMember2024-12-310001794669us-gaap:CommonClassAMember2025-03-310001794669us-gaap:CommonClassBMember2024-12-310001794669us-gaap:CommonClassBMember2025-03-310001794669us-gaap:CommonClassCMember2024-12-310001794669us-gaap:CommonClassCMember2025-03-3100017946692024-01-012024-03-310001794669us-gaap:CommonClassAMember2025-01-012025-03-310001794669us-gaap:CommonClassAMember2024-01-012024-03-310001794669us-gaap:CommonClassCMember2025-01-012025-03-310001794669us-gaap:CommonClassCMember2024-01-012024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-12-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-12-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-12-310001794669us-gaap:AdditionalPaidInCapitalMember2024-12-310001794669us-gaap:RetainedEarningsMember2024-12-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001794669us-gaap:NoncontrollingInterestMember2024-12-310001794669us-gaap:RetainedEarningsMember2025-01-012025-03-310001794669us-gaap:NoncontrollingInterestMember2025-01-012025-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2025-01-012025-03-310001794669us-gaap:AdditionalPaidInCapitalMember2025-01-012025-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2025-01-012025-03-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2025-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2025-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2025-03-310001794669us-gaap:AdditionalPaidInCapitalMember2025-03-310001794669us-gaap:RetainedEarningsMember2025-03-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310001794669us-gaap:NoncontrollingInterestMember2025-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-12-310001794669us-gaap:AdditionalPaidInCapitalMember2023-12-310001794669us-gaap:RetainedEarningsMember2023-12-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001794669us-gaap:NoncontrollingInterestMember2023-12-3100017946692023-12-310001794669us-gaap:RetainedEarningsMember2024-01-012024-03-310001794669us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001794669us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-03-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-03-310001794669us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-03-310001794669us-gaap:AdditionalPaidInCapitalMember2024-03-310001794669us-gaap:RetainedEarningsMember2024-03-310001794669us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001794669us-gaap:NoncontrollingInterestMember2024-03-3100017946692024-03-310001794669four:SeniorNotesDueTwoThousandTwentyFiveMember2025-03-310001794669four:A2027ConvertibleNotesMemberus-gaap:ConvertibleDebtMember2025-03-310001794669four:TheGivingBlockIncMember2025-03-310001794669four:TheGivingBlockIncMember2024-12-310001794669four:ConvertibleNotesDueTwoThousandTwentyFiveAndConvertibleNotesDueTwoThousandTwentySevenMember2019-11-052019-11-050001794669srt:ScenarioPreviouslyReportedMember2024-01-012024-03-310001794669srt:RestatementAdjustmentMember2024-01-012024-03-310001794669four:EigenPaymentsMember2024-11-182024-11-180001794669four:EigenPaymentsMember2024-11-180001794669four:EigenPaymentsMemberfour:MerchantRelationshipsMember2024-11-180001794669four:EigenPaymentsMemberfour:AcquiredTechnologyMember2024-11-180001794669four:EigenPaymentsMemberfour:AcquiredTechnologyMember2024-11-182024-11-180001794669four:EigenPaymentsMemberfour:MerchantRelationshipsMember2024-11-182024-11-180001794669four:GivexCorp.Member2024-11-082024-11-080001794669four:GivexCorp.Member2024-11-080001794669four:GivexCorp.Memberfour:MerchantRelationshipsMember2024-11-180001794669four:GivexCorp.Memberfour:AcquiredTechnologyMember2024-11-180001794669four:GivexCorp.Memberus-gaap:TrademarksAndTradeNamesMember2024-11-180001794669four:GivexCorp.Member2024-11-180001794669four:GivexCorp.Memberfour:AcquiredTechnologyMember2024-11-082024-11-080001794669four:GivexCorp.Memberfour:MerchantRelationshipsMember2024-11-082024-11-080001794669four:GivexCorp.Memberus-gaap:TradeNamesMember2024-11-082024-11-080001794669four:VectronSystemsAGMember2025-03-310001794669four:VectronSystemsAGMember2024-06-142024-06-140001794669four:VectronSystemsAGMember2025-03-310001794669four:VectronSystemsAGMember2024-06-140001794669four:VectronSystemsAGMember2025-01-012025-03-310001794669four:AcardoMember2024-06-140001794669four:AcardoMember2025-01-012025-03-310001794669four:AcardoMember2025-03-310001794669four:VectronSystemsAGMemberfour:MerchantRelationshipsMember2024-06-140001794669four:VectronSystemsAGMemberfour:AcquiredTechnologyMember2024-06-140001794669four:VectronSystemsAGMemberus-gaap:TrademarksAndTradeNamesMember2024-06-140001794669four:VectronSystemsAGMemberfour:AcquiredTechnologyMember2024-06-142024-06-140001794669four:VectronSystemsAGMemberfour:MerchantRelationshipsMember2024-06-142024-06-140001794669four:VectronSystemsAGMemberus-gaap:TradeNamesMember2024-06-142024-06-140001794669four:RevelSystemsInc.Member2024-06-130001794669four:RevelSystemsInc.Member2024-06-132024-06-130001794669four:RevelSystemsInc.Memberfour:MerchantRelationshipsMember2024-06-130001794669four:RevelSystemsInc.Memberfour:AcquiredTechnologyMember2024-06-130001794669four:RevelSystemsInc.Memberus-gaap:TrademarksAndTradeNamesMember2024-06-130001794669four:RevelSystemsInc.Memberfour:AcquiredTechnologyMember2024-06-132024-06-130001794669four:RevelSystemsInc.Memberfour:MerchantRelationshipsMember2024-06-132024-06-130001794669four:RevelSystemsInc.Memberus-gaap:TradeNamesMember2024-06-132024-06-130001794669four:PaymentsBasedRevenueMember2025-01-012025-03-310001794669four:PaymentsBasedRevenueMember2024-01-012024-03-310001794669four:SubscriptionAndOtherRevenuesMember2025-01-012025-03-310001794669four:SubscriptionAndOtherRevenuesMember2024-01-012024-03-310001794669four:ResidualCommissionBuyoutsMember2025-01-012025-03-310001794669us-gaap:OtherIntangibleAssetsMember2025-01-012025-03-310001794669four:CapitalizedAcquisitionCostsMember2025-01-012025-03-310001794669four:EquipmentUnderLeaseMember2025-01-012025-03-310001794669us-gaap:PropertyPlantAndEquipmentMember2025-01-012025-03-310001794669four:ResidualCommissionBuyoutsMember2024-01-012024-03-310001794669us-gaap:OtherIntangibleAssetsMember2024-01-012024-03-310001794669four:CapitalizedAcquisitionCostsMember2024-01-012024-03-310001794669four:EquipmentUnderLeaseMember2024-01-012024-03-310001794669us-gaap:PropertyPlantAndEquipmentMember2024-01-012024-03-310001794669four:AcquiredIntangibleAssetsMember2025-01-012025-03-310001794669four:NonAcquiredIntangibleAssetsMember2025-01-012025-03-310001794669four:AcquiredIntangibleAssetsMember2024-01-012024-03-310001794669four:NonAcquiredIntangibleAssetsMember2024-01-012024-03-310001794669four:ResidualCommissionBuyoutsFromAssetAcquisitionsMember2025-03-310001794669four:ResidualCommissionBuyoutsFromBusinessCombinationsMember2025-03-310001794669four:ResidualCommissionBuyoutsFromAssetAcquisitionsMember2024-12-310001794669four:ResidualCommissionBuyoutsFromBusinessCombinationsMember2024-12-310001794669four:MerchantRelationshipsMember2025-03-310001794669four:AcquiredTechnologyMember2025-03-310001794669us-gaap:TrademarksAndTradeNamesMember2025-03-310001794669four:CapitalizedSoftwareDevelopmentCostsMember2025-03-310001794669four:MerchantRelationshipsMember2024-12-310001794669four:AcquiredTechnologyMember2024-12-310001794669us-gaap:TrademarksAndTradeNamesMember2024-12-310001794669four:CapitalizedSoftwareDevelopmentCostsMember2024-12-310001794669four:EquipmentUnderLeaseMember2025-01-012025-03-310001794669four:EquipmentUnderLeaseMember2025-03-310001794669four:EquipmentHeldForLeaseMember2025-03-310001794669four:EquipmentUnderLeaseMember2024-01-012024-12-310001794669four:EquipmentUnderLeaseMember2024-12-310001794669four:EquipmentHeldForLeaseMember2024-12-310001794669us-gaap:EquipmentMember2025-03-310001794669us-gaap:EquipmentMember2024-12-310001794669us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2025-03-310001794669us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001794669us-gaap:LeaseholdImprovementsMember2025-03-310001794669us-gaap:LeaseholdImprovementsMember2024-12-310001794669us-gaap:FurnitureAndFixturesMember2025-03-310001794669us-gaap:FurnitureAndFixturesMember2024-12-310001794669us-gaap:VehiclesMember2025-03-310001794669us-gaap:VehiclesMember2024-12-310001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMember2025-03-310001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMember2025-01-012025-03-310001794669four:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMemberus-gaap:SeniorNotesMember2024-12-310001794669four:ConvertibleNotesDueTwoThousandTwentyFiveMemberus-gaap:SeniorNotesMember2025-01-012025-03-310001794669four:ConvertibleNotesDueTwoThousandTwentyFiveMemberus-gaap:SeniorNotesMember2025-03-310001794669four:ConvertibleNotesDueTwoThousandTwentyFiveMemberus-gaap:SeniorNotesMember2024-12-310001794669four:ConvertibleNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2025-01-012025-03-310001794669four:ConvertibleNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2025-03-310001794669four:ConvertibleNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2024-12-310001794669four:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMemberus-gaap:SeniorNotesMember2025-03-310001794669four:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMemberus-gaap:SeniorNotesMember2025-01-012025-03-310001794669four:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMemberus-gaap:SeniorNotesMember2024-12-310001794669us-gaap:SeniorNotesMember2025-03-310001794669us-gaap:SeniorNotesMember2024-12-310001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300001794669us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2024-09-300001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2025-03-310001794669four:CreditFacilityMemberfour:SettlementLineCreditAgreementMemberus-gaap:LineOfCreditMember2024-09-300001794669four:BridgeFacilitiesMemberus-gaap:BridgeLoanMember2025-02-012025-02-280001794669four:BridgeFacilitiesMemberus-gaap:BridgeLoanMember2025-02-280001794669four:SeniorSecuredBridgeFacilityMemberus-gaap:BridgeLoanMember2025-02-012025-02-280001794669four:SeniorSecuredBridgeFacilityMemberus-gaap:BridgeLoanMember2025-02-280001794669four:SeniorUnsecuredBridgeFacilityMemberus-gaap:BridgeLoanMember2025-02-012025-02-280001794669four:SeniorUnsecuredBridgeFacilityMemberus-gaap:BridgeLoanMember2025-02-280001794669four:BridgeFacilitiesMemberus-gaap:BridgeLoanMember2025-02-160001794669four:BridgeFacilitiesMemberus-gaap:BridgeLoanMember2025-03-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMember2025-03-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMember2025-03-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMember2024-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:SixPointSevenFiveZeroSeniorNotesDueTwoThousandThirtyTwoMember2024-12-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentyFiveMember2025-03-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentyFiveMember2025-03-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentyFiveMember2024-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentyFiveMember2024-12-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentySevenMember2025-03-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentySevenMember2025-03-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentySevenMember2024-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:ConvertibleNotesDueTwoThousandTwentySevenMember2024-12-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMember2025-03-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMember2025-03-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMemberfour:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMember2024-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfour:FourPointSixTwoFiveSeniorNotesDueTwoThousandTwentySixMember2024-12-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMember2025-03-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2025-03-310001794669us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310001794669us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310001794669us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001794669four:RookHoldingsIncorporationMember2025-03-310001794669us-gaap:RelatedPartyMember2025-01-012025-03-310001794669us-gaap:RelatedPartyMember2024-01-012024-03-310001794669us-gaap:RelatedPartyMember2025-03-310001794669us-gaap:RelatedPartyMember2024-12-3100017946692021-11-3000017946692024-05-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncMember2025-03-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncMember2025-01-012025-03-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncMember2024-12-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncMember2024-01-012024-12-310001794669four:Shift4PaymentsLLCMemberfour:RookHoldingsIncorporationMember2025-03-310001794669four:Shift4PaymentsLLCMemberfour:RookHoldingsIncorporationMember2025-01-012025-03-310001794669four:Shift4PaymentsLLCMemberfour:RookHoldingsIncorporationMember2024-12-310001794669four:Shift4PaymentsLLCMemberfour:RookHoldingsIncorporationMember2024-01-012024-12-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncAndRookHoldingsIncorporationMember2025-03-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncAndRookHoldingsIncorporationMember2025-01-012025-03-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncAndRookHoldingsIncorporationMember2024-12-310001794669four:Shift4PaymentsLLCMemberfour:Shift4PaymentsIncAndRookHoldingsIncorporationMember2024-01-012024-12-310001794669four:VectronSystemsAGMember2024-12-3100017946692022-06-012022-06-300001794669four:RestrictedStockUnitsAndPerformanceBasedRestrictedStockUnitsMember2024-12-310001794669four:RestrictedStockUnitsAndPerformanceBasedRestrictedStockUnitsMember2025-01-012025-03-310001794669four:RestrictedStockUnitsAndPerformanceBasedRestrictedStockUnitsMember2025-03-310001794669us-gaap:MemberUnitsMemberus-gaap:CommonClassAMember2025-01-012025-03-310001794669us-gaap:MemberUnitsMemberus-gaap:CommonClassAMember2024-01-012024-03-310001794669us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2025-01-012025-03-310001794669us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2024-01-012024-03-310001794669four:ConvertibleNotesDueTwoThousandTwentyFiveMemberus-gaap:CommonClassAMember2025-01-012025-03-310001794669four:ConvertibleNotesDueTwoThousandTwentyFiveMemberus-gaap:CommonClassAMember2024-01-012024-03-310001794669four:LLCInterestsConvertIntoPotentialClassACommonSharesMember2024-01-012024-03-310001794669four:PaymentsBasedRevenueMemberfour:ReportableSegmentMember2025-01-012025-03-310001794669four:PaymentsBasedRevenueMemberfour:ReportableSegmentMember2024-01-012024-03-310001794669four:SubscriptionAndOtherRevenuesMemberfour:ReportableSegmentMember2025-01-012025-03-310001794669four:SubscriptionAndOtherRevenuesMemberfour:ReportableSegmentMember2024-01-012024-03-310001794669four:ReportableSegmentMember2025-01-012025-03-310001794669four:ReportableSegmentMember2024-01-012024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-Q

__________________________________________________

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2025

or

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission File Number: 001-39313

__________________________________

SHIFT4 PAYMENTS, INC.

(Exact name of registrant as specified in its charter)

__________________________________

| | | | | | | | |

| Delaware | | 84-3676340 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

3501 Corporate Parkway Center Valley, Pennsylvania | | 18034 |

| (Address of principal executive offices) | | (Zip Code) |

(888) 276-2108

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | FOUR | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | o |

| Emerging growth company | o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of April 22, 2025, there were 67,471,184 shares of the registrant’s Class A common stock, $0.0001 par value per share, outstanding, 19,801,028 shares of the registrant’s Class B common stock, $0.0001 par value per share, outstanding and 1,347,373 shares of the registrant’s Class C common stock, $0.0001 par value per share, outstanding.

SHIFT4 PAYMENTS, INC.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Quarterly Report”) contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“the Exchange Act”). All statements other than statements of historical fact contained in this Quarterly Report, including, without limitation, statements relating to the Offer, the Merger, the Transaction Agreement (each as defined herein), the related financings, our position as a leader within our industry, our future results of operations and financial position, business strategy and plans, the impact of changes in TRA liability and the Restructuring Transaction (each as defined herein), the anticipated benefits of and costs associated with recent acquisitions, and objectives of management for future operations and activities, including, among others, statements regarding expected growth, international expansion, future capital expenditures, debt covenant compliance, financing activities, debt service obligations including the settlement of conversions of our 2025 Convertible Notes, executive transitions and succession planning, and the timing of any of the foregoing, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions, though not all forward-looking statements can be identified by such terms or expressions. The forward-looking statements in this Quarterly Report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Quarterly Report and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including, but not limited to, those factors described in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed on February 19, 2025 (the “2024 Form 10-K”).

Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties.

You should read this Quarterly Report and the documents that we reference herein completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

PART I: FINANCIAL INFORMATION

Item 1. Financial Statements (unaudited)

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)(in millions, except share and per share amounts) | | | | | | | | | | | |

| March 31, 2025 | | December 31, 2024 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 1,167.3 | | | $ | 1,211.9 | |

| Settlement assets | 289.0 | | | 298.1 | |

| Accounts receivable, net | 330.6 | | | 348.7 | |

| | | |

| Prepaid expenses and other current assets | 57.2 | | | 51.7 | |

| Total current assets | 1,844.1 | | | 1,910.4 | |

| Noncurrent assets | | | |

| Equipment for lease, net | 176.9 | | | 165.1 | |

| Property, plant and equipment, net | 24.0 | | | 27.2 | |

| Right-of-use assets | 35.2 | | | 36.9 | |

| Collateral held by the card networks | 38.8 | | | 37.5 | |

| Goodwill | 1,472.2 | | | 1,455.6 | |

| Residual commission buyouts, net | 135.9 | | | 157.2 | |

| Capitalized customer acquisition costs, net | 66.9 | | | 65.3 | |

| Other intangible assets, net | 767.3 | | | 758.4 | |

| Deferred tax assets | 396.3 | | | 396.8 | |

| Other noncurrent assets | 46.1 | | | 31.0 | |

| | | |

| Total assets | $ | 5,003.7 | | | $ | 5,041.4 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities | | | |

| Current portion of debt | $ | 687.8 | | | $ | 686.9 | |

| Settlement liabilities | 281.9 | | | 293.3 | |

| Accounts payable | 263.0 | | | 248.3 | |

| Accrued expenses and other current liabilities | 100.6 | | | 120.5 | |

| Current portion of TRA liability | 1.1 | | | 4.3 | |

| Deferred revenue | 11.0 | | | 15.5 | |

| | | |

| Current lease liabilities | 10.9 | | | 11.0 | |

| Total current liabilities | 1,356.3 | | | 1,379.8 | |

| Noncurrent liabilities | | | |

| Long-term debt | 2,155.7 | | | 2,154.1 | |

| Noncurrent portion of TRA liability | 361.4 | | | 361.2 | |

| Deferred tax liabilities | 44.4 | | | 60.6 | |

| Noncurrent lease liabilities | 27.6 | | | 29.3 | |

| Other noncurrent liabilities | 42.3 | | | 38.7 | |

| | | |

| Total liabilities | 3,987.7 | | | 4,023.7 | |

| Commitments and contingencies (Note 15) | | | |

| Stockholders' equity | | | |

Preferred stock, $0.0001 par value, 20,000,000 shares authorized at March 31, 2025 and December 31, 2024, none issued and outstanding | — | | | — | |

Class A common stock, $0.0001 par value per share, 300,000,000 shares authorized, 67,470,986 and 67,737,305 shares issued and outstanding at March 31, 2025 and December 31, 2024, respectively | — | | | — | |

Class B common stock, $0.0001 par value per share, 100,000,000 shares authorized, 19,801,028 and 19,801,028 shares issued and outstanding at March 31, 2025 and December 31, 2024, respectively. | — | | | — | |

Class C common stock, $0.0001 par value per share, 100,000,000 shares authorized, 1,347,373 and 1,519,826 shares issued and outstanding at March 31, 2025 and December 31, 2024, respectively. | — | | | — | |

| Additional paid-in capital | 1,067.4 | | | 1,063.0 | |

| | | |

| Accumulated other comprehensive loss | (2.6) | | | (28.2) | |

| Retained deficit | (259.6) | | | (228.2) | |

| Total stockholders' equity attributable to Shift4 Payments, Inc. | 805.2 | | | 806.6 | |

| Noncontrolling interests | 210.8 | | | 211.1 | |

| Total stockholders' equity | 1,016.0 | | | 1,017.7 | |

| Total liabilities and stockholders' equity | $ | 5,003.7 | | | $ | 5,041.4 | |

See accompanying notes to unaudited condensed consolidated financial statements. |

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) (in millions, except share and per share amounts)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2025 | | 2024 | | | | |

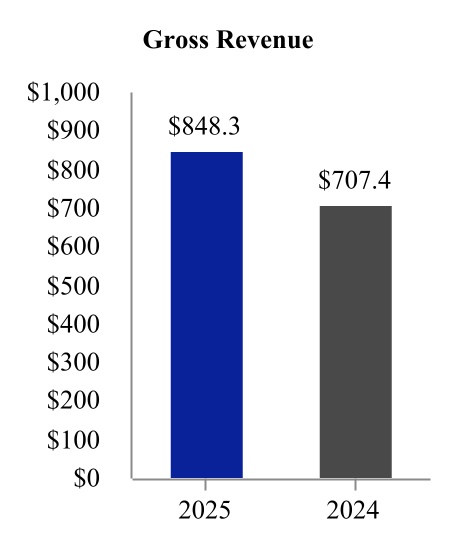

| Gross revenue | $ | 848.3 | | | $ | 707.4 | | | | | |

| Cost of sales (exclusive of certain depreciation and amortization expense shown separately below) | (591.3) | | | (519.6) | | | | | |

| General and administrative expenses | (154.0) | | | (107.1) | | | | | |

| Revaluation of contingent liabilities | 3.7 | | | (2.1) | | | | | |

| Depreciation and amortization expense (a) | (56.0) | | | (44.8) | | | | | |

| Professional expenses | (18.6) | | | (8.0) | | | | | |

| | | | | | | |

| Advertising and marketing expenses | (6.7) | | | (4.4) | | | | | |

| | | | | | | |

| Income from operations | 25.4 | | | 21.4 | | | | | |

| | | | | | | |

| Interest income | 12.4 | | | 5.4 | | | | | |

| Other income (expense), net | (1.2) | | | 1.4 | | | | | |

| Gain on investments in securities | 0.3 | | | 11.0 | | | | | |

| Change in TRA liability | 3.0 | | | (1.2) | | | | | |

| Interest expense | (28.5) | | | (8.1) | | | | | |

| Income before income taxes | 11.4 | | | 29.9 | | | | | |

| Income tax benefit (expense) | 8.1 | | | (1.4) | | | | | |

| Net income | 19.5 | | | 28.5 | | | | | |

| Less: Net income attributable to noncontrolling interests | (2.8) | | | (7.9) | | | | | |

| Net income attributable to Shift4 Payments, Inc. | $ | 16.7 | | | $ | 20.6 | | | | | |

| | | | | | | |

| Basic net income per share | | | | | | | |

| Class A net income per share - basic | $ | 0.24 | | | $ | 0.31 | | | | | |

| Class A weighted average common stock outstanding - basic | 67,700,208 | | | 64,444,479 | | | | | |

| Class C net income per share - basic | $ | 0.24 | | | $ | 0.31 | | | | | |

| Class C weighted average common stock outstanding - basic | 1,452,252 | | | 1,694,915 | | | | | |

| | | | | | | |

| Diluted net income per share | | | | | | | |

| Class A net income per share - diluted | $ | 0.20 | | | $ | 0.31 | | | | | |

| Class A weighted average common stock outstanding - diluted | 90,703,736 | | | 65,962,229 | | | | | |

| Class C net income per share - diluted | $ | 0.20 | | | $ | 0.31 | | | | | |

| Class C weighted average common stock outstanding - diluted | 1,452,252 | | | 1,694,915 | | | | | |

| See accompanying notes to unaudited condensed consolidated financial statements. |

(a)Depreciation and amortization expense includes depreciation of equipment under lease of $16.3 million and $11.9 million for the three months ended March 31, 2025 and 2024, respectively.

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited) (in millions)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2025 | | 2024 | | | | |

| Net income | $ | 19.5 | | | $ | 28.5 | | | | | |

| Other comprehensive income (loss) | | | | | | | |

| Unrealized gain (loss) on foreign currency translation adjustment | 33.1 | | | (14.5) | | | | | |

| | | | | | | |

| | | | | | | |

| Comprehensive income | 52.6 | | | 14.0 | | | | | |

| Less: Comprehensive income attributable to noncontrolling interests | (10.3) | | | (4.0) | | | | | |

| Comprehensive income attributable to Shift4 Payments, Inc. | $ | 42.3 | | | $ | 10.0 | | | | | |

| See accompanying notes to unaudited condensed consolidated financial statements. |

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited) (in millions, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares | | Additional Paid-In Capital | | | | Retained Deficit | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interests | | Total Equity |

| Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | | | | | | | | |

| Balances at December 31, 2024 | 67,737,305 | | | | | 19,801,028 | | | | | 1,519,826 | | | | | $ | 1,063.0 | | | | | | | $ | (228.2) | | | $ | (28.2) | | | $ | 211.1 | | | $ | 1,017.7 | |

| Net income | — | | | | | — | | | | | — | | | | | — | | | | | | | 16.7 | | | — | | | 2.8 | | | 19.5 | |

| Effect of foreign currency translation on Vectron noncontrolling interest | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | — | | | 1.0 | | | 1.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Repurchases and retirement of Class A common stock | (686,177) | | | | | — | | | | | — | | | | | (3.2) | | | | | | | (48.1) | | | — | | | (12.1) | | | (63.4) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange of shares held by Rook | 160,043 | | | | | — | | | | | (160,043) | | | | | — | | | | | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to noncontrolling interests | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | — | | | (0.1) | | | (0.1) | |

| Equity-based compensation | — | | | | | — | | | | | — | | | | | 26.0 | | | | | | | — | | | — | | | — | | | 26.0 | |

| Vesting of restricted stock units, net of tax withholding | 259,815 | | | | | — | | | | | (12,410) | | | | | (18.4) | | | | | | | — | | | — | | | 0.6 | | | (17.8) | |

| Other comprehensive income | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | 25.6 | | | 7.5 | | | 33.1 | |

| Balances at March 31, 2025 | 67,470,986 | | | | | 19,801,028 | | | | | 1,347,373 | | | | | $ | 1,067.4 | | | | | | | $ | (259.6) | | | $ | (2.6) | | | $ | 210.8 | | | $ | 1,016.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares | | Additional Paid-In Capital | | | | Retained Deficit | | Accumulated Other Comprehensive Income | | Noncontrolling Interests | | Total Equity |

| Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | | | | | | | | |

| Balances at December 31, 2023 | 60,664,171 | | | | | 23,831,883 | | | | | 1,694,915 | | | | | $ | 985.9 | | | | | | | $ | (346.7) | | | $ | 14.1 | | | $ | 215.1 | | | $ | 868.4 | |

| Net income | — | | | | | — | | | | | — | | | | | — | | | | | | | 20.6 | | | — | | | 7.9 | | | 28.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to noncontrolling interests | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | — | | | (0.3) | | | (0.3) | |

| Equity-based compensation | — | | | | | — | | | | | — | | | | | 22.8 | | | | | | | — | | | — | | | — | | | 22.8 | |

| Vesting of restricted stock units, net of tax withholding | 151,053 | | | | | — | | | | | — | | | | | (11.6) | | | | | | | — | | | — | | | 2.5 | | | (9.1) | |

| Other comprehensive loss | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | (10.6) | | | (3.9) | | | (14.5) | |

| Balances at March 31, 2024 | 60,815,224 | | | | | 23,831,883 | | | | | 1,694,915 | | | | | $ | 997.1 | | | | | | | $ | (326.1) | | | $ | 3.5 | | | $ | 221.3 | | | $ | 895.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| See accompanying notes to unaudited condensed consolidated financial statements. |

SHIFT4 PAYMENTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) (in millions)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2025 | | 2024 |

| Operating activities | | | |

| Net income | $ | 19.5 | | | $ | 28.5 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | |

| Depreciation and amortization | 85.2 | | | 66.1 | |

| Equity-based compensation expense | 26.0 | | | 22.8 | |

| Revaluation of contingent liabilities | (3.7) | | | 2.1 | |

| | | |

| Gain on investments in securities | (0.3) | | | (11.0) | |

| Change in TRA liability | (3.0) | | | 1.2 | |

| Amortization of capitalized financing costs | 3.5 | | | 2.1 | |

| Provision for bad debts | 4.1 | | | 1.8 | |

| Deferred income taxes | (17.7) | | | — | |

| Unrealized foreign exchange gains | — | | | (1.4) | |

| Other noncash items | — | | | (1.1) | |

| Change in operating assets and liabilities | | | |

| Accounts receivable | 15.2 | | | 0.5 | |

| Prepaid expenses and other assets | (4.0) | | | (7.8) | |

| Capitalized customer acquisition costs | (9.0) | | | (9.5) | |

| Accounts payable | 9.4 | | | 21.4 | |

| Accrued expenses and other liabilities | (23.6) | | | 6.1 | |

| Payments on contingent liabilities in excess of initial fair value | — | | | (0.3) | |

| Right-of-use assets and lease liabilities, net | (0.1) | | | (0.2) | |

| Deferred revenue | (4.9) | | | (6.3) | |

| Net cash provided by operating activities | 96.6 | | | 115.0 | |

| | | |

| Investing activities | | | |

| Acquisitions, net of cash acquired | (3.7) | | | — | |

| Acquisition of equipment to be leased | (30.3) | | | (24.4) | |

| Capitalized software development costs | (18.2) | | | (14.7) | |

| Acquisition of property, plant and equipment | (1.5) | | | (1.3) | |

| Deposits with sponsor bank, net | (26.8) | | | — | |

| Residual commission buyouts | (1.8) | | | (0.9) | |

| | | |

| Proceeds from sale of investments in securities | 0.3 | | | 1.6 | |

| Investments in securities | (3.0) | | | — | |

| Net cash used in investing activities | (85.0) | | | (39.7) | |

| | | |

| Financing activities | | | |

| | | |

| Settlement line of credit | 26.8 | | | — | |

| Settlement activity, net | (25.5) | | | (58.3) | |

| Repurchases of Class A common stock | (62.9) | | | — | |

| Payments for withholding tax related to vesting of restricted stock units | (17.8) | | | (9.1) | |

| Payments on contingent liabilities | — | | | (0.1) | |

| Distributions to noncontrolling interests | (0.1) | | | (0.3) | |

| Net change in bank deposits | — | | | (20.3) | |

| Other financing activities | (1.2) | | | — | |

| | | |

| Net cash used in financing activities | (80.7) | | | (88.1) | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | 14.8 | | | (6.5) | |

| Change in cash and cash equivalents and restricted cash | (54.3) | | | (19.3) | |

| | | |

| Cash and cash equivalents and restricted cash, beginning of period | 1,438.6 | | | 721.8 | |

| Cash and cash equivalents and restricted cash, end of period | $ | 1,384.3 | | | $ | 702.5 | |

| See accompanying notes to unaudited condensed consolidated financial statements. |

SHIFT4 PAYMENTS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited) (in millions, except share and per share amounts)

1.Organization, Basis of Presentation and Significant Accounting Policies

Organization

Shift4 Payments, Inc. (“Shift4 Payments” or “the Company”) was incorporated in Delaware in order to carry on the business of Shift4 Payments, LLC and its consolidated subsidiaries. The Company is a leading independent provider of software and payment processing solutions in the United States (“U.S.”) based on total volume of payments processed.

Basis of Presentation

The accompanying interim condensed consolidated financial statements of the Company are unaudited. These interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the U.S. (“U.S. GAAP”) and the applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) for interim financial information. These financial statements do not include all information and footnotes required by U.S. GAAP for complete financial statements. The December 31, 2024 Condensed Consolidated Balance Sheet was derived from audited financial statements as of that date, but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements.

In the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments consisting only of normal recurring adjustments necessary to state fairly the financial position, results of operations and cash flows for the periods presented in conformity with U.S. GAAP applicable to interim periods. The results of operations for the interim periods presented are not necessarily indicative of results for the full year or future periods. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the related notes thereto as of and for the fiscal year ended December 31, 2024, as disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “2024 Form 10-K”).

The unaudited condensed consolidated financial statements include the accounts of Shift4 Payments, Inc. and its wholly-owned subsidiaries. Shift4 Payments, Inc. consolidates the financial results of Shift4 Payments, LLC, which is considered a variable interest entity. Shift4 Payments, Inc. is the primary beneficiary and sole managing member of Shift4 Payments, LLC and has decision making authority that significantly affects the economic performance of the entity. As a result, the Company consolidates Shift4 Payments, LLC and reports a noncontrolling interest representing the economic interest in Shift4 Payments, LLC held by Rook Holdings Inc. (“Rook”). All intercompany balances and transactions have been eliminated in consolidation.

The assets and liabilities of Shift4 Payments, LLC represent substantially all of the consolidated assets and liabilities of Shift4 Payments, Inc. with the exception of certain cash balances, amounts payable under the Tax Receivable Agreement (“TRA”), and the aggregate principal amount of $690.0 million of 2025 Convertible Notes and $632.5 million of 2027 Convertible Notes (together, the “Convertible Notes”) that are held by Shift4 Payments, Inc. directly. As of March 31, 2025 and December 31, 2024, $49.7 million and $52.0 million of cash, respectively, was directly held by Shift4 Payments, Inc. As of March 31, 2025 and December 31, 2024, the TRA liability was $362.6 million and $365.5 million, respectively. In connection with the issuance of the Convertible Notes, Shift4 Payments, Inc. entered into Intercompany Convertible Notes with Shift4 Payments, LLC, whereby Shift4 Payments, Inc. provided the net proceeds from the issuance of the Convertible Notes to Shift4 Payments, LLC in the amount of $1,322.5 million. Shift4 Payments, Inc., which was incorporated on November 5, 2019, has not had any material operations on a standalone basis since its inception, and all of the operations of the Company are carried out by Shift4 Payments, LLC and its subsidiaries.

Change in Presentation of Consolidated Balance Sheets

Prior period balances have been adjusted to present “Inventory” within the line item “Prepaid expenses and other current assets” on the Company’s unaudited Condensed Consolidated Balance Sheets to conform to the current period presentation.

Change in Presentation of Consolidated Statements of Cash Flows

Prior period balances have been adjusted to present “Inventory” within the line item “Prepaid expenses and other assets” within its unaudited Condensed Consolidated Statements of Cash Flows to conform to the current period presentation.

During the fourth quarter of 2024, the Company elected to change its presentation of the cash flows associated with “Settlement activity, net” from “Operating activities” to present them as “Financing activities” within its unaudited Condensed Consolidated Statements of Cash Flows. Prior period balances have been adjusted to conform to the current period presentation.

The following table presents the effects of the change in presentation within the unaudited Condensed Consolidated Statements of Cash Flows for three months ended March 31, 2024:

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| As Previously Reported | | Adjustment | | As Adjusted |

| Cash flows from operating activities | | | | | |

| Settlement activity, net | $ | (58.3) | | | $ | 58.3 | | | $ | — | |

| All other operating activities | 115.0 | | | — | | | 115.0 | |

| Net cash provided by operating activities | $ | 56.7 | | | $ | 58.3 | | | $ | 115.0 | |

| | | | | |

| Cash flows from financing activities | | | | | |

| Settlement activity, net | $ | — | | | $ | (58.3) | | | $ | (58.3) | |

| All other financing activities | (29.8) | | | — | | | (29.8) | |

| Net cash used in financing activities | $ | (29.8) | | | $ | (58.3) | | | $ | (88.1) | |

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the Company’s unaudited condensed consolidated financial statements and accompanying notes. Significant estimates inherent in the preparation of the accompanying unaudited condensed consolidated financial statements include estimates of fair value of acquired assets and liabilities through business combinations, fair value of contingent liabilities related to earnout payments, deferred income tax valuation allowances, amounts associated with the Company’s tax receivable agreement with Rook and certain affiliates of Searchlight Capital Partners, L.P. (together, the “Continuing Equity Owners”), allowance for doubtful accounts, income taxes, and noncontrolling interests. Estimates are based on past experience and other considerations reasonable under the circumstances. Actual results may differ from these estimates.

Significant Accounting Policies

The Company’s significant accounting policies are discussed in Note 1 to Shift4 Payments, Inc.’s consolidated financial statements as of and for the year ended December 31, 2024 in the 2024 Form 10-K. There have been no significant changes to these policies which have had a material impact on the Company’s unaudited condensed consolidated financial statements and related notes during the three months ended March 31, 2025.

The following table provides a reconciliation between cash and cash equivalents on the unaudited Condensed Consolidated Balance Sheets and the unaudited Condensed Consolidated Statements of Cash Flows:

| | | | | | | | | | | |

| March 31, 2025 | | December 31, 2024 |

| Cash and cash equivalents | $ | 1,167.3 | | | $ | 1,211.9 | |

| Cash and cash equivalents included in Settlement assets | 217.0 | | | 226.7 | |

| Total cash and cash equivalents and restricted cash on the unaudited Condensed Consolidated Statements of Cash Flows | $ | 1,384.3 | | | $ | 1,438.6 | |

Recent Accounting Pronouncements

Accounting Pronouncements Adopted

In January 2025, the SEC issued Staff Accounting Bulletin No. 122 (“SAB 122”), which rescinded the interpretive guidance included in SAB 121 regarding the accounting for obligations to safeguard crypto-assets an entity holds for users of its crypto platform. The guidance in SAB 121 required entities that hold crypto-assets on behalf of platform users to recognize a liability accompanied by an asset of the same value on its balance sheet to reflect the entity’s obligation to safeguard the crypto-assets held for its platform users. SAB 122 became effective for the Company on January 1, 2025, resulting in the derecognition of crypto settlement assets and liabilities from the Company’s unaudited Condensed Consolidated Balance Sheets, the impact of which was immaterial. The adoption of SAB 122 had no impact on the Company’s unaudited Condensed Consolidated Statements of Operations or unaudited Condensed Consolidated Statements of Cash Flows.

In December 2023, the FASB issued ASU 2023-09, Income Taxes: Improvements to Income Tax Disclosures, which provides qualitative and quantitative updates to the rate reconciliation and income taxes paid disclosures, among others, in order to enhance the transparency of income tax disclosures, including consistent categories and greater disaggregation of information in the rate reconciliation and disaggregation by jurisdiction of income taxes paid. ASU 2023-09 became effective for the Company on January 1, 2025. The Company intends to provide these additional disclosures in its 2025 Form 10-K.

Accounting Pronouncements Not Yet Adopted

In November 2024, the FASB issued ASU 2024-03, Income Statement – Reporting Comprehensive Income – Expense Disaggregation Disclosures (Topic 220): Disaggregation of Income Statement Expenses, which requires additional disclosure of certain amounts included in the expense captions presented on the Statements of Operations as well as disclosures about selling expenses. ASU 2024-03 is effective on a prospective basis, with the option for retrospective application, for annual periods beginning after December 15, 2026 and interim reporting periods beginning after December 15, 2027, with early adoption permitted. Besides the additional disclosures noted above, the Company does not believe ASU 2024-03 will have a significant impact on its financial statement disclosures.

2.Acquisitions

Each of the following acquisitions was accounted for as a business combination using the acquisition method of accounting. The respective purchase prices were allocated to the assets acquired and liabilities assumed based on the estimated fair values at the date of acquisition. The excess of the purchase price over the fair value of the net assets acquired was allocated to goodwill and represents the future economic benefits arising from other assets acquired, which cannot be individually identified or separately recognized. Supplemental pro forma financial information has not been provided as the acquisitions were not considered material individually or in the aggregate.

Eigen

On November 18, 2024, the Company completed the acquisition of Eigen Payments (“Eigen”) for $115.0 million of total purchase consideration, net of cash acquired. Eigen is a Canadian-based provider of payment solutions for the retail, restaurant and hospitality industries that management believes will strengthen the Company’s position within these verticals. Total purchase consideration was as follows:

| | | | | |

| Cash | $ | 124.8 | |

| Total purchase consideration | 124.8 | |

| Less: cash acquired | (9.8) | |

| Total purchase consideration, net of cash acquired | $ | 115.0 | |

The following table summarizes the fair value assigned to the assets acquired and liabilities assumed at the acquisition date. These amounts reflect various preliminary fair value estimates and assumptions, and are subject to change within the measurement period as valuations are finalized. The primary area of preliminary purchase price allocation subject to change relates to the valuation of other intangible assets and residual goodwill.

| | | | | |

| Accounts receivable | $ | 1.7 | |

| Prepaid expenses and other current assets | 0.3 | |

| Goodwill (a) | 76.3 | |

| Other intangible assets | 52.4 | |

| Equipment for lease, net | 0.5 | |

| Property, plant and equipment, net | 0.3 | |

| Right-of-use assets | 0.5 | |

| Accounts payable | (0.7) | |

| Accrued expenses and other current liabilities | (0.8) | |

| Deferred revenue | (0.8) | |

| Current lease liabilities | (0.3) | |

| Deferred tax liabilities | (14.2) | |

| Noncurrent lease liabilities | (0.2) | |

| Net assets acquired | $ | 115.0 | |

| |

| (a) Goodwill is not deductible for tax purposes. |

The following table provides further detail on other intangible assets acquired:

| | | | | |

| Merchant relationships | $ | 51.6 | |

| Acquired technology | 0.8 |

| Other intangible assets | $ | 52.4 | |

The fair values of other intangible assets were estimated using inputs classified as Level 3 under the income approach using the relief-from-royalty method for acquired technology and the multi-period excess earnings method for merchant relationships. This transaction was not taxable for income tax purposes. The estimated life of acquired technology and merchant relationships are one and fifteen years, respectively.

The acquisition of Eigen did not have a material impact on the Company’s unaudited condensed consolidated financial statements.

Givex

On November 8, 2024, the Company completed the acquisition of Givex Corp. (“Givex”) for $127.8 million of total purchase consideration, net of cash acquired. Givex is a global provider of gift cards, loyalty programs, and POS solutions which management believes will significantly increase the Company’s overall customer base and geographic footprint. Total purchase consideration was as follows:

| | | | | |

| Cash | $ | 146.0 | |

| Total purchase consideration | 146.0 | |

| Less: cash acquired | (18.2) | |

| Total purchase consideration, net of cash acquired | $ | 127.8 | |

| |

|

The following table summarizes the fair value assigned to the assets acquired and liabilities assumed at the acquisition date. These amounts reflect various preliminary fair value estimates and assumptions, and are subject to change within the measurement period as valuations are finalized. The primary area of preliminary purchase price allocation subject to change relates to the valuation of accounts receivable, other intangible assets, accounts payable, accrued expenses and other current liabilities, and residual goodwill.

| | | | | |

| Accounts receivable | $ | 8.6 | |

| Inventory | 2.2 | |

| Prepaid expenses and other current assets | 1.2 | |

| Goodwill (a) | 85.7 | |

| Other intangible assets | 66.1 | |

| Property, plant and equipment, net | 1.5 | |

| Right-of-use assets | 1.1 | |

| Other noncurrent assets | 1.7 | |

| Accounts payable | (4.8) | |

| Accrued expenses and other current liabilities | (4.7) | |

| Current lease liabilities | (0.4) | |

| Current portion of long-term debt | (2.2) | |

| Deferred tax liabilities | (18.9) | |

| Noncurrent lease liabilities | (0.8) | |

| Other noncurrent liabilities | (8.5) | |

| Net assets acquired | $ | 127.8 | |

| |

| (a) Goodwill is not deductible for tax purposes. |

The following table provides further detail on other intangible assets acquired:

| | | | | |

| Merchant relationships | $ | 58.2 | |

| Acquired technology | 6.6 | |

| Trademark and trade names | 1.3 | |

| Other intangible assets | $ | 66.1 | |

The fair values of other intangible assets were estimated using inputs classified as Level 3 under the income approach using the relief-from-royalty method for acquired technology and the trade name, and the multi-period excess earnings method for merchant relationships. This transaction was not taxable for income tax purposes. The estimated life of acquired technology, merchant relationships and trade name are ten, fifteen and three years, respectively.

The acquisition of Givex did not have a material impact on the Company’s unaudited condensed consolidated financial statements.

Vectron

On June 14, 2024, the Company acquired a majority stake in Vectron Systems AG (“Vectron”). Based in Germany, Vectron is a supplier of POS systems to the restaurant and hospitality industries that management believes will provide the Company with local product expertise and a European distribution network of POS resellers. Throughout the remainder of June and July 2024, the Company purchased additional shares of Vectron’s common stock through a public tender offer and open market purchases. As of March 31, 2025, the Company owned approximately 75% of Vectron’s common stock, for which it paid $62.7 million of total purchase consideration, net of cash acquired. The Company consolidates 100% of Vectron’s assets, liabilities, revenues and expenses and records a noncontrolling interest balance for the 25% economic interest in Vectron not held by the Company as of March 31, 2025.

In March of 2025, Arrow HoldCo GmbH (“Arrow HoldCo”), a wholly owned indirect subsidiary of the Company, and Vectron agreed on a final draft of the domination and profit and loss transfer agreement (the “DPLTA”) between Arrow HoldCo, as the controlling company, and Vectron, as the controlled company. The parties’ execution of the DPLTA remains subject to approval of the DPLTA by the general shareholders meeting of Vectron. If and when signed, effectiveness of the DPLTA is subject to the subsequent registration of the DPLTA with the commercial register of the local court at the registered offices of Vectron, with such effectiveness expected to occur no earlier than late May of 2025.

Total purchase consideration was as follows:

| | | | | |

| Cash | $ | 66.9 | |

| Contingent consideration (a) | 2.9 | |

| Total purchase consideration | 69.8 | |

| Less: cash acquired | (7.1) | |

| Total purchase consideration, net of cash acquired | 62.7 | |

| Noncontrolling interest | 24.9 | |

| Fair value of net assets acquired | $ | 87.6 | |

| |

|

(a) The Company agreed to a cash earnout due to certain former shareholders of Vectron based on the achievement against certain operational metrics through 2027. The actual earnout can range between zero and €7.0 million. The fair value of the earnout was included in the initial purchase consideration and will be revalued and recorded quarterly until the end of the earnout period as a fair value adjustment within “Revaluation of contingent liabilities” in the Company’s unaudited Condensed Consolidated Statements of Operations. As of March 31, 2025, the fair value of the earnout was $4.1 million, which is recognized in “Other noncurrent liabilities” on the Company’s unaudited Condensed Consolidated Balance Sheets. |

The following table summarizes the fair value assigned to the assets acquired and liabilities assumed at the acquisition date. These amounts reflect various preliminary fair value estimates and assumptions, and are subject to change within the measurement period as valuations are finalized. The primary area of preliminary purchase price allocation subject to change relates to the valuation of accounts receivable, prepaid expenses and other current assets, other intangible assets, accounts payable, accrued expenses and other current liabilities, and residual goodwill.

| | | | | |

| Accounts receivable | $ | 7.5 | |

| Inventory | 3.4 | |

| Prepaid expenses and other current assets | 6.3 | |

| Goodwill (a) | 80.7 | |

| Other intangible assets | 30.1 | |

| Property, plant and equipment, net | 1.5 | |

| Right-of-use assets | 8.9 | |

| Other noncurrent assets | 2.5 | |

| Accounts payable | (5.3) | |

| Accrued expenses and other current liabilities | (6.6) | |

| Deferred revenue | (4.6) | |

| Current lease liabilities | (1.2) | |

| Deferred tax liabilities, net | (9.5) | |

| Noncurrent lease liabilities | (7.9) | |

| Other noncurrent liabilities (b) | (18.2) | |

| Net assets acquired | $ | 87.6 | |

| |

| (a) Goodwill is not deductible for tax purposes. |

(b) In connection with the Company’s majority stake in Vectron and due to Vectron’s acquisition of Acardo Group AG (“Acardo”) in December 2022, the Company became party to an earnout agreement with certain former shareholders of Acardo. The earnout is payable in multiple tranches, with up to €25.0 million payable in 2026. This amount is based on a multiple of the average of Acardo’s earnings before interest and taxes (“EBIT”) achieved in 2024 and 2025. Additionally, a percentage of Acardo’s net income for fiscal years 2023, 2024 and 2025 are payable in 2025 and 2026. Each portion of the earnout is expected to be paid in cash. The fair value of the earnout was included in the initial purchase consideration and will be revalued quarterly until the end of the earnout period as a fair value adjustment within “Revaluation of contingent liabilities” in the Company’s unaudited Condensed Consolidated Statements of Operations. As of March 31, 2025, the fair value of the earnout was $9.4 million, of which $0.4 million was recognized in “Accrued expenses and other current liabilities” and $9.0 million was recognized in “Other noncurrent liabilities” on the Company’s unaudited Condensed Consolidated Balance Sheets. |

The following table provides further detail on other intangible assets acquired:

| | | | | |

| Merchant relationships | $ | 26.8 | |

| Acquired technology | 2.0 | |

| Trademarks and trade names | 1.3 | |

| Other intangible assets | $ | 30.1 | |

The fair values of other intangible assets were estimated using inputs classified as Level 3 under the income approach using the relief-from-royalty method for acquired technology and the trade name, and the multi-period excess earnings method for merchant relationships. This transaction was not taxable for income tax purposes. The estimated life of acquired technology, merchant relationships and trade name are six, twelve and seven years, respectively.

The acquisition of Vectron did not have a material impact on the Company’s unaudited condensed consolidated financial statements.

Revel

On June 13, 2024, the Company completed the acquisition of Revel Systems, Inc. (“Revel”) by acquiring 100% of its common stock for $245.3 million of total purchase consideration, net of cash acquired. Revel offers a cloud-based POS system primarily for multi-location merchants, focusing on restaurants, as well as back office and marketing tools that management believes will strengthen the Company’s presence within the restaurant and retail markets. Total purchase consideration was as follows:

| | | | | |

| Cash | $ | 262.6 | |

| Total purchase consideration | 262.6 | |

| Less: cash acquired | (17.3) | |

| Total purchase consideration, net of cash acquired | $ | 245.3 | |

The following table summarizes the fair value assigned to the assets acquired and liabilities assumed at the acquisition date. These amounts reflect various preliminary fair value estimates and assumptions, and are subject to change within the measurement period as valuations are finalized. The primary area of preliminary purchase price allocation subject to change relates to the valuation of accounts receivable, prepaid expenses and other current assets, other intangible assets, accounts payable, accrued expenses and other current liabilities, and residual goodwill.

| | | | | |

| Accounts receivable | $ | 9.9 | |

| Inventory | 1.8 | |

| Prepaid expenses and other current assets | 4.4 | |

| Property, plant and equipment, net | 0.3 | |

| Right-of-use assets | 1.4 | |

| Goodwill (a) | 123.1 | |

| Other intangible assets | 118.9 | |

| Deferred tax assets | 7.9 | |

| Other noncurrent assets | 0.3 | |

| Accounts payable | (6.6) | |

| Accrued expenses and other current liabilities | (7.1) | |

| Deferred revenue | (6.1) | |

| Current lease liabilities | (0.6) | |

| Noncurrent lease liabilities | (1.0) | |

| Other noncurrent liabilities | (1.3) | |

| Net assets acquired | $ | 245.3 | |

| |

| (a) Goodwill is not deductible for tax purposes. |

The following table provides further detail on other intangible assets acquired:

| | | | | |

| Merchant relationships | $ | 106.3 | |

| Acquired technology | 10.9 | |

| Trademarks and trade names | 1.7 | |

| Other intangible assets | $ | 118.9 | |

The fair values of other intangible assets were estimated using inputs classified as Level 3 under the income approach using the relief-from-royalty method for acquired technology and the trade name, and the multi-period excess earnings method for merchant relationships. Management’s estimates of fair value are based upon assumptions related to projected revenues, earnings before interest income, interest expense, income taxes, and depreciation and amortization (“EBITDA”) margins, attrition rates, and discount rates. This transaction was not taxable for income tax purposes. The estimated life of acquired technology, merchant relationships and trade name are three, ten and three years, respectively.

The acquisition of Revel did not have a material impact on the Company’s unaudited condensed consolidated financial statements.

3.Revenue

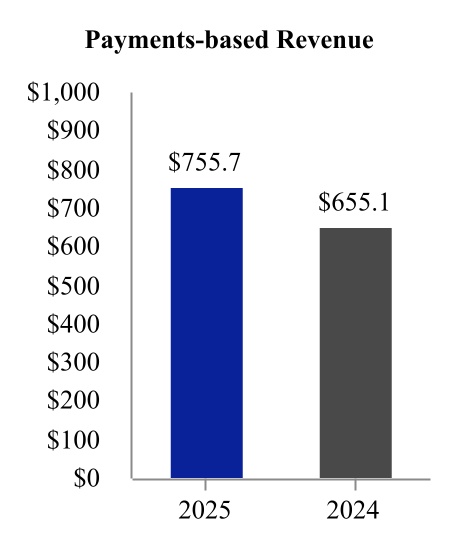

The Company’s revenue is comprised primarily of payments-based revenue which includes fees for payment processing and gateway services. Payment processing fees are primarily driven as a percentage of volume.

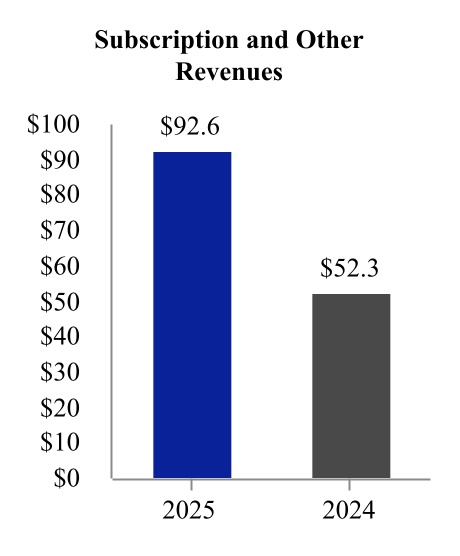

The Company also generates revenues from recurring fees which are based on the technology deployed to the merchant. Under ASC 606, the Company typically has three separate performance obligations under its recurring software as a service (“SaaS”) agreements for point-of-sale systems provided to merchants: (1) point-of-sale software, (2) lease of hardware and (3) other support services.

Disaggregated Revenue

The following table presents a disaggregation of the Company’s revenue from contracts with customers based on similar operational characteristics:

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2025 | | 2024 | | | | |

| Payments-based revenue | $ | 755.7 | | | $ | 655.1 | | | | | |

| Subscription and other revenues | 92.6 | | | 52.3 | | | | | |

| Total | $ | 848.3 | | | $ | 707.4 | | | | | |

The vast majority of the Company’s revenue is recognized over time.

Contract Liabilities

The Company charges merchants for various post-contract license support and service fees. These fees typically relate to a period of one year. The Company recognizes the revenue on a straight-line basis over its respective period. As of March 31, 2025 and December 31, 2024, the Company had deferred revenue of $14.1 million and $18.9 million, respectively. The change in the contract liabilities was primarily the result of a timing difference between payment from the customer and the Company’s satisfaction of each performance obligation.

The amount of gross revenue recognized that was included in the December 31, 2024 balance of deferred revenue was $7.9 million for the three months ended March 31, 2025.

4.Goodwill

The changes in the carrying amount of goodwill were as follows:

| | | | | |

| Balance at December 31, 2024 | $ | 1,455.6 | |

| |

| |

| |

| |

| |

| Effect of foreign currency translation, adjustments related to prior period acquisitions, and other | 16.6 | |

| Balance at March 31, 2025 | $ | 1,472.2 | |

5.Depreciation and Amortization

Amounts charged to expense in the Company’s unaudited Condensed Consolidated Statements of Operations for depreciation and amortization were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amortization | | Depreciation | | |

| | Residual Commission Buyouts | | Other Intangible Assets | | Capitalized Customer Acquisition Costs | | Equipment Under Lease | | Property, Plant and Equipment | | Total |

| Three Months Ended March 31, 2025 | | | | | |

| Depreciation and amortization expense | | $ | 22.5 | | | $ | 14.1 | | | $ | — | | | $ | 16.3 | | | $ | 3.1 | | | $ | 56.0 | |

| Cost of sales | | — | | | 21.8 | | | 7.3 | | | — | | | 0.1 | | | 29.2 | |

| Total depreciation and amortization (a) | | $ | 22.5 | | | $ | 35.9 | | | $ | 7.3 | | | $ | 16.3 | | | $ | 3.2 | | | $ | 85.2 | |

| | | | | | | | | | | | |

| Three Months Ended March 31, 2024 | | | | | | | | | | | | |

| Depreciation and amortization expense | | $ | 21.8 | | | $ | 8.7 | | | $ | — | | | $ | 11.9 | | | $ | 2.4 | | | $ | 44.8 | |

| Cost of sales | | — | | | 15.5 | | | 5.7 | | | — | | | 0.1 | | | 21.3 | |

| Total depreciation and amortization (b) | | $ | 21.8 | | | $ | 24.2 | | | $ | 5.7 | | | $ | 11.9 | | | $ | 2.5 | | | $ | 66.1 | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(a) Total amortization of $65.7 million consisted of amortization of acquired intangibles of $45.8 million and amortization of non-acquired intangibles of $19.9 million.

(b) Total amortization of $51.7 million consisted of amortization of acquired intangibles of $38.0 million and amortization of non-acquired intangibles of $13.7 million.

As of March 31, 2025, the estimated amortization expense for each of the five succeeding years and thereafter is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residual Commission Buyouts | | Other Intangible Assets | | Capitalized Customer

Acquisition Costs | | Total Amortization | | Amortization of Acquired Intangible Assets |

| 2025 (remaining nine months) | $ | 66.4 | | | $ | 104.7 | | | $ | 20.8 | | | $ | 191.9 | | | $ | 134.5 | |

| 2026 | 54.9 | | | 122.6 | | | 22.5 | | | 200.0 | | | 139.9 | |

| 2027 | 6.4 | | | 99.4 | | | 16.1 | | | 121.9 | | | 83.2 | |

| 2028 | 4.8 | | | 69.0 | | | 7.2 | | | 81.0 | | | 71.4 | |

| 2029 | 1.5 | | | 65.1 | | | 0.3 | | | 66.9 | | | 66.9 | |

| Thereafter | 1.9 | | | 306.5 | | | — | | | 308.4 | | | 307.6 | |

| Total | $ | 135.9 | | | $ | 767.3 | | | $ | 66.9 | | | $ | 970.1 | | | $ | 803.5 | |

6.Residual Commission Buyouts

Residual commission buyouts represent transactions with certain third-party distribution partners, pursuant to which the Company acquires their ongoing merchant relationships that subscribe to the Company’s payments platform.

Residual commission buyouts, net consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Weighted Average Amortization Period (in years) | | March 31, 2025 |

| | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value |

| Residual commission buyouts from asset acquisitions | | 4 | | $ | 338.3 | | | $ | (212.0) | | | $ | 126.3 | |

| Residual commission buyouts from business combinations | | 8 | | 13.9 | | | (4.3) | | | 9.6 | |

| Total residual commission buyouts | | | | $ | 352.2 | | | $ | (216.3) | | | $ | 135.9 | |

| | | | | | | | |

| | Weighted Average Amortization Period (in years) | | December 31, 2024 |

| | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value |

| Residual commission buyouts from asset acquisitions | | 4 | | $ | 337.3 | | | $ | (190.1) | | | $ | 147.2 | |

| Residual commission buyouts from business combinations | | 8 | | 13.9 | | | (3.9) | | | 10.0 | |

| Total residual commission buyouts | | | | $ | 351.2 | | | $ | (194.0) | | | $ | 157.2 | |

7.Other Intangible Assets, Net

Other intangible assets, net consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Amortization Period (in years) | | March 31, 2025 |

| Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value |

| Merchant relationships | 12 | | $ | 591.8 | | | $ | (109.5) | | | $ | 482.3 | |

| Acquired technology | 8 | | 288.0 | | | (122.6) | | | 165.4 | |

| Trademarks and trade names | 12 | | 29.4 | | | (9.5) | | | 19.9 | |

| Capitalized software development costs | 3 | | 159.1 | | | (59.4) | | | 99.7 | |

| Total other intangible assets, net | | | $ | 1,068.3 | | | $ | (301.0) | | | $ | 767.3 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Amortization Period (in years) | | December 31, 2024 |

| Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value |

| Merchant relationships | 12 | | $ | 584.0 | | | $ | (95.4) | | | $ | 488.6 | |

| Acquired technology | 8 | | 269.0 | | | (112.3) | | | 156.7 | |

| Trademarks and trade names | 12 | | 29.4 | | | (8.5) | | | 20.9 | |

| Capitalized software development costs | 3 | | 150.7 | | | (58.5) | | | 92.2 | |

| Total other intangible assets, net | | | $ | 1,033.1 | | | $ | (274.7) | | | $ | 758.4 | |

8.Capitalized Customer Acquisition Costs, Net

Capitalized customer acquisition costs, net consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Weighted Average Amortization Period (in years) | | | | | | |

| | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value |

Total costs as of March 31, 2025 | | 4 | | $ | 121.1 | | | $ | (54.2) | | | $ | 66.9 | |

Total costs as of December 31, 2024 | | 4 | | $ | 118.1 | | | $ | (52.8) | | | $ | 65.3 | |

9.Equipment for Lease, Net

Equipment for lease, net consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Depreciation Period (in years) | | March 31, 2025 |

| Gross Carrying Value | | Accumulated Depreciation | | Net Carrying Value |

| Equipment under lease | 4 | | $ | 259.9 | | | $ | (100.5) | | | $ | 159.4 | |

| Equipment held for lease (a) | N/A | | 17.5 | | | — | | | 17.5 | |

| Total equipment for lease, net | | | $ | 277.4 | | | $ | (100.5) | | | $ | 176.9 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Depreciation Period (in years) | | December 31, 2024 |

| Gross Carrying Value | | Accumulated Depreciation | | Net Carrying Value |

| Equipment under lease | 4 | | $ | 243.6 | | | $ | (93.0) | | | $ | 150.6 | |

| Equipment held for lease (a) | N/A | | 14.5 | | | — | | | 14.5 | |

| Total equipment for lease, net | | | $ | 258.1 | | | $ | (93.0) | | | $ | 165.1 | |

| | | | | | | |

| (a) Represents equipment that was not yet initially deployed to a merchant and, accordingly, is not being depreciated. |

In addition to equipment for lease, the Company had $6.9 million and $8.9 million of inventory as of March 31, 2025 and December 31, 2024, respectively. Inventory represents hardware devices to be sold.

10.Property, Plant and Equipment, Net

Property, plant and equipment, net consisted of the following:

| | | | | | | | | | | | | | |

| | March 31,

2025 | | December 31,

2024 |

| Equipment | | $ | 22.2 | | | $ | 21.0 | |

| Capitalized software | | 3.1 | | | 4.4 | |

| Leasehold improvements | | 19.6 | | | 19.5 | |

| Furniture and fixtures | | 2.5 | | | 2.4 | |

| Vehicles | | 0.4 | | | 0.5 | |

| Total property, plant and equipment, gross | | 47.8 | | | 47.8 | |

| Less: Accumulated depreciation | | (23.8) | | | (20.6) | |

| Total property, plant and equipment, net | | $ | 24.0 | | | $ | 27.2 | |

11.Debt

The Company’s outstanding debt consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Maturity | | Effective Interest Rate | | March 31,

2025 | | December 31,

2024 |

6.750% Senior Notes due 2032 ("2032 Senior Notes") | | August 15, 2032 | | 6.92% | | $ | 1,100.0 | | | $ | 1,100.0 | |